Llc 37 40 2012-2026

What is the LLC 37 40?

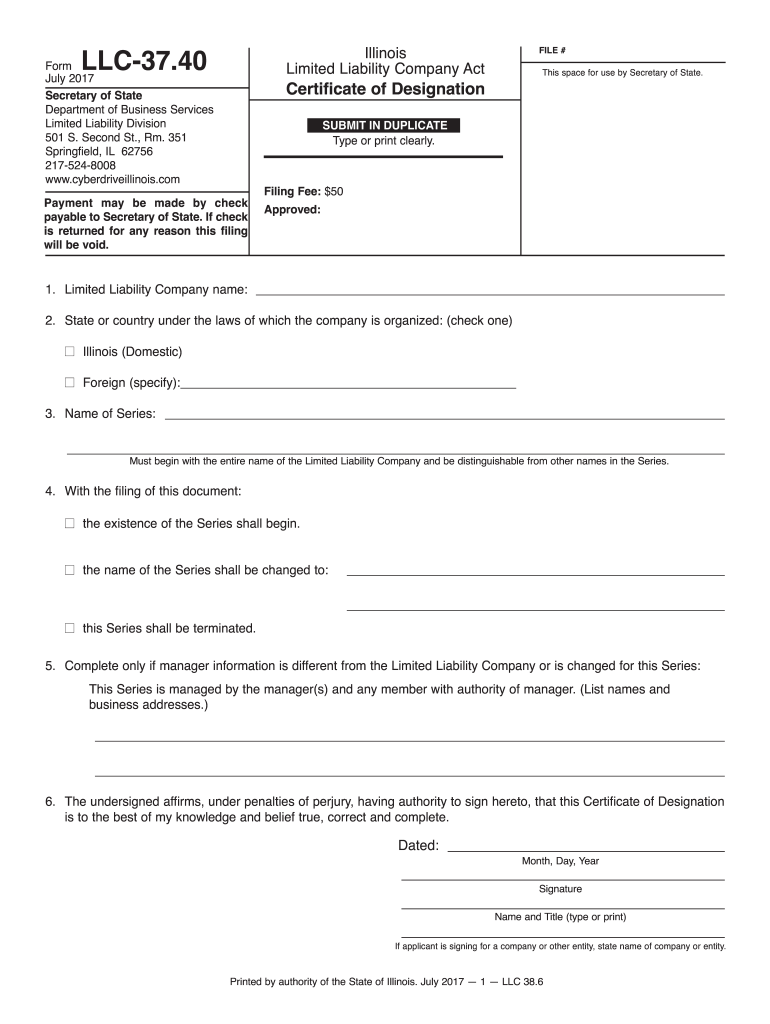

The LLC 37 40 form, also known as the Illinois LLC Certificate of Designation, is a crucial document for businesses operating as limited liability companies (LLCs) in Illinois. This form is specifically used to designate a series LLC, which allows a single LLC to create multiple series, each with its own assets and liabilities. Understanding the purpose and requirements of the LLC 37 40 is essential for compliance with state regulations.

How to Use the LLC 37 40

Using the LLC 37 40 involves several steps to ensure that your series LLC is properly established and recognized by the state. First, you must complete the form with accurate information regarding your LLC and the specific series being designated. This includes naming the series, providing the principal office address, and detailing the management structure. Once completed, the form must be submitted to the Illinois Secretary of State along with the required filing fee.

Steps to Complete the LLC 37 40

Completing the LLC 37 40 form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the LLC 37 40 form from the Illinois Secretary of State's website.

- Fill in the required fields, including the name of the series and the address of the principal office.

- Include the names and addresses of the managers or members responsible for the series.

- Review the form for accuracy and completeness.

- Submit the completed form along with the appropriate filing fee to the Secretary of State.

Legal Use of the LLC 37 40

The legal use of the LLC 37 40 is governed by Illinois state law. This form must be filed to create a valid series LLC, which provides liability protection for each series within the LLC structure. It is essential to adhere to all legal requirements to maintain the integrity of the series and protect the assets associated with each series from liabilities incurred by others.

Required Documents

When filing the LLC 37 40, certain documents may be required to accompany the form. These typically include:

- A copy of the original LLC formation documents.

- Any amendments or previous designations related to the LLC.

- Proof of payment for the filing fee.

Ensuring that all required documents are included will facilitate a smoother approval process.

Who Issues the Form

The LLC 37 40 form is issued by the Illinois Secretary of State. This office is responsible for maintaining business records and ensuring compliance with state laws regarding LLCs and their designations. It is advisable to check the Secretary of State's website for the most current information and any updates to the form or filing process.

Quick guide on how to complete llc 37 40 form

Manage Llc 37 40 Anytime, Anywhere

Your everyday organizational tasks may necessitate additional focus when managing state-specific business documents. Reclaim your working hours and minimize the costs related to paper-based processes with airSlate SignNow. airSlate SignNow provides you with a variety of pre-made business documents, including Llc 37 40, which you can utilize and collaborate on with your business associates. Manage your Llc 37 40 effortlessly using powerful editing and eSignature features and send it directly to your intended recipients.

How to Obtain Llc 37 40 in a Few Clicks:

- Select a form pertinent to your state.

- Click on Learn More to review the document and ensure its accuracy.

- Choose Get Form to start using it.

- Llc 37 40 will promptly open in the editor. No additional steps are required.

- Leverage airSlate SignNow’s sophisticated editing tools to complete or modify the form.

- Locate the Sign feature to create your personal signature and eSign your document.

- When you're finished, click Done, save changes, and access your document.

- Send the form via email or SMS, or utilize a link-to-fill option with your collaborators or allow them to download the document.

airSlate SignNow signNowly conserves your time managing Llc 37 40 and enables you to find necessary documents in one central location. An extensive collection of forms is organized and designed to address key business functions crucial for your organization. The advanced editor minimizes the risk of errors, as you can easily rectify mistakes and review your documents on any device before sending them out. Start your free trial today to explore all the benefits of airSlate SignNow for your daily business processes.

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

Which W-8 form should I fill out as an LLC company?

How do they know to request a W-8 instead of a W-9? Are you Foreign?Assuming you need to submit a W-8 instead of a W-9, here are the questions to guide your W-8 decision.Do you have other members in your LLC? If you are the only member, a Single Member LLC is a Disregarded Entity taxed on your personal tax return. So you would submit the W-8BEN.If you have other members, are you subject to the default status or have you elected corporate status?If you are subject to the default status, your LLC is taxed as a partnership so submit the W-8IMYIf you elected Corporate status, submit the W-8BEN-E.https://www.irs.gov/pub/irs-pdf/...Other great answers here. Especially good advice from Carl and Mark, get to a CPA.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the llc 37 40 form

How to make an eSignature for the Llc 37 40 Form online

How to make an eSignature for your Llc 37 40 Form in Chrome

How to create an electronic signature for putting it on the Llc 37 40 Form in Gmail

How to create an electronic signature for the Llc 37 40 Form from your mobile device

How to create an eSignature for the Llc 37 40 Form on iOS devices

How to create an electronic signature for the Llc 37 40 Form on Android OS

People also ask

-

What is airSlate SignNow's pricing for the 37 40 plan?

The 37 40 plan from airSlate SignNow offers competitive pricing designed for businesses looking for an efficient eSignature solution. With various tiers available, you can choose a plan that best fits your budget while ensuring powerful features for document management and signing.

-

What features are included in the 37 40 package?

The 37 40 package includes essential features such as unlimited eSigning, document templates, and integrations with popular applications. It is designed to streamline your document processes, making it easier for teams to collaborate and execute agreements quickly.

-

How does airSlate SignNow benefit my business with the 37 40 solution?

Using the 37 40 solution from airSlate SignNow can signNowly improve your business efficiency. It allows for faster document turnaround times, reduced paper usage, and enhanced security measures, which can ultimately lead to cost savings and improved customer satisfaction.

-

Can I integrate airSlate SignNow with other tools using the 37 40 plan?

Yes, the 37 40 plan includes seamless integrations with a variety of other business tools such as CRM systems and cloud storage options. This allows you to synchronize your workflows efficiently and enhances the overall productivity of your team.

-

Is the 37 40 plan suitable for small businesses?

Absolutely! The 37 40 plan is designed with small businesses in mind, providing an affordable and scalable solution for eSigning needs. It ensures that smaller teams can access powerful document management tools without overwhelming their budgets.

-

How secure is the airSlate SignNow 37 40 solution?

Security is a top priority for airSlate SignNow, and the 37 40 solution includes robust encryption and secure data storage. Your documents are protected through advanced security protocols, giving you peace of mind while conducting business online.

-

What kind of support is available for the 37 40 plan users?

Users of the 37 40 plan benefit from comprehensive support options, including email and live chat assistance. The airSlate SignNow team is dedicated to helping you resolve any issues quickly and efficiently, ensuring you get the most out of your eSigning experience.

Get more for Llc 37 40

Find out other Llc 37 40

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself