Form ID K 1 and Instructions, Partner's, Shareholder's or

Understanding the Form K-1 and Its Instructions

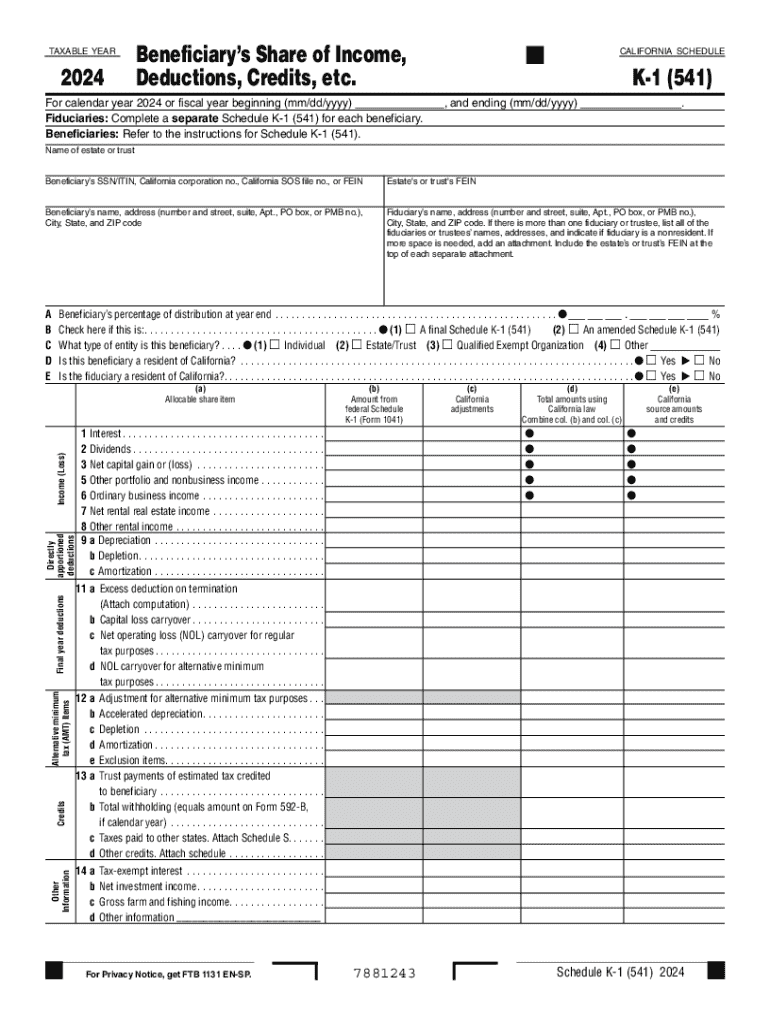

The Form K-1, specifically the California Form 541 K-1, is used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form provides essential information for partners or shareholders regarding their share of the entity's income and tax obligations. It is crucial for accurate tax reporting and compliance with state regulations.

Steps to Complete the California Form 541 K-1

Completing the California Form 541 K-1 involves several key steps:

- Gather necessary information about the partnership or corporation, including its federal identification number.

- Fill out the partner's or shareholder's identifying information, such as name, address, and Social Security number.

- Report the income, deductions, and credits allocated to the partner or shareholder as provided by the entity.

- Review the completed form for accuracy and ensure all required information is included.

Legal Use of the California Form 541 K-1

The California Form 541 K-1 is legally required for entities that distribute income to partners or shareholders. This form must be accurately filled out and provided to each partner or shareholder to ensure compliance with California tax laws. Failure to provide this form can result in penalties for both the entity and the individual receiving the income.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the California Form 541 K-1. Typically, the form must be issued to partners or shareholders by the entity by the due date of the entity's tax return. This ensures that individuals have the necessary information to file their personal tax returns on time.

Who Issues the California Form 541 K-1

The California Form 541 K-1 is issued by partnerships, S corporations, estates, and trusts. These entities are responsible for preparing the form based on the income and deductions allocated to each partner or shareholder. It is important for these entities to ensure that the information reported is accurate and reflects the financial activities of the entity during the tax year.

Examples of Using the California Form 541 K-1

Partners in a partnership may receive a California Form 541 K-1 detailing their share of the partnership's income, which they will report on their personal tax returns. Similarly, shareholders of an S corporation will receive this form to report their allocated income and deductions. This form is vital for accurately reflecting income from these entities on individual tax filings.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form id k 1 and instructions partners shareholders or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ca 2024 1?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. With ca 2024 1, users can streamline their document workflows, ensuring efficiency and compliance in their operations.

-

How much does airSlate SignNow cost in relation to ca 2024 1?

The pricing for airSlate SignNow is competitive and designed to fit various business needs. For ca 2024 1, we offer flexible plans that cater to different user requirements, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for ca 2024 1 users?

airSlate SignNow provides a range of features including customizable templates, real-time tracking, and secure cloud storage. These features are essential for ca 2024 1 users looking to enhance their document management processes.

-

What are the benefits of using airSlate SignNow for ca 2024 1?

Using airSlate SignNow for ca 2024 1 can signNowly reduce turnaround times for document signing. Additionally, it enhances security and compliance, making it a reliable choice for businesses aiming to improve their operational efficiency.

-

Can airSlate SignNow integrate with other tools for ca 2024 1?

Yes, airSlate SignNow offers seamless integrations with various applications and platforms. This capability is particularly beneficial for ca 2024 1 users who want to enhance their existing workflows and improve productivity.

-

Is airSlate SignNow user-friendly for ca 2024 1 customers?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for ca 2024 1 customers to navigate and utilize its features. The intuitive interface ensures that users can quickly adapt and start benefiting from the platform.

-

How does airSlate SignNow ensure document security for ca 2024 1?

airSlate SignNow prioritizes document security by employing advanced encryption and authentication measures. For ca 2024 1 users, this means that sensitive information is protected, ensuring compliance with industry standards.

Get more for Form ID K 1 And Instructions, Partner's, Shareholder's Or

Find out other Form ID K 1 And Instructions, Partner's, Shareholder's Or

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online