Gross Premiums Tax Foreign Casualty or Foreign Fire Insurance Companies RCT 121C Form

Understanding the Gross Premiums Tax for Foreign Casualty or Foreign Fire Insurance Companies RCT 121C

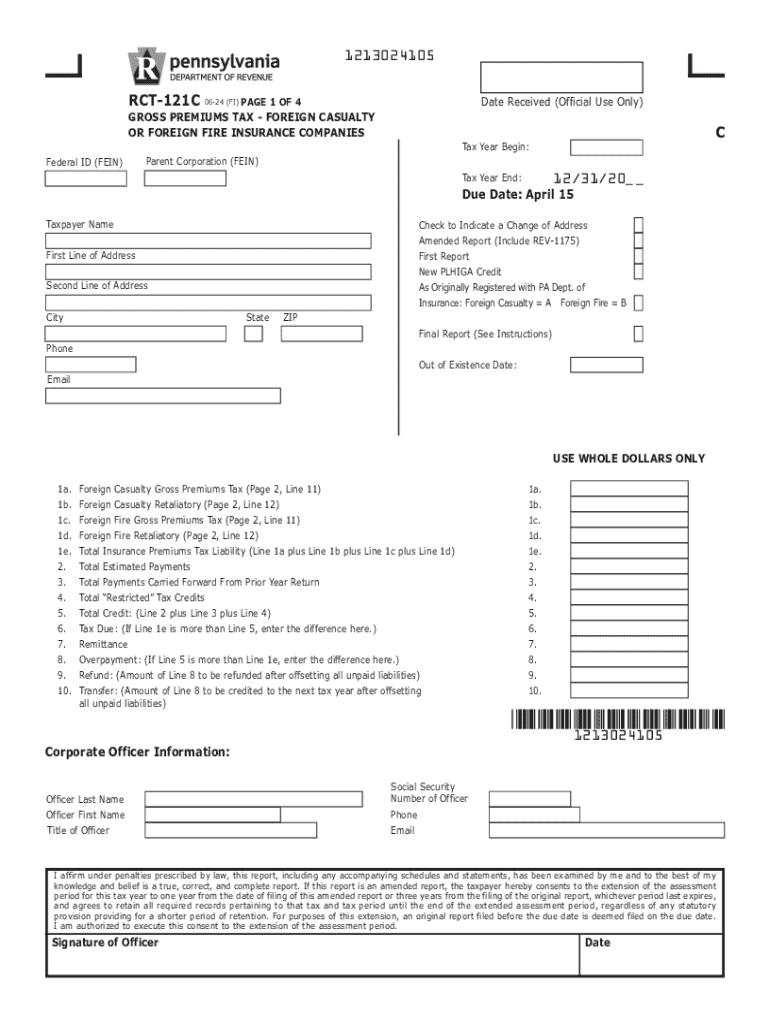

The Gross Premiums Tax for Foreign Casualty or Foreign Fire Insurance Companies, commonly referred to as RCT 121C, is a tax imposed on foreign insurance companies operating within Pennsylvania. This tax is calculated based on the gross premiums collected by these companies from policyholders in the state. It is essential for these companies to be aware of the specific tax obligations and the calculation methods to ensure compliance with state regulations.

Steps to Complete the RCT 121C Form

Filling out the RCT 121C form involves several key steps:

- Gather all necessary financial documents, including premium statements and previous tax filings.

- Calculate the total gross premiums received during the tax year.

- Complete the RCT 121C form by entering the calculated gross premiums and any applicable deductions.

- Review the form for accuracy and completeness before submission.

- Submit the form by the designated deadline to avoid penalties.

Required Documents for Filing RCT 121C

When preparing to file the RCT 121C form, several documents are necessary:

- Financial statements detailing the gross premiums collected.

- Previous year’s tax returns for reference.

- Any supporting documentation for deductions claimed.

- Proof of payment for any estimated taxes previously submitted.

Filing Deadlines for RCT 121C

Timely filing of the RCT 121C form is crucial to avoid penalties. The typical deadline for submission is the 15th day of the fourth month following the close of the tax year. Companies should mark their calendars and ensure that all necessary documents are prepared well in advance of this date.

Penalties for Non-Compliance with RCT 121C

Failure to comply with the filing requirements for the RCT 121C can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential legal action by state authorities for persistent non-compliance.

Digital vs. Paper Version of RCT 121C

Companies have the option to file the RCT 121C form either digitally or via paper submission. The digital version is often preferred due to its convenience and the ability to track submission status online. However, some companies may still opt for paper filing, especially if they are more comfortable with traditional methods. It is important to ensure that whichever method is chosen, it complies with the state’s filing requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gross premiums tax foreign casualty or foreign fire insurance companies rct 121c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'return received' mean in the context of airSlate SignNow?

'Return received' refers to the confirmation that a signed document has been successfully returned to the sender. With airSlate SignNow, you can easily track the status of your documents, ensuring that you know when a return has been received, which streamlines your workflow.

-

How does airSlate SignNow ensure the security of documents once a return is received?

airSlate SignNow employs advanced encryption and security protocols to protect your documents. Once a return is received, you can rest assured that your data is safe, allowing you to focus on your business without worrying about unauthorized access.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Each plan includes features that enhance document management, including tracking when a return is received, making it a cost-effective solution for eSigning needs.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and more. This integration allows you to manage your documents efficiently and receive notifications when a return is received, enhancing your productivity.

-

What features does airSlate SignNow offer for tracking document status?

airSlate SignNow provides comprehensive tracking features that notify you when a document is viewed, signed, and when a return is received. This transparency helps you manage your documents effectively and ensures timely follow-ups.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can streamline the document signing process, reduce turnaround times, and improve overall efficiency. The ability to track when a return is received allows for better planning and resource allocation.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to send, sign, and manage documents on the go. You will receive notifications when a return is received, ensuring you stay updated no matter where you are.

Get more for Gross Premiums Tax Foreign Casualty Or Foreign Fire Insurance Companies RCT 121C

- Georgia lpn license by endorsement application form

- Licence application form rms 1001

- St 105 fillable form

- Click here for an application town of eastchester eastchester form

- Fillable certification of assumed business name all entities form

- Hoa coupon book template form

- Tr 570 form pdf

- Conditional waiver and release on final payment form

Find out other Gross Premiums Tax Foreign Casualty Or Foreign Fire Insurance Companies RCT 121C

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF