DR 0021W Oil and Gas Withholding Statement Form

What is the DR 0021W Oil And Gas Withholding Statement

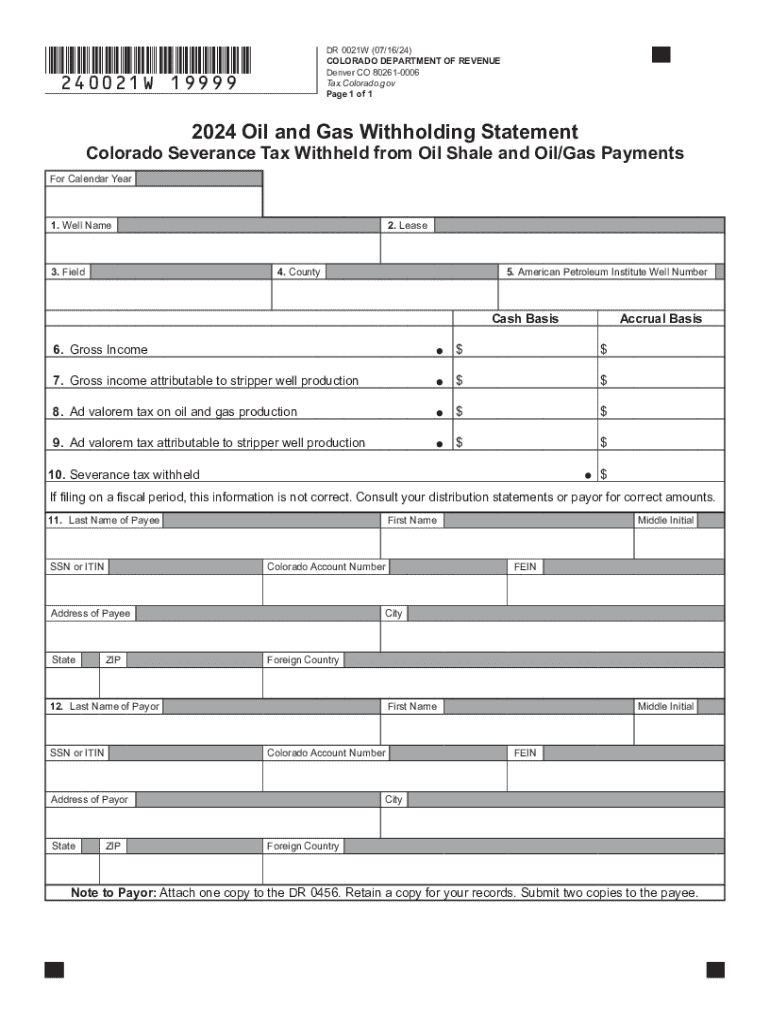

The DR 0021W Oil and Gas Withholding Statement is a specific form used in Colorado for reporting and withholding state income tax from payments made to oil and gas operators and contractors. This form is essential for ensuring compliance with Colorado tax regulations, particularly for businesses involved in the oil and gas sector. It serves as a declaration of the amount withheld from payments, which is then submitted to the Colorado Department of Revenue.

How to use the DR 0021W Oil And Gas Withholding Statement

Using the DR 0021W form involves several steps to ensure accurate reporting of withheld taxes. First, businesses must complete the form by providing necessary details such as the payee's information, the amount paid, and the tax withheld. After filling out the required fields, the form should be submitted to the appropriate tax authority. It's important to keep a copy for your records, as this documentation may be needed for future reference or audits.

Steps to complete the DR 0021W Oil And Gas Withholding Statement

Completing the DR 0021W form requires careful attention to detail. Follow these steps:

- Gather necessary information, including the payee's name, address, and taxpayer identification number.

- Enter the total amount paid to the payee in the designated field.

- Calculate the amount of state income tax to withhold based on the payment amount.

- Fill in the withholding amount on the form.

- Review the form for accuracy before submission.

Key elements of the DR 0021W Oil And Gas Withholding Statement

The DR 0021W form includes several key elements that must be accurately reported. These elements typically consist of:

- Payee information: Name, address, and taxpayer identification number.

- Payment amount: Total payment made to the payee.

- Withholding amount: The calculated state income tax withheld from the payment.

- Signature: Required to validate the information provided on the form.

Legal use of the DR 0021W Oil And Gas Withholding Statement

The DR 0021W form is legally required for businesses making payments to oil and gas operators in Colorado. Proper use of this form ensures compliance with state tax laws and helps avoid potential penalties for non-compliance. It is crucial for businesses to understand their obligations regarding withholding taxes and to use the form correctly to report these withholdings to the state.

Filing Deadlines / Important Dates

Filing deadlines for the DR 0021W form are typically aligned with Colorado's tax reporting schedule. Businesses must ensure that the form is submitted by the designated due date to avoid penalties. Staying informed about these deadlines is essential for maintaining compliance and ensuring that all required taxes are reported and paid on time.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0021w oil and gas withholding statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 0021w colorado and how does it relate to airSlate SignNow?

dr 0021w colorado refers to a specific document type that can be efficiently managed using airSlate SignNow. Our platform allows users to easily send, sign, and store documents like dr 0021w colorado, ensuring a streamlined workflow for businesses.

-

What are the pricing options for using airSlate SignNow with dr 0021w colorado?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those requiring dr 0021w colorado document management. You can choose from monthly or annual subscriptions, with options that provide access to all features necessary for handling dr 0021w colorado efficiently.

-

What features does airSlate SignNow offer for managing dr 0021w colorado?

With airSlate SignNow, you can utilize features such as customizable templates, automated workflows, and secure eSigning specifically for dr 0021w colorado. These tools enhance productivity and ensure compliance with legal standards for document handling.

-

How can airSlate SignNow benefit my business when dealing with dr 0021w colorado?

Using airSlate SignNow for dr 0021w colorado can signNowly reduce the time spent on document management. The platform's user-friendly interface and automation capabilities allow businesses to focus on core activities while ensuring that all dr 0021w colorado documents are processed efficiently.

-

Does airSlate SignNow integrate with other software for dr 0021w colorado?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage dr 0021w colorado alongside your existing tools. This interoperability enhances your workflow and ensures that all your document processes are connected.

-

Is airSlate SignNow secure for handling sensitive dr 0021w colorado documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive dr 0021w colorado documents. You can trust that your data is safe while using our platform for eSigning and document management.

-

Can I customize templates for dr 0021w colorado in airSlate SignNow?

Yes, airSlate SignNow allows you to create and customize templates specifically for dr 0021w colorado. This feature enables you to standardize your documents while saving time on repetitive tasks, ensuring consistency across all your communications.

Get more for DR 0021W Oil And Gas Withholding Statement

- Maryland divorce papers pdf form

- Income tax form vsi r

- Ga studies study guide answer key form

- Utility service request spotsylvania county form

- Pregnancy risk assessment template word 210567471 form

- The leaders guide to corporate culture form

- Maryland state inspection checklist pdf form

- Ontario residential tenancy agreement form

Find out other DR 0021W Oil And Gas Withholding Statement

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free