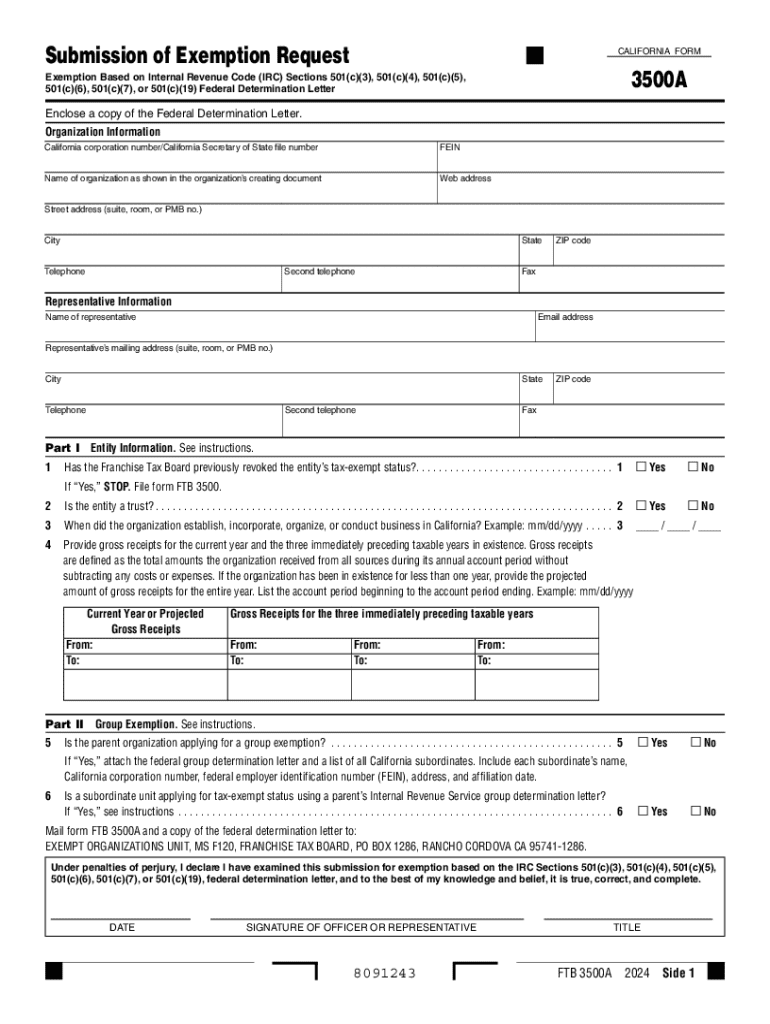

California Form 3500 A, Submission of Exemption Request

What is the California Form 3500A?

The California Form 3500A is a state-specific document used to request an exemption from certain tax obligations. This form is primarily utilized by organizations seeking to establish their tax-exempt status under California law. It serves as a formal application for exemption from the California Franchise Tax Board (FTB) and is an essential step for qualifying entities to avoid unnecessary tax liabilities.

How to Use the California Form 3500A

To effectively use the California Form 3500A, applicants must first ensure they meet the eligibility criteria for exemption. The form should be filled out with accurate information regarding the organization, including its purpose and activities. Once completed, the form must be submitted to the FTB along with any required documentation that supports the exemption request. It is important to keep copies of all submissions for record-keeping purposes.

Steps to Complete the California Form 3500A

Completing the California Form 3500A involves several key steps:

- Gather necessary documentation that demonstrates the organization's eligibility for tax exemption.

- Fill out the form with accurate and complete information, ensuring all sections are addressed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the FTB, either online or by mail, along with any required attachments.

Following these steps carefully can help streamline the application process and improve the chances of approval.

Required Documents for the California Form 3500A

When submitting the California Form 3500A, certain documents are typically required to support the exemption request. These may include:

- Articles of incorporation or organization documents.

- Bylaws or operating agreements.

- Financial statements or budgets that demonstrate the organization's activities.

- Any additional documentation that supports the claim for tax exemption.

It is crucial to review the specific requirements outlined by the FTB to ensure all necessary documents are included with the submission.

Eligibility Criteria for the California Form 3500A

Eligibility for submitting the California Form 3500A is generally limited to specific types of organizations. Commonly eligible entities include:

- Nonprofit organizations.

- Charitable organizations.

- Religious institutions.

- Educational entities.

Each organization must demonstrate that its activities align with the criteria set forth by the FTB to qualify for tax exemption.

Form Submission Methods for the California Form 3500A

The California Form 3500A can be submitted through various methods, providing flexibility for applicants. The options include:

- Online submission through the FTB's official website.

- Mailing the completed form and supporting documents to the appropriate FTB address.

- In-person submission at designated FTB offices.

Choosing the most convenient submission method can help facilitate a smoother application process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 3500 a submission of exemption request 772017387

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California 3500A form?

The California 3500A form is a document used for reporting specific tax information to the state of California. It is essential for businesses to ensure compliance with state regulations. Understanding this form can help streamline your tax reporting process.

-

How can airSlate SignNow help with the California 3500A form?

airSlate SignNow provides a user-friendly platform to easily fill out and eSign the California 3500A form. Our solution simplifies the document management process, ensuring that your forms are completed accurately and submitted on time.

-

What are the pricing options for using airSlate SignNow for the California 3500A form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that fits your needs, whether you need to manage a few California 3500A forms or a large volume of documents. Our cost-effective solution ensures you get the best value.

-

Are there any features specifically designed for the California 3500A form?

Yes, airSlate SignNow includes features that enhance the completion of the California 3500A form, such as templates, automated reminders, and secure eSigning. These features help ensure that your forms are filled out correctly and efficiently.

-

Can I integrate airSlate SignNow with other software for managing the California 3500A form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the California 3500A form alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the California 3500A form?

Using airSlate SignNow for the California 3500A form offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your documents are handled with care, making the process smoother for your business.

-

Is airSlate SignNow secure for handling the California 3500A form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the California 3500A form. We use advanced encryption and security protocols to protect your sensitive information throughout the signing process.

Get more for California Form 3500 A, Submission Of Exemption Request

- New india assurance personal accident proposal form download

- Modello ci520 form

- B7 form

- Sarkarijalt form

- Nysdec nuisance wildlife control log nysdec nuisance wildlife control log dec ny form

- Anesthesia monitoring sheet veterinary form

- Will employment contract template form

- Work employment contract template form

Find out other California Form 3500 A, Submission Of Exemption Request

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement