Declaration of De Minimis Pennsylvania Activity RCT 101D Form

What is the Declaration of De Minimis Pennsylvania Activity RCT 101D

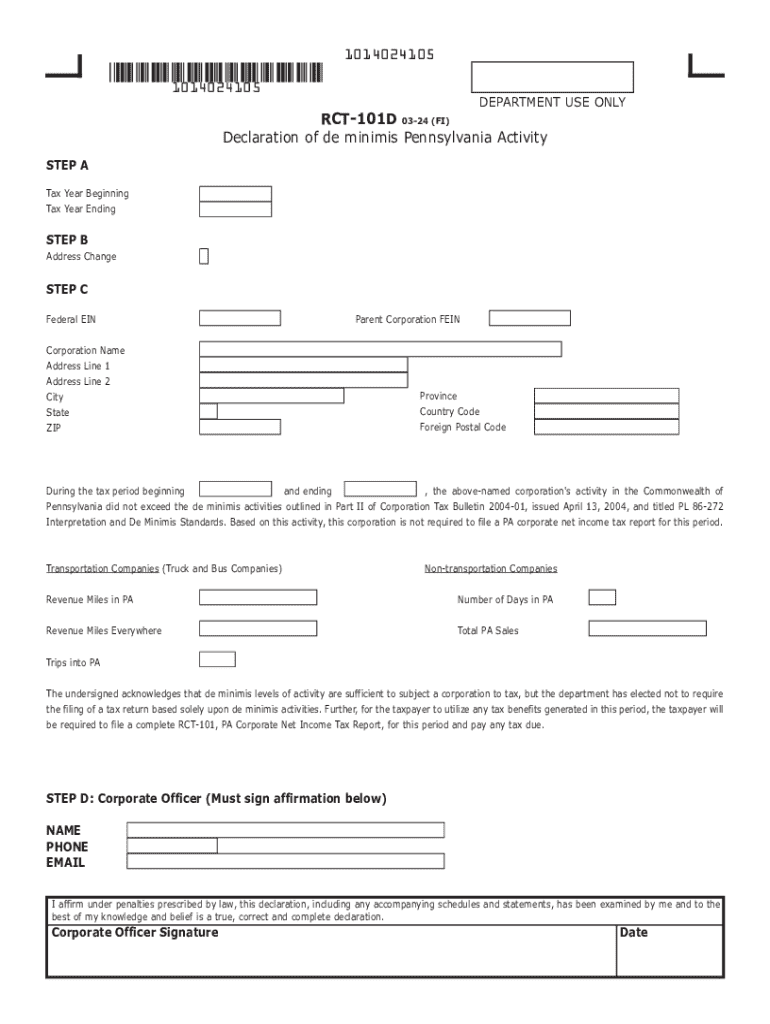

The Declaration of De Minimis Pennsylvania Activity RCT 101D is a form used by businesses in Pennsylvania to declare activities that are considered minimal in terms of tax implications. This declaration is essential for entities that engage in limited business activities within the state, allowing them to avoid certain tax liabilities. The form is particularly relevant for businesses that do not meet the thresholds for more extensive tax obligations, simplifying compliance with state regulations.

How to Use the Declaration of De Minimis Pennsylvania Activity RCT 101D

To effectively use the RCT 101D, businesses should first determine their eligibility based on the nature and scope of their activities in Pennsylvania. Once eligibility is confirmed, the form can be filled out with the necessary details, including business identification and a description of the activities. After completing the form, it should be submitted to the appropriate state authority to ensure compliance with Pennsylvania tax laws.

Steps to Complete the Declaration of De Minimis Pennsylvania Activity RCT 101D

Completing the RCT 101D involves several key steps:

- Gather necessary information about your business, including identification numbers and activity descriptions.

- Access the RCT 101D form, which can be obtained online or through state offices.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the designated state agency, either online or by mail.

Legal Use of the Declaration of De Minimis Pennsylvania Activity RCT 101D

The legal use of the RCT 101D is crucial for businesses to maintain compliance with Pennsylvania tax laws. By submitting this declaration, businesses affirm that their activities fall within the de minimis threshold, thereby avoiding unnecessary tax liabilities. It is important to understand that misrepresentation or failure to file when required can lead to penalties, making accurate reporting essential.

Key Elements of the Declaration of De Minimis Pennsylvania Activity RCT 101D

The RCT 101D includes several key elements that must be accurately reported:

- Business Identification: This includes the name, address, and identification number of the business.

- Description of Activities: A clear explanation of the business activities that qualify as de minimis.

- Signature and Date: The form must be signed by an authorized representative of the business and dated appropriately.

Filing Deadlines / Important Dates

Filing deadlines for the RCT 101D are essential for compliance. Businesses must be aware of specific dates to ensure timely submission. Generally, the form should be filed annually, and any changes in business activities should be reported as they occur. Keeping track of these deadlines helps avoid penalties and ensures that businesses remain in good standing with state tax authorities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the declaration of de minimis pennsylvania activity rct 101d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rct 101d and how does it work?

The rct 101d is a powerful tool within airSlate SignNow that allows users to easily send and eSign documents. It streamlines the signing process, making it efficient and user-friendly. With the rct 101d, businesses can manage their document workflows seamlessly.

-

What are the key features of the rct 101d?

The rct 101d offers a variety of features including customizable templates, real-time tracking, and secure cloud storage. These features enhance the document signing experience, ensuring that users can manage their documents effectively. Additionally, the rct 101d integrates with other tools to further improve productivity.

-

How much does the rct 101d cost?

The pricing for the rct 101d is competitive and designed to fit various business needs. airSlate SignNow offers flexible subscription plans that cater to different usage levels. You can choose a plan that best suits your requirements without breaking the bank.

-

What are the benefits of using the rct 101d?

Using the rct 101d provides numerous benefits, including increased efficiency and reduced turnaround time for document signing. It also enhances security and compliance, ensuring that your documents are handled safely. Overall, the rct 101d helps businesses save time and resources.

-

Can the rct 101d integrate with other software?

Yes, the rct 101d can seamlessly integrate with various software applications, enhancing its functionality. This allows businesses to incorporate the rct 101d into their existing workflows without any hassle. Popular integrations include CRM systems, project management tools, and more.

-

Is the rct 101d suitable for small businesses?

Absolutely! The rct 101d is designed to be user-friendly and cost-effective, making it ideal for small businesses. It provides all the essential features needed for efficient document management without overwhelming users with complexity.

-

How secure is the rct 101d for document signing?

The rct 101d prioritizes security, employing advanced encryption and authentication measures to protect your documents. This ensures that all signed documents are secure and compliant with industry standards. You can trust the rct 101d to keep your sensitive information safe.

Get more for Declaration Of De Minimis Pennsylvania Activity RCT 101D

Find out other Declaration Of De Minimis Pennsylvania Activity RCT 101D

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online