Form it 214 Claim for Real Property Tax Credit for Homeowners and Renters Tax Year

Understanding the IT 214 Form for Real Property Tax Credit

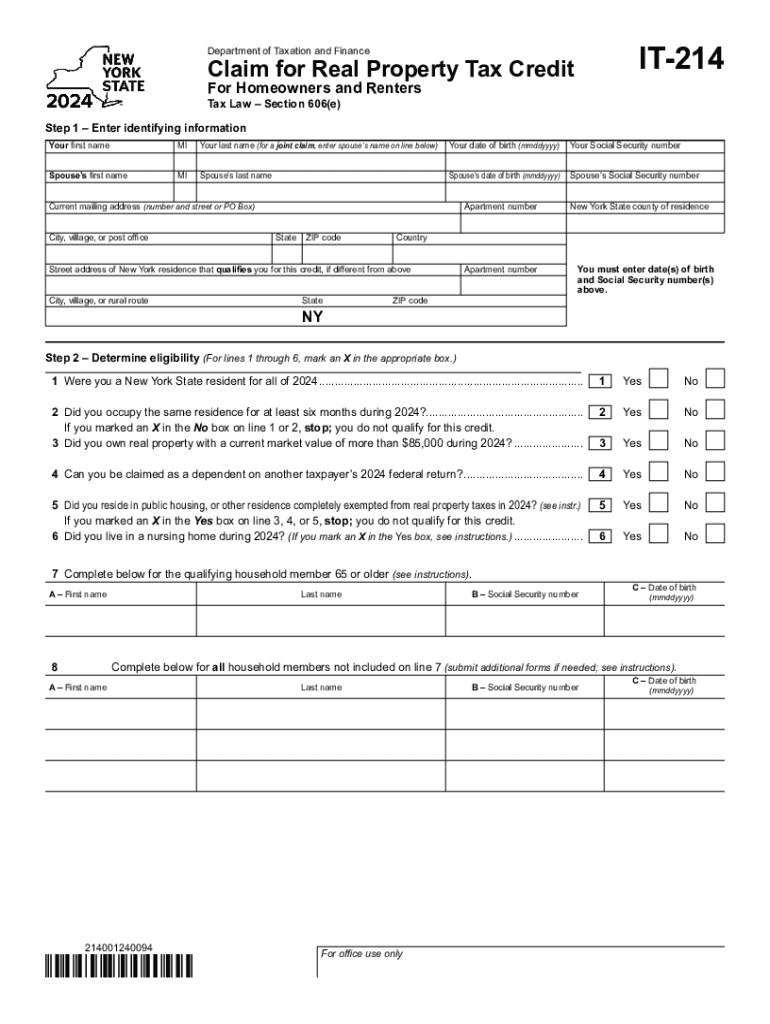

The IT 214 form is a crucial document for homeowners and renters in New York seeking to claim the Real Property Tax Credit. This credit is designed to provide financial relief to eligible individuals by offsetting property taxes paid on their primary residence. The form is applicable for the tax year 2024 and is essential for those who meet specific income and residency criteria. Understanding the purpose of this form can help taxpayers maximize their benefits and ensure compliance with state regulations.

Steps to Complete the IT 214 Form

Completing the IT 214 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of residency and income statements. Next, fill out the form by providing personal information, such as your name, address, and Social Security number. Carefully follow the instructions provided on the form to calculate your eligibility for the credit. Once completed, review the form for any errors before submission. This thorough approach will help facilitate a smooth filing process.

Eligibility Criteria for the IT 214 Form

To qualify for the Real Property Tax Credit using the IT 214 form, applicants must meet specific eligibility criteria. This includes being a resident of New York State and having a total income below a certain threshold, which is adjusted annually. Additionally, the property for which the credit is claimed must be the applicant's primary residence. Understanding these requirements is essential for ensuring that you can successfully claim the credit and avoid potential issues with your application.

Obtaining the IT 214 Form

The IT 214 form can be easily obtained through various channels. Taxpayers can download the form directly from the New York State Department of Taxation and Finance website. Alternatively, physical copies may be available at local tax offices or public libraries. It is advisable to ensure you have the most current version of the form for the tax year 2024 to avoid any complications during the filing process.

Filing Deadlines for the IT 214 Form

Timely submission of the IT 214 form is crucial to ensure that you receive the tax credit. The filing deadline for the 2024 tax year typically aligns with the general tax filing deadline, which is usually April fifteenth. However, it is important to verify any updates or changes to the deadline each year to avoid late penalties. Staying informed about these dates will help ensure that your claim is processed without delay.

Form Submission Methods for the IT 214

Taxpayers have several options for submitting the IT 214 form. The form can be filed online through the New York State Department of Taxation and Finance's e-filing system, which offers a convenient and efficient way to submit your claim. Alternatively, you may choose to mail the completed form to the appropriate tax office or submit it in person. Each method has its own advantages, so selecting the one that best fits your needs is important.

Key Elements of the IT 214 Form

The IT 214 form includes several key elements that applicants must complete to ensure their claim is valid. These elements typically include personal identification information, income details, and the calculation of the property tax credit. Additionally, the form may require supporting documentation to verify income and residency. Understanding these components is essential for accurately completing the form and maximizing your potential tax benefits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 214 claim for real property tax credit for homeowners and renters tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 214 2024 form and how does airSlate SignNow help with it?

The it 214 2024 form is a crucial document for businesses that need to manage their tax obligations efficiently. airSlate SignNow simplifies the process by allowing users to eSign and send the it 214 2024 form securely, ensuring compliance and reducing paperwork.

-

How much does airSlate SignNow cost for managing the it 214 2024?

airSlate SignNow offers competitive pricing plans that cater to various business needs. For managing the it 214 2024, you can choose a plan that fits your budget while enjoying features that enhance document management and eSigning.

-

What features does airSlate SignNow provide for the it 214 2024?

airSlate SignNow provides a range of features for the it 214 2024, including customizable templates, secure eSigning, and real-time tracking. These features streamline the document workflow, making it easier for businesses to handle their tax forms.

-

Can I integrate airSlate SignNow with other software for the it 214 2024?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage the it 214 2024. This allows for a more efficient workflow by connecting your existing tools with our eSigning solution.

-

What are the benefits of using airSlate SignNow for the it 214 2024?

Using airSlate SignNow for the it 214 2024 provides numerous benefits, including time savings, reduced errors, and enhanced security. Our platform ensures that your documents are handled efficiently, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling the it 214 2024?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your it 214 2024 documents. You can trust that your sensitive information is safe while using our eSigning services.

-

How does airSlate SignNow improve the efficiency of processing the it 214 2024?

airSlate SignNow improves the efficiency of processing the it 214 2024 by automating the eSigning process and providing easy access to documents. This reduces the time spent on manual tasks and accelerates the overall workflow.

Get more for Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year

Find out other Form IT 214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF