37 Final Form PDF

What is the 37 final form PDF?

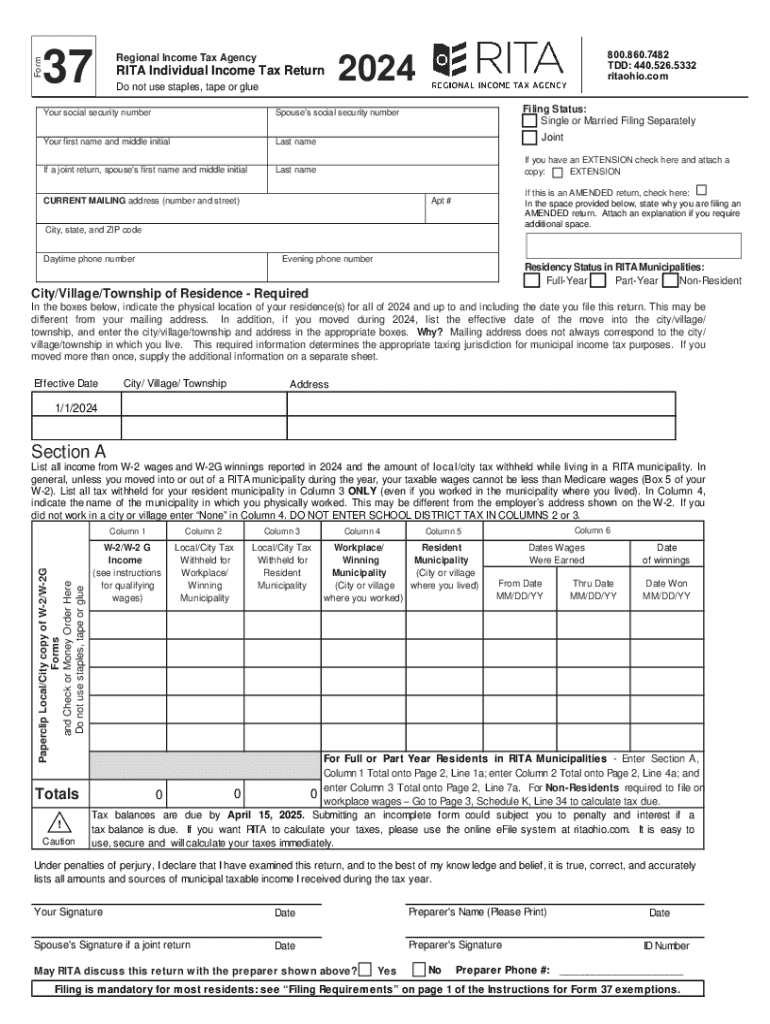

The 37 final form PDF, commonly referred to as the RITA Form 37, is a tax document used by residents of Ohio to report their income and calculate their local income tax obligations. This form is specifically designed for individuals who work or reside in municipalities that participate in the Regional Income Tax Agency (RITA). It captures essential information about the taxpayer's income, deductions, and credits applicable to local taxes.

How to obtain the 37 final form PDF

The RITA Form 37 can be easily obtained from the official RITA website. Users can download the form directly in PDF format, ensuring they have the most current version for their tax filings. Additionally, local tax offices may provide physical copies of the form for those who prefer to fill it out by hand.

Steps to complete the 37 final form PDF

Completing the RITA Form 37 involves several key steps:

- Gather all necessary financial documents, including W-2s and 1099s.

- Fill in personal information, such as name, address, and Social Security number.

- Report total income, including wages, salaries, and any other earnings.

- Apply any applicable deductions and credits specific to local taxes.

- Calculate the total tax owed based on the local tax rate.

- Review the completed form for accuracy before submission.

Form submission methods

The RITA Form 37 can be submitted through various methods, providing flexibility for taxpayers:

- Online: Taxpayers can file the form electronically through the RITA online portal.

- Mail: Completed forms can be printed and mailed to the appropriate RITA office.

- In-Person: Taxpayers may also submit the form in person at designated RITA locations.

Filing deadlines / important dates

It is crucial for taxpayers to be aware of the filing deadlines for the RITA Form 37 to avoid penalties. Generally, the form must be submitted by April 15 of the following tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may apply to their specific situation.

Key elements of the 37 final form PDF

The RITA Form 37 includes several important sections that taxpayers must complete:

- Personal Information: This section captures the taxpayer's basic details.

- Income Reporting: Taxpayers must detail all sources of income.

- Deductions and Credits: This area allows for the application of any local tax deductions or credits.

- Tax Calculation: The form includes a section for calculating the total tax liability based on reported income.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 37 final form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio RITA tax and how does it affect businesses?

The Ohio RITA tax refers to the tax administered by the Regional Income Tax Agency for residents and businesses in Ohio. It is essential for businesses to understand their obligations under this tax to ensure compliance and avoid penalties. Utilizing tools like airSlate SignNow can help streamline the documentation process related to Ohio RITA tax filings.

-

How can airSlate SignNow help with Ohio RITA tax documentation?

airSlate SignNow provides an easy-to-use platform for businesses to send and eSign documents related to Ohio RITA tax. This simplifies the process of preparing and submitting necessary tax forms, ensuring that all documentation is accurate and timely. By using airSlate SignNow, businesses can focus more on their operations rather than paperwork.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses dealing with Ohio RITA tax. Each plan provides access to essential features that help streamline document management and eSigning processes. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow for Ohio RITA tax?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software that can assist with Ohio RITA tax compliance. These integrations allow for efficient data transfer and management, reducing the risk of errors in tax documentation. This ensures that your business remains compliant with Ohio RITA tax regulations.

-

What features does airSlate SignNow offer for managing Ohio RITA tax documents?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning, which are particularly beneficial for managing Ohio RITA tax documents. These features help businesses save time and reduce the complexity of tax-related paperwork. With airSlate SignNow, you can ensure that your documents are organized and easily accessible.

-

How does airSlate SignNow ensure the security of Ohio RITA tax documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive Ohio RITA tax documents. The platform employs advanced encryption and secure cloud storage to protect your data. This ensures that your tax information remains confidential and secure throughout the signing and submission process.

-

Can airSlate SignNow assist with tracking Ohio RITA tax submissions?

Absolutely! airSlate SignNow includes tracking features that allow businesses to monitor the status of their Ohio RITA tax submissions. This transparency helps ensure that all documents are submitted on time and provides peace of mind regarding compliance. You can easily check the progress of your submissions directly within the platform.

Get more for 37 final form pdf

- Britam medical claim form

- Juzo return form

- Financial help applications form

- Mn nursing assistant registry renewal form

- Babysitter instruction form

- Kidslearningstation form

- Texas women s health program application form the texas women s health program provides an annual exam health screenings

- Mv 1l 776756768 form

Find out other 37 final form pdf

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself