Form 540 2EZ California Resident Income Tax Return

What is the Form 540 2EZ California Resident Income Tax Return

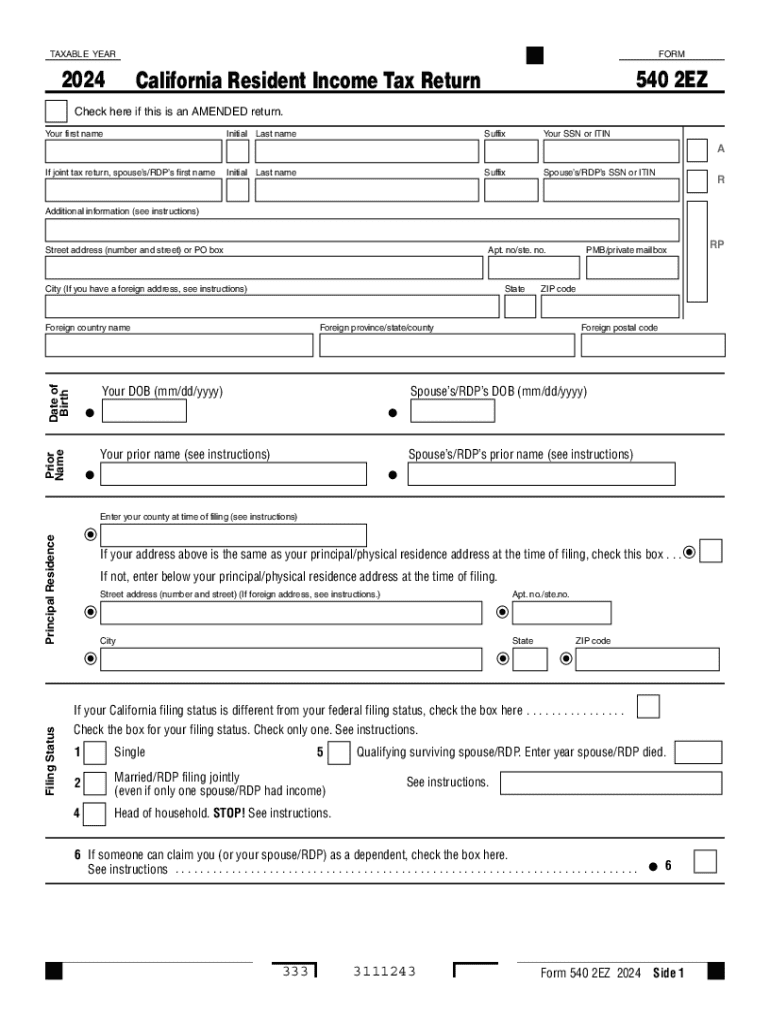

The Form 540 2EZ is a simplified version of the California Resident Income Tax Return, designed for eligible taxpayers who have straightforward tax situations. This form allows individuals to report their income and calculate their tax liability efficiently. It is specifically tailored for those who meet certain criteria, such as having a total income below a specified threshold and not claiming specific tax credits or deductions that require more complex forms. The 540 2EZ form is ideal for single filers or married couples filing jointly who do not have dependents.

How to use the Form 540 2EZ California Resident Income Tax Return

To use the Form 540 2EZ, taxpayers should first ensure they meet the eligibility criteria, which include income limits and filing status. Once confirmed, individuals can download the form from the California Franchise Tax Board website or obtain a printed copy. After filling out the required fields, including personal information, income details, and tax calculations, the completed form can be submitted either electronically or via mail. It is important to review all entries for accuracy to avoid delays in processing.

Steps to complete the Form 540 2EZ California Resident Income Tax Return

Completing the Form 540 2EZ involves several clear steps:

- Gather necessary documents, including W-2 forms and any other income statements.

- Fill in personal information, such as name, address, and Social Security number.

- Report total income, including wages, interest, and other sources.

- Calculate the total tax owed using the provided tax tables.

- Complete any applicable sections regarding tax credits.

- Sign and date the form before submission.

Eligibility Criteria

To qualify for using the Form 540 2EZ, taxpayers must meet specific eligibility criteria. This includes having a total income below a certain limit, which is adjusted annually. Additionally, filers must not claim dependents or certain tax credits that require more detailed reporting. The form is designed for individuals who have a basic tax situation, making it a convenient option for many California residents.

Form Submission Methods

The completed Form 540 2EZ can be submitted in several ways. Taxpayers have the option to file electronically through approved e-filing software, which can expedite processing and provide confirmation of receipt. Alternatively, individuals can print the form and mail it to the appropriate address provided by the California Franchise Tax Board. In-person submissions may also be possible at designated tax offices, depending on local regulations.

Key elements of the Form 540 2EZ California Resident Income Tax Return

The Form 540 2EZ includes several key elements that are essential for accurate tax reporting. These elements consist of personal information fields, total income reporting sections, tax calculation tables, and spaces for applicable credits. Additionally, the form provides instructions for completing each section, ensuring that taxpayers can navigate the filing process with ease. Understanding these components is crucial for successful completion and submission of the tax return.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540 2ez california resident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California 540 EZ printable form?

The California 540 EZ printable form is a simplified tax return form designed for eligible California residents. It allows taxpayers to report their income and claim deductions in a straightforward manner. Using this form can help streamline the filing process, making it easier for individuals to meet their tax obligations.

-

How can I access the California 540 EZ printable form?

You can easily access the California 540 EZ printable form through the airSlate SignNow platform. Our user-friendly interface allows you to download and print the form directly from your device. This ensures that you have the most up-to-date version of the form for your tax filing needs.

-

Is there a cost associated with using the California 540 EZ printable form on airSlate SignNow?

Using the California 540 EZ printable form on airSlate SignNow is part of our cost-effective solution for document management. While there may be subscription fees for premium features, accessing and printing the form itself is free. This makes it an affordable option for individuals looking to file their taxes efficiently.

-

What features does airSlate SignNow offer for the California 540 EZ printable form?

airSlate SignNow offers a range of features for the California 540 EZ printable form, including eSignature capabilities and document tracking. These features enhance the filing process by allowing users to sign and send their forms securely. Additionally, our platform ensures that your documents are stored safely and can be accessed anytime.

-

Can I integrate the California 540 EZ printable form with other tools?

Yes, airSlate SignNow allows for seamless integration with various tools and applications. This means you can easily incorporate the California 540 EZ printable form into your existing workflow. Whether you use accounting software or other document management systems, our platform can enhance your productivity.

-

What are the benefits of using airSlate SignNow for the California 540 EZ printable form?

Using airSlate SignNow for the California 540 EZ printable form offers numerous benefits, including ease of use and enhanced security. Our platform simplifies the process of filling out and submitting your tax forms, ensuring that you can focus on what matters most. Additionally, our eSignature feature allows for quick approvals, saving you time.

-

Is the California 540 EZ printable form suitable for everyone?

The California 540 EZ printable form is designed for specific taxpayers, typically those with simple tax situations. It is ideal for individuals with straightforward income sources and limited deductions. However, if your tax situation is more complex, you may need to consider other forms or consult a tax professional.

Get more for Form 540 2EZ California Resident Income Tax Return

Find out other Form 540 2EZ California Resident Income Tax Return

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application