Form 8863 2018

What is the Form 8863

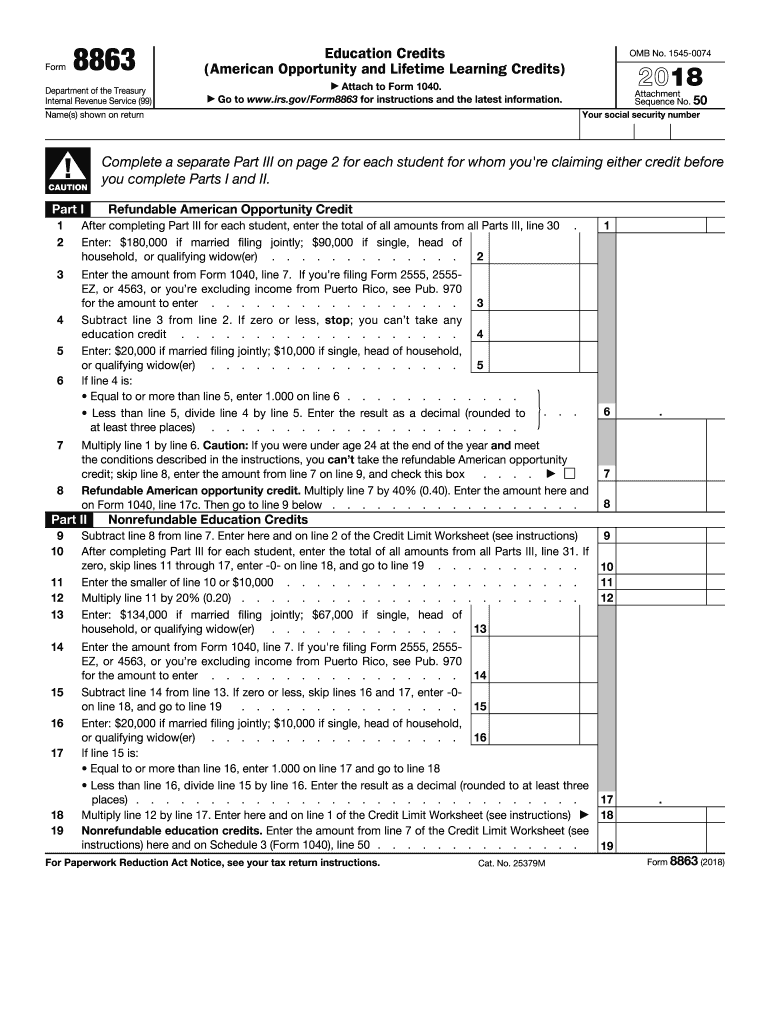

The Form 8863 is an important document used by taxpayers in the United States to claim education credits. Specifically, it allows individuals to apply for the American Opportunity Credit and the Lifetime Learning Credit. These credits can significantly reduce the amount of tax owed, making education more affordable for many families. Understanding the purpose and eligibility criteria for this form is essential for maximizing potential tax benefits.

How to use the Form 8863

To effectively use the Form 8863, taxpayers should first determine their eligibility for the education credits. This involves reviewing the qualifying expenses related to higher education, such as tuition and fees. Once eligibility is confirmed, the form must be filled out accurately, providing detailed information about the educational institution and the taxpayer's enrollment status. It is crucial to retain supporting documentation, such as receipts and enrollment records, to substantiate the claims made on the form.

Steps to complete the Form 8863

Completing the Form 8863 involves several key steps:

- Gather necessary documents, including Form 1098-T from the educational institution.

- Determine the amount of qualified education expenses incurred during the tax year.

- Fill out the form, ensuring all required fields are completed accurately.

- Calculate the credits based on the information provided, following the instructions for the American Opportunity and Lifetime Learning Credits.

- Attach the completed Form 8863 to your tax return when filing.

Filing Deadlines / Important Dates

Filing deadlines for Form 8863 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns must be filed by April 15 of the following year. However, if additional time is needed, taxpayers can file for an extension, which extends the deadline to October 15. It is important to submit Form 8863 by these deadlines to ensure eligibility for the education credits.

Eligibility Criteria

To qualify for the education credits claimed on Form 8863, taxpayers must meet specific eligibility criteria. The American Opportunity Credit is available for students pursuing a degree or other recognized education credential, while the Lifetime Learning Credit is available for any post-secondary education. Income limits also apply, affecting the amount of credit that can be claimed. Taxpayers should review these criteria carefully to ensure compliance and maximize their benefits.

Required Documents

When filing Form 8863, several documents are required to substantiate the claims made. Key documents include:

- Form 1098-T from the educational institution, which reports qualified tuition and related expenses.

- Receipts or statements that detail payments made for qualified education expenses.

- Records of enrollment status and course load, which may include transcripts or enrollment letters.

Form Submission Methods (Online / Mail / In-Person)

Form 8863 can be submitted in several ways, depending on how the taxpayer chooses to file their tax return. If filing electronically, the form is typically included as part of the e-filing process through tax software. For those who prefer to file by mail, the completed form should be attached to the paper tax return and sent to the appropriate IRS address. In-person submissions are not common for this form, as most taxpayers utilize electronic or mail methods for convenience.

Quick guide on how to complete irs form 2018 2019

Uncover the simplest method to complete and endorse your Form 8863

Are you still spending time preparing your official paperwork on physical copies instead of handling it online? airSlate SignNow offers a superior alternative to complete and endorse your Form 8863 and associated forms for public services. Our intelligent electronic signature solution equips you with everything required to manage documents swiftly and in alignment with official standards - comprehensive PDF editing, organizing, securing, signing, and sharing tools all at your fingertips within a user-friendly interface.

Only a few steps are needed to finalize and endorse your Form 8863:

- Incorporate the fillable template to the editor using the Get Form button.

- Verify what details you need to enter in your Form 8863.

- Navigate between the fields using the Next option to avoid missing anything.

- Utilize Text, Check, and Cross tools to complete the blanks with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is truly signNow or Obscure fields that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and finalize your task with the Done button.

Store your completed Form 8863 in the Documents folder of your profile, download it, or transfer it to your chosen cloud storage. Our solution also provides adaptable file sharing. There’s no requirement to print out your templates when you need to send them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it now!

Create this form in 5 minutes or less

Find and fill out the correct irs form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs form 2018 2019

How to make an eSignature for your Irs Form 2018 2019 in the online mode

How to make an eSignature for your Irs Form 2018 2019 in Chrome

How to create an electronic signature for signing the Irs Form 2018 2019 in Gmail

How to create an eSignature for the Irs Form 2018 2019 from your smart phone

How to make an eSignature for the Irs Form 2018 2019 on iOS

How to generate an eSignature for the Irs Form 2018 2019 on Android OS

People also ask

-

What is Form 8863 and who needs to file it?

Form 8863 is used to claim education credits for qualified tuition and related expenses. Taxpayers who have paid for higher education can file Form 8863 to receive tax benefits, such as the American Opportunity Credit and the Lifetime Learning Credit.

-

How can airSlate SignNow help with filling out Form 8863?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending Form 8863. By using our solution, you can ensure that the form is completed accurately and submitted on time, making the process of claiming education credits much simpler.

-

Is there a cost associated with using airSlate SignNow to manage Form 8863?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. While the exact cost may vary depending on the features you choose, our solution is designed to be cost-effective, especially for those handling multiple documents like Form 8863.

-

What features does airSlate SignNow offer for Form 8863 management?

airSlate SignNow offers features like customizable templates, secure eSigning, and document tracking for Form 8863. These tools help streamline the process, ensuring you can manage your education credit claims efficiently.

-

Can I integrate airSlate SignNow with other software for managing Form 8863?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage Form 8863 alongside your existing tools. This integration enhances your workflow, making it easier to collect signatures and maintain records.

-

What are the benefits of using airSlate SignNow for Form 8863?

Using airSlate SignNow for Form 8863 offers several benefits, including reduced paperwork, faster processing times, and improved accuracy. Our platform ensures that you can focus on your education credits without the hassle of traditional document management.

-

Is airSlate SignNow secure for handling sensitive documents like Form 8863?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents like Form 8863. You can trust our platform to keep your personal and financial information safe.

Get more for Form 8863

Find out other Form 8863

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free