Form 943 Employer's Annual Federal Tax Return for Agricultural Employees Eitc Irs

What is the Form 943 Employer's Annual Federal Tax Return for Agricultural Employees?

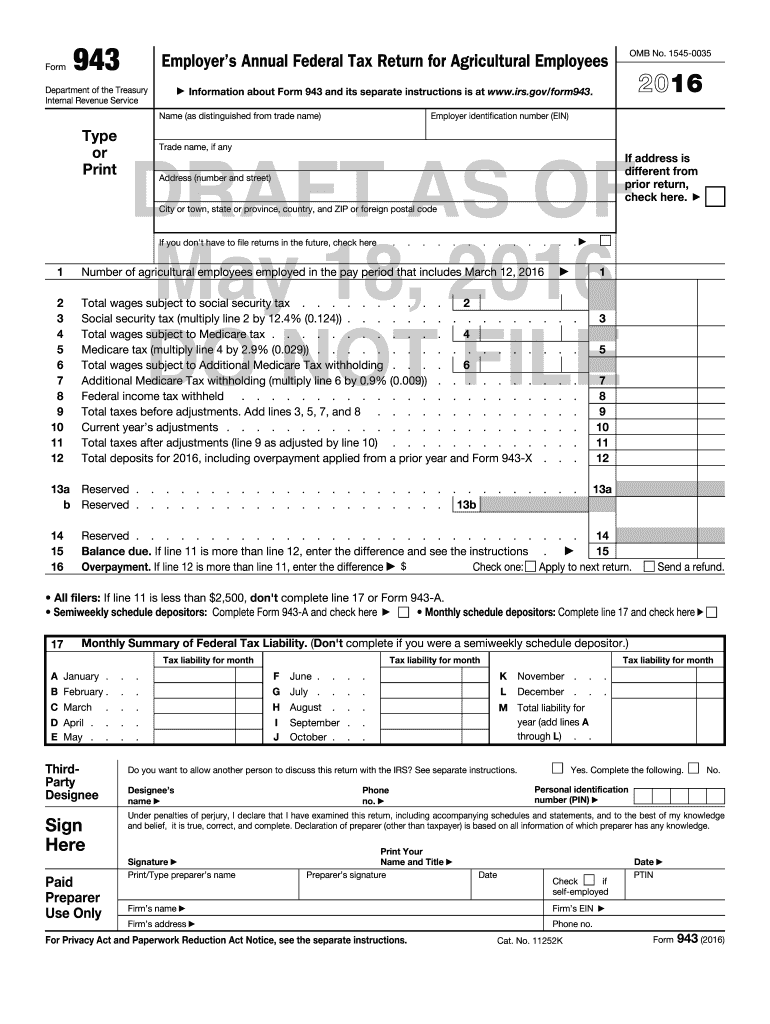

The Form 943 is an essential document used by employers in the agricultural sector to report annual federal tax obligations related to their employees. Specifically, this form is designed for those who pay wages to farmworkers and need to report income taxes withheld, as well as Social Security and Medicare taxes. The IRS Form 943 is crucial for ensuring compliance with federal tax regulations and for determining eligibility for various tax credits, including the Earned Income Tax Credit (EITC).

Steps to Complete the Form 943

Completing the Form 943 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your agricultural employees, including their names, Social Security numbers, and total wages paid. Next, accurately calculate the total amount of federal income tax withheld, as well as Social Security and Medicare taxes. After filling out the form, review it for any errors or omissions. Finally, submit the completed Form 943 to the IRS by the designated deadline, which is typically January 31 of the following year.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with Form 943 to avoid penalties. The IRS requires that Form 943 be filed annually by January 31 for the previous tax year. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, any payments owed must also be submitted by this date to ensure compliance and avoid interest or penalties.

Legal Use of the Form 943

The legal use of Form 943 is governed by IRS regulations, which outline the requirements for reporting agricultural employment taxes. This form must be filled out accurately and submitted on time to avoid potential legal issues, including penalties for non-compliance. Employers must also ensure that they maintain proper records of wages paid and taxes withheld, as these may be subject to audit by the IRS.

Key Elements of the Form 943

Several key elements must be included when completing the Form 943. These include the employer's identification information, total wages paid to employees, the amount of federal income tax withheld, and the total Social Security and Medicare taxes. Additionally, employers must provide information regarding any adjustments or corrections from previous filings, ensuring that all data is accurate and up to date.

How to Obtain the Form 943

Employers can obtain the Form 943 directly from the IRS website or through various tax preparation software that includes this form. It is essential to ensure that you are using the most current version of the form to comply with the latest tax regulations. Additionally, printed copies may be available at local IRS offices or through authorized tax professionals.

Quick guide on how to complete 2016 form 943 employers annual federal tax return for agricultural employees eitc irs

Complete Form 943 Employer's Annual Federal Tax Return For Agricultural Employees Eitc Irs effortlessly on any device

Online document management has become popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Form 943 Employer's Annual Federal Tax Return For Agricultural Employees Eitc Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The simplest way to alter and eSign Form 943 Employer's Annual Federal Tax Return For Agricultural Employees Eitc Irs without hassle

- Locate Form 943 Employer's Annual Federal Tax Return For Agricultural Employees Eitc Irs and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to deliver your form: by email, text message (SMS), invite link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing out new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Form 943 Employer's Annual Federal Tax Return For Agricultural Employees Eitc Irs and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 943 employers annual federal tax return for agricultural employees eitc irs

How to make an electronic signature for your 2016 Form 943 Employers Annual Federal Tax Return For Agricultural Employees Eitc Irs in the online mode

How to generate an eSignature for the 2016 Form 943 Employers Annual Federal Tax Return For Agricultural Employees Eitc Irs in Google Chrome

How to generate an eSignature for signing the 2016 Form 943 Employers Annual Federal Tax Return For Agricultural Employees Eitc Irs in Gmail

How to generate an eSignature for the 2016 Form 943 Employers Annual Federal Tax Return For Agricultural Employees Eitc Irs right from your smartphone

How to create an electronic signature for the 2016 Form 943 Employers Annual Federal Tax Return For Agricultural Employees Eitc Irs on iOS devices

How to create an eSignature for the 2016 Form 943 Employers Annual Federal Tax Return For Agricultural Employees Eitc Irs on Android devices

People also ask

-

What is form 943 and why do I need it?

Form 943 is used by employers to report wages and tax withholdings for agricultural employees. If your business hires workers in agriculture, you are required to fill out this form to ensure compliance with IRS regulations. Using airSlate SignNow can simplify the eSigning process for submitting your form 943.

-

How can airSlate SignNow help me with form 943?

airSlate SignNow offers an easy-to-use platform that allows you to send, eSign, and store your form 943 safely and securely. The intuitive interface helps streamline the signing process and ensures that your documents are compliant with all relevant regulations. This can save you time and reduce the hassle associated with tax reporting.

-

Is there a cost associated with using airSlate SignNow for form 943?

Yes, airSlate SignNow offers various pricing plans based on your business needs. These plans allow you to access features specifically designed for managing documents like form 943 efficiently. The cost-effective solution ensures that you get the best value for your investment in eSignature technology.

-

What features does airSlate SignNow provide for managing form 943?

airSlate SignNow includes features like document templates, secure eSignatures, and tracking for form 943 submissions. These tools help you manage the entire process efficiently, from document creation to final approval. Additionally, you can easily share and collaborate on documents with your team.

-

Can I integrate airSlate SignNow with my existing software for form 943s?

Yes, airSlate SignNow offers integrations with a variety of accounting and HR software, making it easier to align your form 943 processes with existing workflows. These integrations save time and reduce manual entry errors, allowing for a more seamless experience. You can connect it with tools you already use to enhance efficiency.

-

What are the benefits of using airSlate SignNow for eSigning form 943?

Using airSlate SignNow for your form 943 offers numerous benefits, including increased speed, security, and compliance. It simplifies the process of obtaining necessary signatures and securely stores your documents for easy access. This ensures that your tax filings are accurate and submitted on time.

-

Is airSlate SignNow compliant with IRS regulations for form 943?

Absolutely, airSlate SignNow adheres to all relevant IRS regulations which makes it a reliable choice for managing form 943. The platform ensures secure eSignatures and provides an audit trail for every document, giving you peace of mind regarding compliance. You can trust that your submissions meet all legal standards.

Get more for Form 943 Employer's Annual Federal Tax Return For Agricultural Employees Eitc Irs

- Application for allowing medicines ine form

- Samajik suraksha yojana form pdf

- Patient auth form

- Aerospace engineering from the ground up pdf form

- He v application for veterans college for texans form

- Group dental claim form ebs rmsco inc

- Aae endodontic diagnosis form

- Dependency case opening and title iv e form guide

Find out other Form 943 Employer's Annual Federal Tax Return For Agricultural Employees Eitc Irs

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy