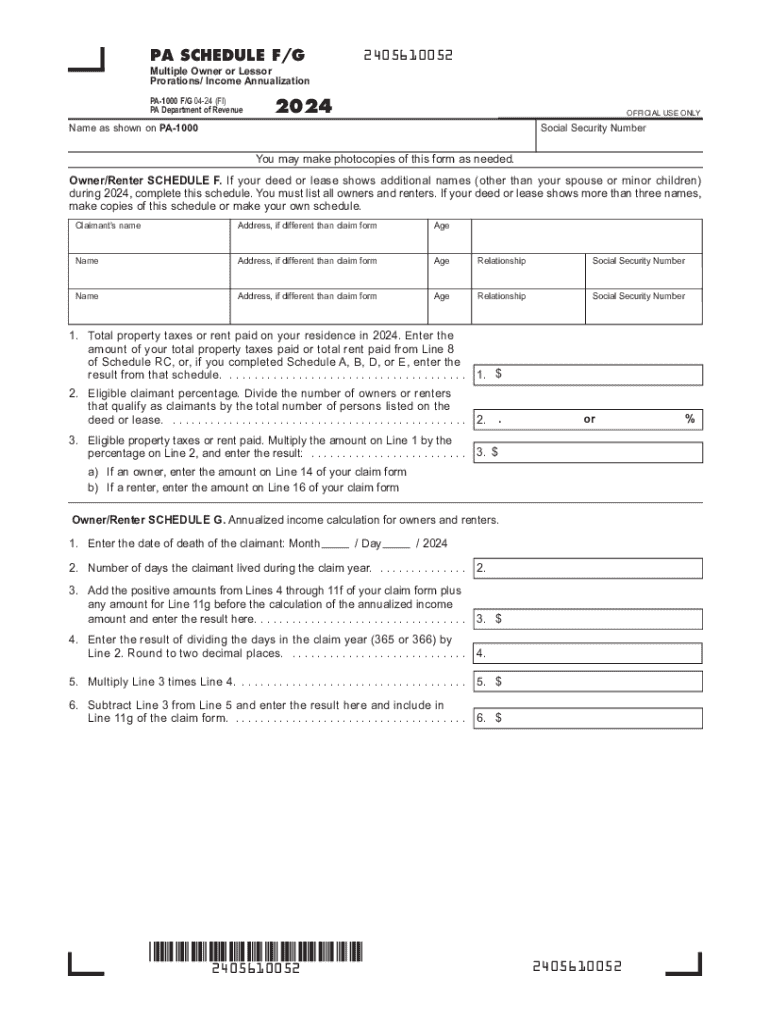

PA Schedule FG Multiple Owner or Lessor ProrationsIncome Annualization PA 1000 FG Form

Understanding the PA Schedule F-G for Multiple Owners

The PA Schedule F-G is designed for reporting income from multiple owners or lessors. This form is essential for individuals or businesses that share ownership of property or assets, ensuring that income is accurately prorated among all parties involved. It allows for a clear breakdown of income and expenses related to the shared property, facilitating compliance with Pennsylvania tax regulations.

Steps to Complete the PA Schedule F-G

Filling out the PA Schedule F-G involves several key steps:

- Gather necessary information: Collect all relevant details about the property, including ownership percentages and income generated.

- Complete the income section: Report total income received from the property, ensuring to allocate amounts based on ownership share.

- Detail expenses: List all allowable expenses related to the property, such as maintenance and management fees.

- Calculate net income: Subtract total expenses from total income to determine the net income for each owner.

- Review and verify: Ensure all information is accurate and complete before submission.

Key Elements of the PA Schedule F-G

The PA Schedule F-G includes several critical components:

- Owner Information: Details about each owner, including names, addresses, and ownership percentages.

- Income Reporting: A section dedicated to reporting total income generated from the property.

- Expense Reporting: A detailed account of all expenses that can be deducted.

- Net Income Calculation: A formula to determine the net income after expenses are accounted for.

Filing Deadlines for the PA Schedule F-G

It is important to be aware of the filing deadlines associated with the PA Schedule F-G. Typically, the form must be filed by the due date of the Pennsylvania personal income tax return, which is usually April 15. Extensions may be available, but it is essential to check current regulations to avoid penalties.

Required Documents for the PA Schedule F-G

To successfully complete the PA Schedule F-G, you will need the following documents:

- Income statements: Any documents that provide evidence of income generated from the property.

- Expense receipts: Documentation for all expenses claimed on the form.

- Ownership agreements: Any legal documents that outline ownership percentages and responsibilities.

Legal Use of the PA Schedule F-G

The PA Schedule F-G must be used in accordance with Pennsylvania tax laws. It is crucial for all owners to accurately report their income and expenses to avoid issues with the state tax authority. Misreporting can lead to penalties, so understanding the legal implications of the information provided on this form is vital for compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa schedule fg multiple owner or lessor prorationsincome annualization pa 1000 fg

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA Form 1000 and how can airSlate SignNow help?

The PA Form 1000 is a crucial document for various business processes in Pennsylvania. airSlate SignNow simplifies the completion and signing of the PA Form 1000 by providing an intuitive platform that allows users to eSign and send documents securely and efficiently.

-

How much does it cost to use airSlate SignNow for the PA Form 1000?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring you have all the necessary features to manage the PA Form 1000 effectively.

-

What features does airSlate SignNow offer for managing the PA Form 1000?

airSlate SignNow provides a range of features including customizable templates, automated workflows, and real-time tracking for the PA Form 1000. These features enhance efficiency and ensure that your documents are processed quickly and accurately.

-

Can I integrate airSlate SignNow with other applications for the PA Form 1000?

Yes, airSlate SignNow supports integrations with various applications, making it easy to manage the PA Form 1000 alongside your existing tools. This seamless integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the PA Form 1000?

Using airSlate SignNow for the PA Form 1000 offers numerous benefits, including reduced turnaround time, enhanced security, and improved compliance. The platform's user-friendly interface ensures that even those unfamiliar with digital signing can navigate it with ease.

-

Is airSlate SignNow secure for signing the PA Form 1000?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the PA Form 1000. With encryption and secure access controls, you can trust that your sensitive information remains safe.

-

How can I get started with airSlate SignNow for the PA Form 1000?

Getting started with airSlate SignNow for the PA Form 1000 is simple. You can sign up for a free trial to explore the features and functionalities, and once you're ready, choose a plan that suits your needs to begin managing your documents efficiently.

Get more for PA Schedule FG Multiple Owner Or Lessor ProrationsIncome Annualization PA 1000 FG

Find out other PA Schedule FG Multiple Owner Or Lessor ProrationsIncome Annualization PA 1000 FG

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online