Mason Individual Return 24 Form

What is the Mason Individual Return 24

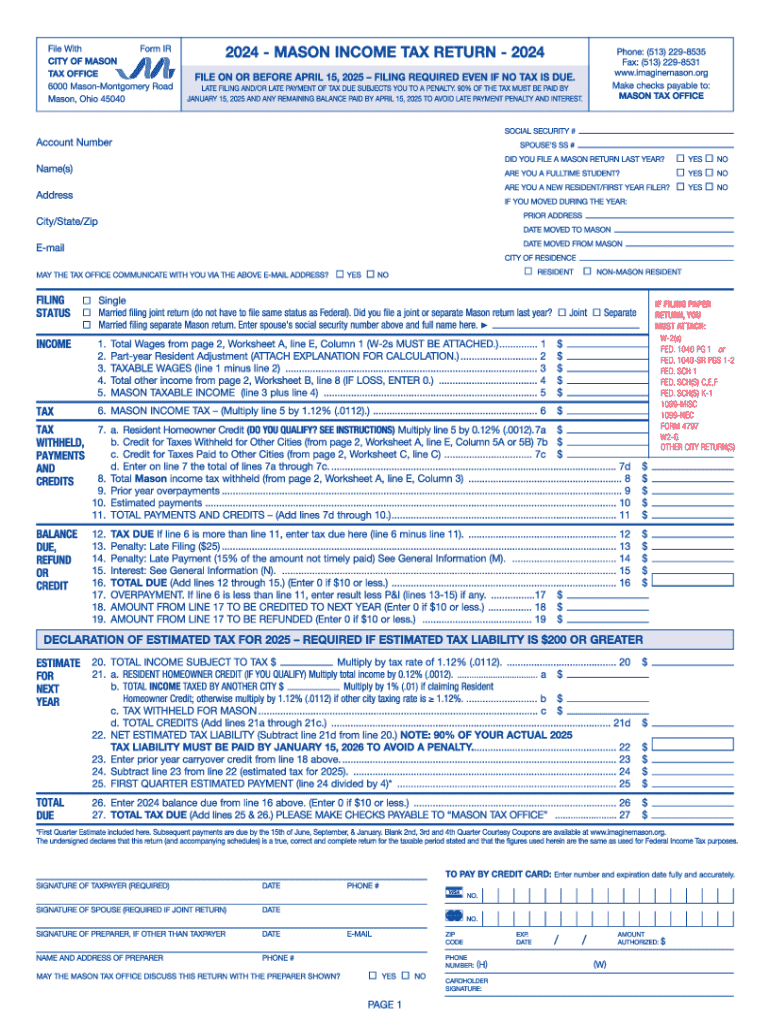

The Mason Individual Return 24 is a specific tax form used by residents of Mason, Ohio, to report their income and calculate their local income tax obligations. This form is essential for individuals who earn income within the city and are required to comply with local tax regulations. The Mason Individual Return 24 helps ensure that taxpayers accurately report their earnings and pay the appropriate amount of taxes to the city.

Steps to complete the Mason Individual Return 24

Completing the Mason Individual Return 24 involves several key steps:

- Gather necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and other earnings.

- Calculate deductions and credits applicable to your situation, which may reduce your taxable income.

- Determine the total tax owed based on the income reported and the current tax rates.

- Review the completed form for accuracy before submission.

How to obtain the Mason Individual Return 24

The Mason Individual Return 24 can be obtained through various means:

- Visit the official City of Mason website, where the form is often available for download in PDF format.

- Request a physical copy from the Mason city tax office if you prefer to fill it out by hand.

- Consult local tax preparation services, which may provide the form as part of their services.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Mason Individual Return 24 to avoid penalties. Typically, the form is due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may apply, as well as the deadlines for estimated tax payments if applicable.

Required Documents

To successfully complete the Mason Individual Return 24, taxpayers need to gather several important documents:

- W-2 forms from employers, detailing annual earnings and taxes withheld.

- 1099 forms for any freelance or contract work, showing income received.

- Records of any other income sources, such as interest or dividends.

- Documentation for any deductions or credits claimed, like receipts for charitable contributions.

Penalties for Non-Compliance

Failure to file the Mason Individual Return 24 or to pay the taxes owed can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for continued non-compliance. It is essential for taxpayers to understand their obligations and ensure timely submission of the form to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mason individual return 24

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ohio form ir mason tax?

The ohio form ir mason tax is a specific tax form required for residents of Mason, Ohio, to report their income and calculate their local taxes. It is essential for compliance with local tax regulations and ensures that residents fulfill their tax obligations accurately.

-

How can airSlate SignNow help with the ohio form ir mason tax?

airSlate SignNow provides a seamless platform for eSigning and sending the ohio form ir mason tax. With our user-friendly interface, you can easily fill out, sign, and send your tax documents securely, ensuring timely submission and compliance.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Whether you are an individual or a business, you can choose a plan that fits your budget while efficiently managing documents like the ohio form ir mason tax.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features specifically designed for tax document management, such as templates for the ohio form ir mason tax, automated reminders, and secure storage. These features streamline the process, making it easier to manage your tax documents.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This allows you to manage the ohio form ir mason tax alongside your other financial documents, enhancing your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for the ohio form ir mason tax?

Using airSlate SignNow for the ohio form ir mason tax offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform ensures that your documents are signed and sent quickly, reducing the stress associated with tax season.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive tax documents, including the ohio form ir mason tax, are protected. We use advanced encryption and secure storage to keep your information safe.

Get more for Mason Individual Return 24

Find out other Mason Individual Return 24

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later