MO 1120ES Declaration of Estimated Tax for Corporation Income Tax Form

What is the MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax

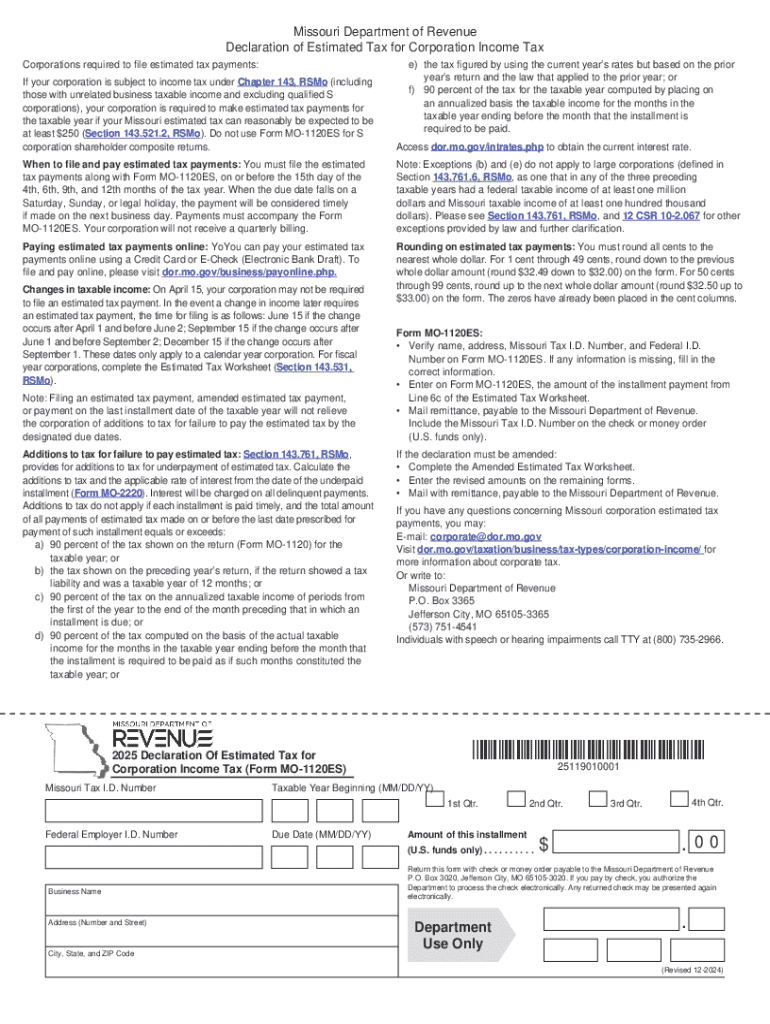

The MO 1120ES Declaration of Estimated Tax for Corporation Income Tax is a form used by corporations in Missouri to report and pay estimated taxes on their income. This form is essential for corporations that anticipate owing tax of five hundred dollars or more for the year. By submitting this declaration, corporations can avoid penalties associated with underpayment of taxes and ensure compliance with state tax regulations.

How to use the MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax

To effectively use the MO 1120ES, corporations must first estimate their expected income and tax liability for the year. This involves calculating the total expected income and applying the appropriate tax rates. Once the estimated tax amount is determined, the corporation can fill out the form, providing necessary information such as the business name, address, and federal employer identification number (EIN). The completed form should then be submitted according to the specified filing methods.

Steps to complete the MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax

Completing the MO 1120ES involves several key steps:

- Gather financial information, including projected income and expenses.

- Calculate the estimated tax liability based on the projected income.

- Fill out the form with accurate business details and estimated tax amounts.

- Review the form for accuracy to prevent errors that could lead to penalties.

- Submit the completed form by the appropriate deadline.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the MO 1120ES. Generally, the estimated tax payments are due quarterly, with deadlines typically falling on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the corporation's fiscal year. It is crucial for corporations to mark these dates on their calendars to ensure timely submissions and avoid late fees.

Who Issues the Form

The MO 1120ES form is issued by the Missouri Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with tax laws in Missouri. Corporations can obtain the form directly from the department's website or through authorized tax professionals.

Penalties for Non-Compliance

Failure to file the MO 1120ES or to pay the estimated taxes on time can result in significant penalties. Corporations may face a late payment penalty, which is typically a percentage of the unpaid tax amount. Additionally, interest may accrue on any unpaid taxes, further increasing the total liability. It is essential for corporations to understand these penalties to maintain compliance and avoid financial repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo 1120es declaration of estimated tax for corporation income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax?

The MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax is a form used by corporations in Missouri to report and pay estimated taxes. This form helps businesses manage their tax obligations throughout the year, ensuring they meet state requirements. Understanding this form is crucial for maintaining compliance and avoiding penalties.

-

How can airSlate SignNow help with the MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax?

airSlate SignNow simplifies the process of preparing and submitting the MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax. With our eSigning capabilities, you can easily sign and send documents securely. This streamlines your tax filing process, saving you time and reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those related to the MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax. Our plans are designed to be cost-effective, ensuring you get the best value for your document management and eSigning needs. You can choose a plan that fits your budget and requirements.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, including templates for the MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax. You can create, edit, and store your tax documents securely. Additionally, our platform allows for easy collaboration with your tax professionals.

-

What benefits does airSlate SignNow provide for businesses filing the MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax?

Using airSlate SignNow for the MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax offers numerous benefits, including increased efficiency and reduced paperwork. Our platform ensures that your documents are securely signed and stored, making it easier to access them when needed. This can lead to faster processing times and improved compliance.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your ability to manage the MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax. This integration allows for automatic data transfer and reduces the need for manual entry, making your tax preparation process more efficient.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security, ensuring that your MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax and other sensitive documents are protected. We use advanced encryption and secure storage solutions to safeguard your data. You can trust that your information is safe with us.

Get more for MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax

- Nairobi city county single business permit 2017 form

- Student records goldsboro nc form

- Pennsylvania parenting plan form

- Parenting plan form adobe pdf georgiaamp39s eighth judicial district eighthdistrict

- Optumrx prior authorization form

- Afp dependent id form

- Inz manila checklist partnership form

- Combined instructions and form for pension unlocking form 52

Find out other MO 1120ES Declaration Of Estimated Tax For Corporation Income Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors