Form MT 15519Mortgage Recording Tax Returnmt15

What is the Form MT 15519 Mortgage Recording Tax Return

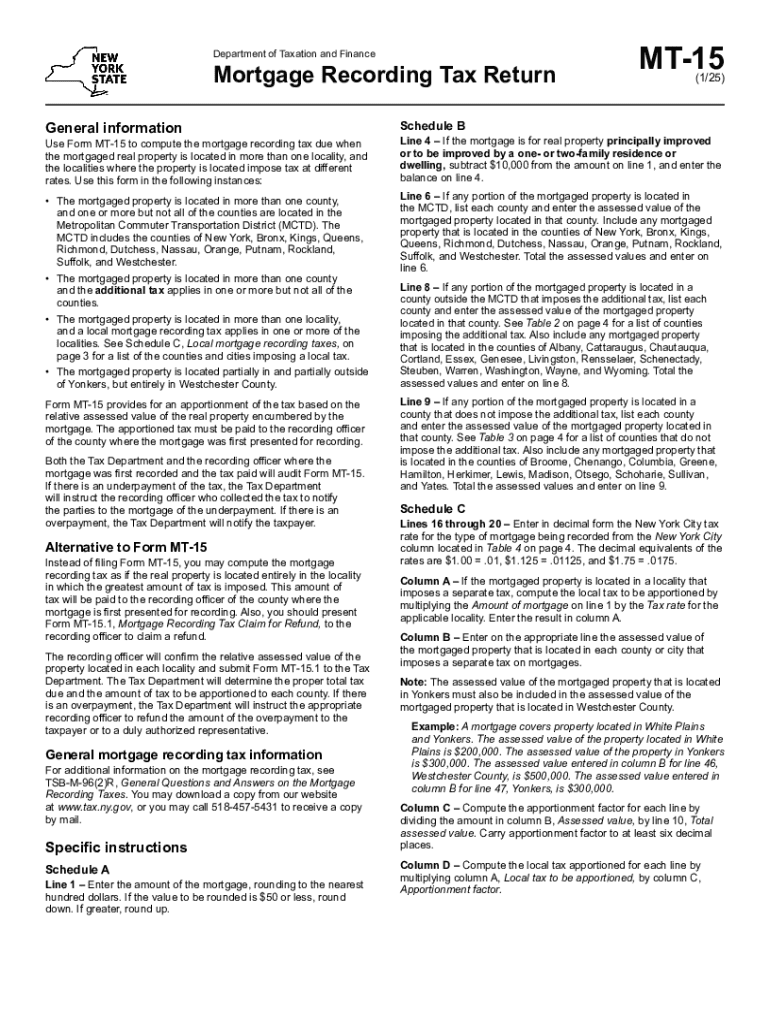

The Form MT 15519, also known as the Mortgage Recording Tax Return, is a document used in the United States to report and pay the mortgage recording tax. This tax is typically assessed when a mortgage is recorded against a property, and the form ensures compliance with state and local regulations. The form collects essential information regarding the mortgage transaction, including the amount of the mortgage, the parties involved, and the property details. Proper completion of this form is crucial for legal documentation and tax purposes.

How to use the Form MT 15519 Mortgage Recording Tax Return

Using the Form MT 15519 involves several steps to ensure accuracy and compliance. First, gather all necessary information related to the mortgage, including the loan amount, borrower details, and property information. Next, fill out the form accurately, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions. Finally, submit the form along with the required payment to the appropriate tax authority, either online or via mail, depending on local regulations.

Steps to complete the Form MT 15519 Mortgage Recording Tax Return

Completing the Form MT 15519 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the appropriate state or local tax authority.

- Fill in the borrower’s name and address, as well as the lender’s information.

- Provide details about the mortgage, including the amount and date of the transaction.

- Include property information such as the address and legal description.

- Calculate the mortgage recording tax based on the applicable rate.

- Sign and date the form to certify its accuracy.

Legal use of the Form MT 15519 Mortgage Recording Tax Return

The Form MT 15519 serves a legal purpose in documenting the mortgage recording tax. It is required by law to be filed with the appropriate authorities when a mortgage is recorded. Failure to submit this form can result in penalties or fines, and may affect the legality of the mortgage itself. It is essential for both lenders and borrowers to understand the legal implications of this form to ensure compliance with state and local laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form MT 15519 can vary by state and locality. Generally, the form must be submitted at the time of recording the mortgage. It is advisable to check with the local tax authority for specific deadlines to avoid any potential penalties. Keeping track of these important dates is crucial for ensuring timely compliance and avoiding complications with mortgage transactions.

Required Documents

To complete the Form MT 15519, several documents may be required. These typically include:

- The mortgage agreement or loan documents.

- Identification information for both the borrower and lender.

- Property deed or legal description of the property.

- Any previous tax documents related to the property, if applicable.

Having these documents on hand will facilitate the accurate completion of the form and ensure all necessary information is provided.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mt 15519mortgage recording tax returnmt15

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form MT 15519Mortgage Recording Tax Returnmt15?

Form MT 15519Mortgage Recording Tax Returnmt15 is a document required for reporting mortgage recording taxes in certain jurisdictions. It ensures compliance with local tax regulations and helps streamline the recording process for real estate transactions.

-

How can airSlate SignNow help with Form MT 15519Mortgage Recording Tax Returnmt15?

airSlate SignNow provides an efficient platform for completing and eSigning Form MT 15519Mortgage Recording Tax Returnmt15. Our user-friendly interface simplifies the process, allowing users to fill out and submit the form quickly and securely.

-

Is there a cost associated with using airSlate SignNow for Form MT 15519Mortgage Recording Tax Returnmt15?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the completion of Form MT 15519Mortgage Recording Tax Returnmt15, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Form MT 15519Mortgage Recording Tax Returnmt15?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to manage Form MT 15519Mortgage Recording Tax Returnmt15 and other important documents efficiently.

-

Can I integrate airSlate SignNow with other software for Form MT 15519Mortgage Recording Tax Returnmt15?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for Form MT 15519Mortgage Recording Tax Returnmt15. This allows for seamless data transfer and improved efficiency in document management.

-

What are the benefits of using airSlate SignNow for Form MT 15519Mortgage Recording Tax Returnmt15?

Using airSlate SignNow for Form MT 15519Mortgage Recording Tax Returnmt15 provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled efficiently and securely, giving you peace of mind.

-

Is airSlate SignNow compliant with regulations for Form MT 15519Mortgage Recording Tax Returnmt15?

Yes, airSlate SignNow is designed to comply with relevant regulations for Form MT 15519Mortgage Recording Tax Returnmt15. We prioritize security and compliance, ensuring that your documents meet all necessary legal requirements.

Get more for Form MT 15519Mortgage Recording Tax Returnmt15

- Claim review form 542 3

- School evaluation form pdf

- Warranty replacement form folica com

- Raccoon rex form

- Application for a paye tax clearance certificate tc11 application for a paye tax clearance certificate tc11 revenue form

- Contact us kilncraigs building greenside street alloa form

- In the shelby county court of general sessions form

- Ny form mv 45fill out and use this pdf

Find out other Form MT 15519Mortgage Recording Tax Returnmt15

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms