4340 Individual Consumer's Use Tax Return Form

What is the 4340 Individual Consumer's Use Tax Return

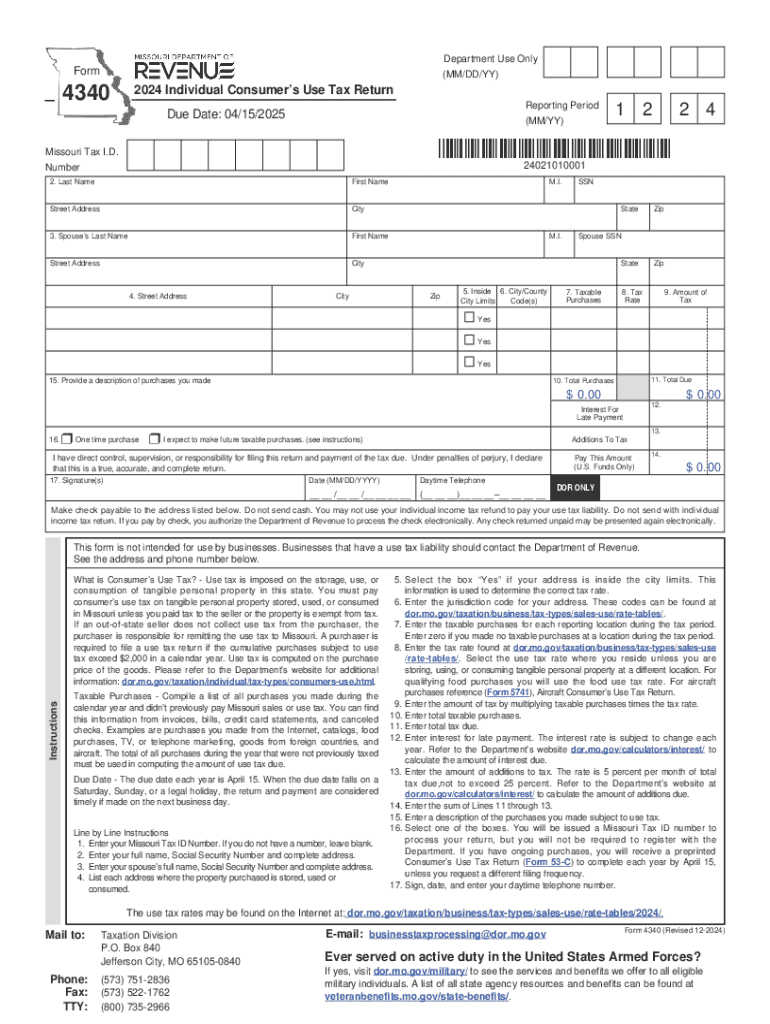

The 4340 Individual Consumer's Use Tax Return is a tax document used by individuals in the United States to report and pay use tax on items purchased for personal use. This form is essential for taxpayers who buy goods from out-of-state vendors or online retailers that do not charge sales tax. The use tax ensures that consumers contribute to state revenue in a manner similar to sales tax, maintaining fairness in the tax system.

Steps to Complete the 4340 Individual Consumer's Use Tax Return

Completing the 4340 Individual Consumer's Use Tax Return involves several key steps:

- Gather all receipts and documentation for purchases made during the tax year.

- Determine the total amount of purchases subject to use tax.

- Calculate the use tax owed based on your state's tax rate.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

How to Obtain the 4340 Individual Consumer's Use Tax Return

The 4340 Individual Consumer's Use Tax Return can be obtained through several channels. Most state revenue department websites provide downloadable versions of the form. Additionally, physical copies may be available at local tax offices or public libraries. It is advisable to ensure you are using the most current version of the form to avoid any issues during filing.

Filing Deadlines / Important Dates

Filing deadlines for the 4340 Individual Consumer's Use Tax Return typically align with state income tax deadlines. Most states require the form to be submitted by April fifteenth of the following year. It is important to check your specific state's guidelines for any variations or extensions that may apply.

Required Documents

To successfully complete the 4340 Individual Consumer's Use Tax Return, taxpayers should prepare the following documents:

- Receipts for all taxable purchases made during the year.

- Documentation of any out-of-state purchases.

- Previous tax returns, if applicable, for reference.

Penalties for Non-Compliance

Failing to file the 4340 Individual Consumer's Use Tax Return or underreporting use tax can result in penalties imposed by state tax authorities. These penalties may include interest on unpaid taxes, fines, or additional assessments. It is essential for taxpayers to comply with use tax regulations to avoid these potential consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4340 individual consumers use tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4340 Individual Consumer's Use Tax Return?

The 4340 Individual Consumer's Use Tax Return is a form used by individuals to report and pay use tax on items purchased for personal use. This tax applies to goods bought outside of your state that are used within it. Understanding this form is crucial for compliance with state tax laws.

-

How can airSlate SignNow help with the 4340 Individual Consumer's Use Tax Return?

airSlate SignNow provides an efficient platform for completing and eSigning the 4340 Individual Consumer's Use Tax Return. With our user-friendly interface, you can easily fill out the form, ensuring all necessary information is included for accurate submission.

-

What are the pricing options for using airSlate SignNow for the 4340 Individual Consumer's Use Tax Return?

airSlate SignNow offers flexible pricing plans that cater to different needs, whether you're an individual or a business. Our plans are designed to be cost-effective, allowing you to manage your 4340 Individual Consumer's Use Tax Return without breaking the bank.

-

Are there any features specifically designed for the 4340 Individual Consumer's Use Tax Return?

Yes, airSlate SignNow includes features that simplify the process of completing the 4340 Individual Consumer's Use Tax Return. These features include customizable templates, automated reminders, and secure eSigning capabilities to ensure your documents are processed efficiently.

-

What benefits does airSlate SignNow offer for managing the 4340 Individual Consumer's Use Tax Return?

Using airSlate SignNow for your 4340 Individual Consumer's Use Tax Return provides numerous benefits, including time savings and enhanced accuracy. Our platform minimizes the risk of errors and allows for quick submission, helping you stay compliant with tax regulations.

-

Can I integrate airSlate SignNow with other software for the 4340 Individual Consumer's Use Tax Return?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage your 4340 Individual Consumer's Use Tax Return alongside your other financial tools. This integration streamlines your workflow and enhances productivity.

-

Is airSlate SignNow secure for submitting the 4340 Individual Consumer's Use Tax Return?

Yes, airSlate SignNow prioritizes security and compliance. When submitting your 4340 Individual Consumer's Use Tax Return, you can trust that your information is protected with advanced encryption and secure storage protocols.

Get more for 4340 Individual Consumer's Use Tax Return

- Tempus unlimited pca application nloxy ikons shop form

- Faa 1701a verification of terminated employment form

- Job application with criminal background tennessee form

- Fillable online track ampampamp field application home school form

- Dvr 17037 e job hire report form

- Addressnamegender change etf form

- Iris payroll payment schedule pdf form

- Quality staffing serviceseastern shore job recruiting form

Find out other 4340 Individual Consumer's Use Tax Return

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement