Nd Sundry Notice 2006-2026

What is the Nd Sundry Notice

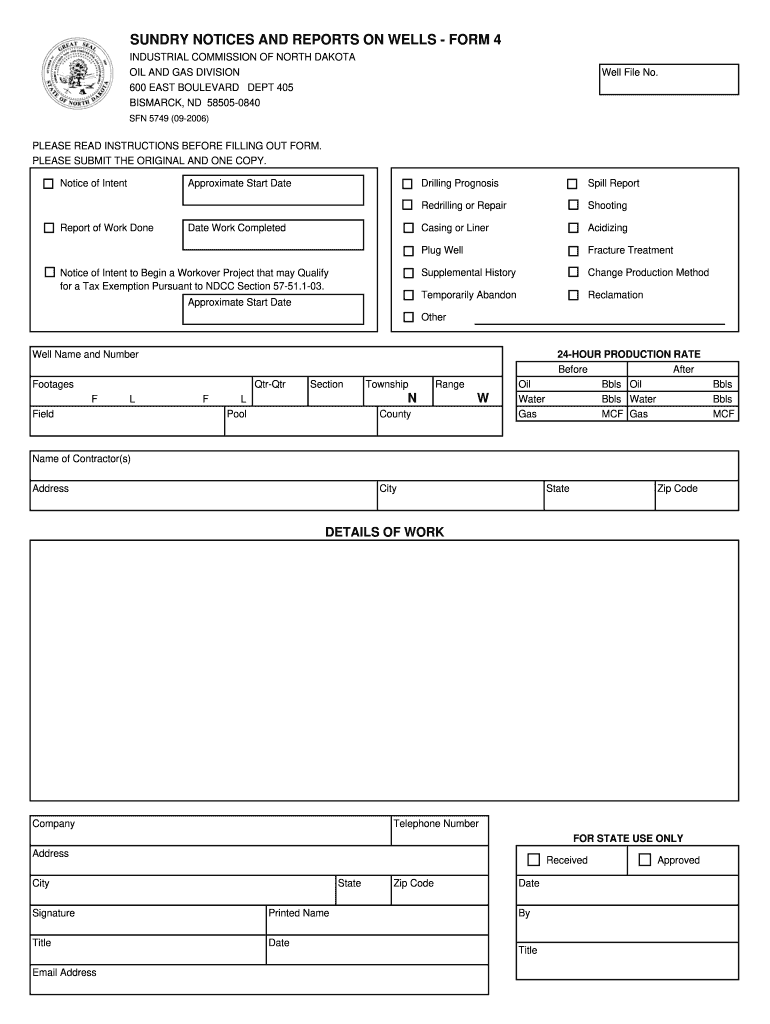

The Nd Sundry Notice is a specific form used primarily in North Dakota, often required for various administrative purposes related to land management and resource extraction. This form is essential for reporting activities that do not fall under standard categories, allowing for the submission of additional information that may be necessary for compliance with state regulations. It serves as a formal request or notification to the Bureau of Land Management regarding sundry activities, ensuring that all relevant details are documented and processed appropriately.

How to use the Nd Sundry Notice

Using the Nd Sundry Notice involves several steps to ensure that the information provided is accurate and complete. First, identify the specific purpose of the notice, whether it pertains to land use, resource extraction, or other administrative actions. Next, gather all necessary information and documentation that supports your request. Fill out the form carefully, ensuring that all sections are completed as required. Once the form is filled out, it can be submitted through the appropriate channels, which may include online submission, mailing, or in-person delivery.

Steps to complete the Nd Sundry Notice

Completing the Nd Sundry Notice involves a systematic approach:

- Gather all relevant information, including property details and the nature of the request.

- Access the Nd Sundry Notice form, which can typically be found on the official state or Bureau of Land Management website.

- Fill in the required fields, ensuring accuracy and clarity in your responses.

- Review the form for completeness and correctness before submission.

- Submit the completed form through the specified method, whether online, by mail, or in person.

Legal use of the Nd Sundry Notice

The Nd Sundry Notice is legally binding when completed and submitted correctly. It is important to adhere to the legal requirements set forth by the state of North Dakota and the Bureau of Land Management. This includes ensuring that the information provided is truthful and accurate, as any discrepancies can lead to legal repercussions. The notice must be filed within the specified timelines to maintain compliance with state regulations, thereby preventing potential penalties or issues with land use rights.

Who Issues the Form

The Nd Sundry Notice is issued by the Bureau of Land Management in North Dakota. This agency is responsible for overseeing land use and resource management within the state. They provide the necessary forms and guidelines for individuals and businesses to report sundry activities, ensuring that all submissions are processed according to established regulations. Understanding the role of this agency is crucial for anyone looking to complete and submit the Nd Sundry Notice.

Form Submission Methods

The Nd Sundry Notice can be submitted through various methods, depending on the preferences of the submitter and the requirements of the Bureau of Land Management. Common submission methods include:

- Online submission through the Bureau of Land Management's official portal.

- Mailing the completed form to the appropriate office address.

- In-person submission at designated Bureau of Land Management locations.

Choosing the right submission method is important to ensure timely processing and compliance with all regulations.

Quick guide on how to complete nd form 4

Effortlessly Prepare Nd Sundry Notice on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage Nd Sundry Notice on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to Edit and Electronically Sign Nd Sundry Notice with Ease

- Obtain Nd Sundry Notice and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight key sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Select your preferred method to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Nd Sundry Notice to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How do I fill out an NDA 2 application form?

visit Welcome to UPSC | UPSCclick on apply online option their and select the ndaII option.Its in 2 parts, Fill part 1 and theirafter 2nd as guided on the website their.

-

Bharat Petroleum Corporation Limited: What are the topics that I should prepare for BPCL interview (Management Trainee-Mechanical)?

BPCL Recruitment process guide.A.Group Discussion1.They will form a group of 12 to 14 people.2. They will give u a case study.3.Time alloted to read a case study is 5 mins.4.Then GD will be open for 10 to 12 mins.Tips to crack GDAs soon as u get case study,dont waste time by writing ur name,date just start reading it nd make notes on d same page.2.Dont ever look at panel from entering d room to leaving.3.Dont start d GD unless u r thorough with case study nd hav full confidence.(d person who started d GD from our group was not selected cause he was not fluent nd sounded like he has less confidence)4.Only 1 entry is sufficient to crack d GD.U should explain y u will take certain action their consequence nd y not others in span of 1 min.Dont take long.Keep it to d point.5.Dont ever interrupt any1.Let them complete their point after that speak with just a bit high pitch to get in d game nd after that speak with audible voice to everyone.6.Try to look at every1 in ur group while speaking.7.Take second entry in GD when its absolute necessary nd u hav a good point,otherwise Don't repeat points in 2nd entry.8.Listen to each person while speaking nd try to nod ur head whenever necessary.(this was absent in our group so only 4 of 12 people selected from GD,normally in others group 6-7 are selected from 12)9.Dont wait till panel itself ask u to speak in GD,thats a bad impression.Try to make entry before that.10.Again Conclude only when u know u wil do it better nd hav confidence.While concluding take everyone's point in consideration.11.Last but not d least is to SPEAK FLUENTLY as much as possible.Avoid pauses.MY CASE STUDYX person is working as a manager in a company.He has taken education loan of 10 lakhs from company.Company has ash handling plant but to increase profit nd reduce expenses they shut down that plant which is against d law.When u know this situation u talk with higher management but they already knew about it nd ask u to stay silent.Now if u take any action u might lose ur job.Now what will u do and y?FRIEND CASE STUDYX person is working as manager in company.There is overtime done by employees to save their job for which they are not get paid.But they are happy with it because they want to save their job.What will u do and y? ( I heard it nd dont know in details but that was it)U Can see 3 to 4 case study on internet.Total around 100 students came from that around 50 were shortlisted.B.TECHNICAL INTERVIEW1. Last upto 10,15 or 20 mins.Depends.10 mins is average.2. Fluid mechanics nd machinery is compulsory topic u hav to study that specifically PUMPS.Pump types,their application,pump characterastics,NPSH,cavitation,basic working principle.Hav a basic idea about pump used regularly in home i.e their head nd discharge.They dont ask formulas.They dont ask DEEP QUESTIONS also.They just want basic info from U.3.Almost to most of people they ask their favourite subjects.Prepare 3 subjects strong.They don't ask anything else from ur fav subjects plus FM.4.They ask very basic questions.e.g if u say ur fav subject is THERMO(which was told by 90% of all people in our group) then questions likea.How many laws of thermodynamics are there and what are they? ( I m answering this because most of people dont know.Ans- 4 laws are there. 0th,1st,2nd nd 3rd.I hope u all know d statementb.what is difference between HT and THERMO.c. What us Rankine cycle nd where it is used?d.How power plant works?e.What are power plant accessories and how thay are used?Similar basic questions with other subject also.5. Ur FINAL YEAR PROJECT nd SUMMER(INDUSTRIAL) TRAINING is VERY VERY IMPORTANT.(My 80% Interview was based on that).So prepare that THOROUGHLY.6.Also after cracking GD they give u PART B to fill up which consist following questions.This is very imp part.U hav to fill it carefully.They might ask u questions from that in TECHNICAL interview itself though its for PERSONAL interview.a.why are u keen to join BPCL?b.y did u chose to specialise in this stream?c.what have been ur biggest(Academic,Personal,Profession) achievements till date?d.what has been ur biggest failure and what did u learn from it?e.Your 2 biggest strengthef.According to u what are the areas for improvementsg.Give an example of Initiative,Assignment,Project that didn't work out well.h.How would ur friends describe you?i.What are 3 values u subscribe to?j.where do u see urself after 5 years from now?I won't answer these questions because if i did everyone will write d same nd that doesn't gonna help u.Take help of Internet mostly Quora.From 50 students 22 were shortlisted for FINAL INTERVIEW. It may vary.C. FINAL HR INTERVIEW1. Duration is average 10 mins.2.Mostly d 1st question is Tell me about urself( Same question is asked in TECHNICAL INTERVIEW also, i forgot to mention there.3.From that onward interview revolves based on what u http://tell.So be prepared for that question well.4.If u hav gap or work experience then be ready for that question also.This 1 is very imp.5.Other questions asked in HR were ur hobbies,family,ur other interests.6.Also read as much as u can about BPCL but Basic info of BPCL is mandatory like their products,their plants refineries location.More u know will be better.7.The questions i hav given above in PART B plays important role here.Remember answers of that question.8 .If u hav good rank then they will ask Y not MTech or MBA?9.All remaining questions were like if u placed in that location will u b ok like that.10.Also y do u want to join BPCL nd not IOCL or ONGC.This is it about interview.Most important thing is CONFIDENCE.Believe in urself and be honest as much as u can that way u wil feel less fear.I hope this is helpful.All d very best...\U0001f44dWritten by,Abhijeet(Sourabh) Yadav.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

What is the upcoming date to fill out the NDA form?

Hi there,The probable date of the starting of online registration for NDA II 2018 is 6th june 2018.For more information you can visit the following link :-NDA (2) 2018: Application Form, Eligibility, Exam Dates, Exam PatternLastly, ALL THE BEST FOR YOUR PREPARATION AND EXAMS

-

How much do accountants charge for helping you fill out a W-4 form?

A W-4 is a very simple form to instruct your employer to withhold the proper tax. It's written in very plain English and is fairly easy to follow. I honestly do not know of a CPA that will do one of these. If you're having trouble and cannot find a tutorial you like on line see if you can schedule a probing meeting. It should take an accounting student about 10 minutes to walk you through. There is even a worksheet on the back.If you have mitigating factors such as complex investments, partnership income, lies or garnishments, talk to your CPA about those, and then ask their advice regarding the W4 in the context of those issues.

Create this form in 5 minutes!

How to create an eSignature for the nd form 4

How to make an electronic signature for your Nd Form 4 online

How to make an electronic signature for your Nd Form 4 in Chrome

How to generate an electronic signature for signing the Nd Form 4 in Gmail

How to make an electronic signature for the Nd Form 4 from your mobile device

How to create an electronic signature for the Nd Form 4 on iOS

How to create an eSignature for the Nd Form 4 on Android OS

People also ask

-

What is an Nd Sundry Notice and how does it work with airSlate SignNow?

An Nd Sundry Notice is a formal communication often used in business transactions to address various notifications. With airSlate SignNow, you can easily create, send, and eSign Nd Sundry Notices, streamlining your documentation process. This ensures that all parties are informed and can respond promptly, enhancing your operational efficiency.

-

How can airSlate SignNow improve the way I manage Nd Sundry Notices?

airSlate SignNow provides a seamless platform for managing Nd Sundry Notices by allowing you to create templates, automate workflows, and track document status. This means you can save time and reduce errors while ensuring that all Nd Sundry Notices are handled efficiently. Plus, you can access all documents from any device, making management even easier.

-

Is there a free trial available for airSlate SignNow to test Nd Sundry Notice features?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including those specifically designed for Nd Sundry Notices. During this trial, you can test the ease of document creation, eSigning capabilities, and overall user experience. This way, you can determine if our solution meets your needs without any commitments.

-

What pricing plans does airSlate SignNow offer for managing Nd Sundry Notices?

airSlate SignNow provides flexible pricing plans tailored to different business needs when it comes to managing Nd Sundry Notices. You can choose from monthly or annual subscriptions, with options that scale according to your usage. This ensures that you pay only for what you need while benefiting from a powerful eSigning solution.

-

Can I integrate airSlate SignNow with other tools for Nd Sundry Notice management?

Absolutely! airSlate SignNow offers integrations with various applications and platforms, making it easy to manage Nd Sundry Notices alongside your existing tools. Whether you use CRM systems or project management software, our integrations help streamline your workflow and improve collaboration.

-

What security measures does airSlate SignNow have for Nd Sundry Notices?

airSlate SignNow prioritizes security, implementing features such as encryption, secure access controls, and compliance with industry standards to protect your Nd Sundry Notices. Our platform ensures that sensitive information remains confidential and secure throughout the document lifecycle, giving you peace of mind.

-

How can airSlate SignNow enhance collaboration on Nd Sundry Notices?

With airSlate SignNow, collaboration on Nd Sundry Notices is simplified through features like shared templates and real-time commenting. Multiple users can easily review, edit, and eSign documents together, fostering better communication and faster decision-making. This collaborative approach ensures everyone stays on the same page.

Get more for Nd Sundry Notice

Find out other Nd Sundry Notice

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement