5632 MOST Missouri's 529 Education Plan Direct Deposit Form Individual Income Tax

Understanding the Missouri 5632 MOST Form

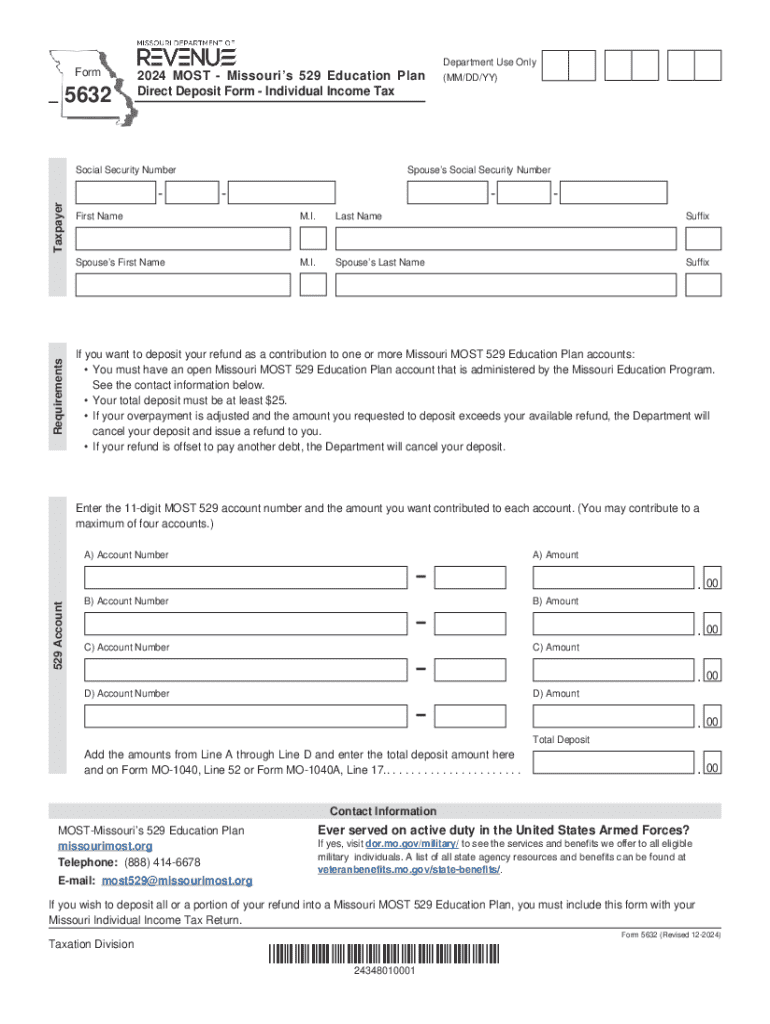

The Missouri 5632 MOST form is officially known as the Missouri's 529 Education Plan Direct Deposit Form for Individual Income Tax. This form is specifically designed for taxpayers who wish to direct deposit their tax refunds into a 529 education savings account. This account allows families to save for future education expenses in a tax-advantaged manner. Understanding the purpose of this form is crucial for ensuring that your education savings are maximized while complying with state tax regulations.

Steps to Complete the Missouri 5632 MOST Form

Completing the Missouri 5632 MOST form involves several straightforward steps:

- Gather your personal information, including your Social Security number and the details of your 529 education savings account.

- Fill out the form accurately, ensuring that all sections are completed, especially the account information for direct deposit.

- Review the completed form for any errors or omissions to avoid delays in processing.

- Submit the form along with your individual income tax return, ensuring it is included in your filing package.

By following these steps, you can ensure that your tax refund is directed to your education savings account without complications.

Eligibility Criteria for the Missouri 5632 MOST Form

To utilize the Missouri 5632 MOST form, you must meet specific eligibility criteria:

- You must be a resident of Missouri and file a Missouri individual income tax return.

- You must have a valid 529 education savings account set up in your name or for a beneficiary.

- Your tax refund must be eligible for direct deposit; not all refunds qualify.

Ensuring that you meet these criteria will help facilitate a smooth process when filing your taxes and directing your refund.

Legal Use of the Missouri 5632 MOST Form

The Missouri 5632 MOST form is legally recognized for directing tax refunds to a 529 education savings account. It is important to use this form in accordance with Missouri state tax laws to ensure compliance. Misuse of the form or incorrect information can lead to delays or complications in your tax processing. Always ensure that the information provided is accurate and reflects your current financial situation.

Obtaining the Missouri 5632 MOST Form

The Missouri 5632 MOST form can be obtained through several channels:

- Visit the official Missouri Department of Revenue website, where the form is available for download.

- Request a physical copy from your local tax office or public library.

- Consult with a tax professional who can provide the form as part of their services.

Having access to the form is the first step in ensuring that you can take advantage of the benefits offered by the Missouri 529 education savings plan.

Form Submission Methods for the Missouri 5632 MOST Form

Once you have completed the Missouri 5632 MOST form, you can submit it using the following methods:

- File electronically through the Missouri Department of Revenue's online tax filing system, if you are e-filing your taxes.

- Mail the completed form along with your paper tax return to the address specified in the tax return instructions.

- In-person submission at your local tax office, if you prefer to file your taxes in person.

Choosing the right submission method can help ensure timely processing of your tax refund and direct deposit into your education savings account.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5632 most missouris 529 education plan direct deposit form individual income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Missouri 5632 in relation to airSlate SignNow?

Missouri 5632 refers to a specific document or form that can be easily managed using airSlate SignNow. Our platform allows users to send, sign, and store documents securely, making it ideal for handling Missouri 5632 and similar forms efficiently.

-

How much does airSlate SignNow cost for Missouri 5632 users?

The pricing for airSlate SignNow is competitive and designed to fit various budgets. Users interested in managing documents like Missouri 5632 can choose from different plans, ensuring they find a cost-effective solution that meets their needs.

-

What features does airSlate SignNow offer for handling Missouri 5632?

airSlate SignNow provides a range of features tailored for documents like Missouri 5632, including eSignature capabilities, document templates, and secure cloud storage. These features streamline the signing process and enhance document management efficiency.

-

Can I integrate airSlate SignNow with other applications for Missouri 5632?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easy to manage Missouri 5632 alongside your existing tools. This flexibility allows users to enhance their workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for Missouri 5632?

Using airSlate SignNow for Missouri 5632 provides numerous benefits, including faster turnaround times for document signing and improved compliance. Our platform ensures that your documents are handled securely and efficiently, saving you time and resources.

-

Is airSlate SignNow user-friendly for managing Missouri 5632?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage documents like Missouri 5632. The intuitive interface allows users to navigate the platform effortlessly, regardless of their technical expertise.

-

How secure is airSlate SignNow when handling Missouri 5632?

Security is a top priority at airSlate SignNow. When managing documents like Missouri 5632, users can trust that their information is protected with advanced encryption and compliance with industry standards, ensuring peace of mind.

Get more for 5632 MOST Missouri's 529 Education Plan Direct Deposit Form Individual Income Tax

- Rcmp grc 6423e form

- Loan application westpac form

- Home loan application form security bank

- Bencor new fica rollover form fillable1pdf 2013 ford focus brochure

- Verification form 14 15 aggregate blue ridge community and blueridgectc

- Vendor information form

- Indusind bank rtgs form in excel format

- Orange lake xapitol mamagement rentalform

Find out other 5632 MOST Missouri's 529 Education Plan Direct Deposit Form Individual Income Tax

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease