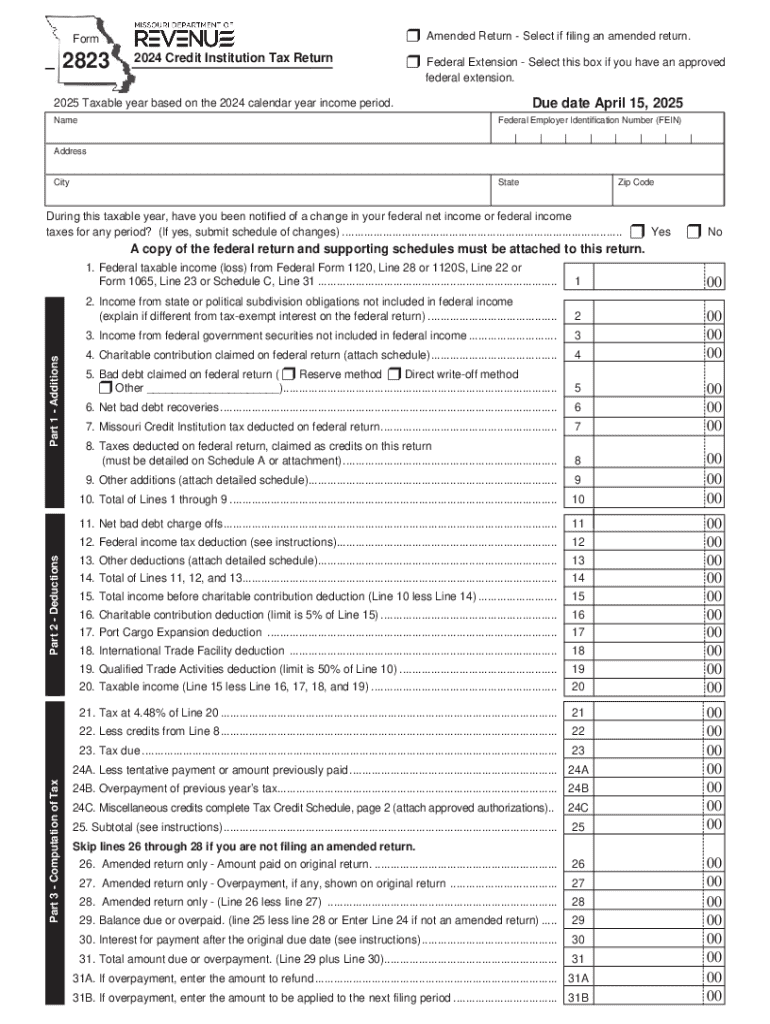

Form 2823 Credit Institution Tax Return

What is the Form 2823 Credit Institution Tax Return

The Form 2823 Credit Institution Tax Return is a specific tax document used by credit institutions in the United States to report their financial activities and tax obligations to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and is designed to capture detailed information regarding the institution's income, deductions, and credits. Understanding this form is crucial for credit institutions to accurately fulfill their tax responsibilities and avoid penalties.

How to use the Form 2823 Credit Institution Tax Return

Using the Form 2823 involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant tax records. Next, accurately fill out the form by entering the required information in the designated fields. It is important to review the completed form for accuracy before submission. Lastly, submit the form to the IRS by the specified deadline to ensure compliance and avoid potential penalties.

Steps to complete the Form 2823 Credit Institution Tax Return

Completing the Form 2823 requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial data, including income, expenses, and tax credits.

- Access the Form 2823, either through the IRS website or authorized tax preparation software.

- Fill in the form, ensuring that all sections are completed accurately.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 2823 is crucial for credit institutions. Typically, the deadline for submitting this tax return aligns with the standard corporate tax filing dates. Institutions should be aware of any specific extensions or changes that may apply. Timely submission helps avoid late fees and potential penalties, ensuring compliance with IRS regulations.

Required Documents

To complete the Form 2823, certain documents are necessary. These typically include:

- Income statements detailing revenue generated by the institution.

- Balance sheets reflecting the institution's financial position.

- Records of any deductions or credits being claimed.

- Previous tax returns for reference and consistency.

Having these documents organized and readily available can streamline the process of filling out the form.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 2823 can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for credit institutions to adhere to all filing requirements and deadlines to mitigate these risks. Regular audits and consultations with tax professionals can help ensure compliance and reduce the likelihood of penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2823 credit institution tax return 772045179

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2823 Credit Institution Tax Return?

The Form 2823 Credit Institution Tax Return is a tax document specifically designed for credit institutions to report their financial activities. It ensures compliance with tax regulations and helps institutions accurately calculate their tax liabilities. Understanding this form is crucial for maintaining financial integrity and avoiding penalties.

-

How can airSlate SignNow help with the Form 2823 Credit Institution Tax Return?

airSlate SignNow simplifies the process of preparing and submitting the Form 2823 Credit Institution Tax Return by providing an intuitive platform for document management. Users can easily eSign and send documents securely, ensuring that all necessary information is accurately captured. This streamlines the tax filing process and enhances overall efficiency.

-

What are the pricing options for using airSlate SignNow for the Form 2823 Credit Institution Tax Return?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small credit institution or a large organization, you can choose a plan that fits your budget while ensuring you have access to all the necessary features for managing the Form 2823 Credit Institution Tax Return. Visit our pricing page for detailed information.

-

What features does airSlate SignNow provide for managing the Form 2823 Credit Institution Tax Return?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing the Form 2823 Credit Institution Tax Return. These tools help ensure that your documents are completed accurately and submitted on time. Additionally, the platform offers integration with various applications to enhance workflow.

-

Are there any benefits to using airSlate SignNow for the Form 2823 Credit Institution Tax Return?

Using airSlate SignNow for the Form 2823 Credit Institution Tax Return provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick collaboration among team members, ensuring that all necessary signatures are obtained promptly. This ultimately leads to a smoother tax filing experience.

-

Can I integrate airSlate SignNow with other software for the Form 2823 Credit Institution Tax Return?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the Form 2823 Credit Institution Tax Return alongside your existing tools. This integration capability allows for a more streamlined workflow, enabling you to pull in data and documents from other platforms effortlessly. Check our integrations page for a complete list.

-

Is airSlate SignNow secure for handling the Form 2823 Credit Institution Tax Return?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the Form 2823 Credit Institution Tax Return, are protected with advanced encryption and secure storage. Our platform adheres to industry standards to safeguard sensitive information, giving you peace of mind while managing your tax documents.

Get more for Form 2823 Credit Institution Tax Return

- 2013 2014 satisfactory academic progress appeal kingsborough kbcc cuny form

- Dfw airport access badge application form

- Petition for divorce bell county co bell tx form

- Download form jk69

- Beml vendor registration form

- Target edi 850 purchase order domestic basic jobisez llc form

- Example of sad 500 customs form

- Decisions regarding assessment participation and accommodations kindergartengrade 5 decisions regarding assessment form

Find out other Form 2823 Credit Institution Tax Return

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile