Form 81 Fillable

What is the Form 81 Fillable

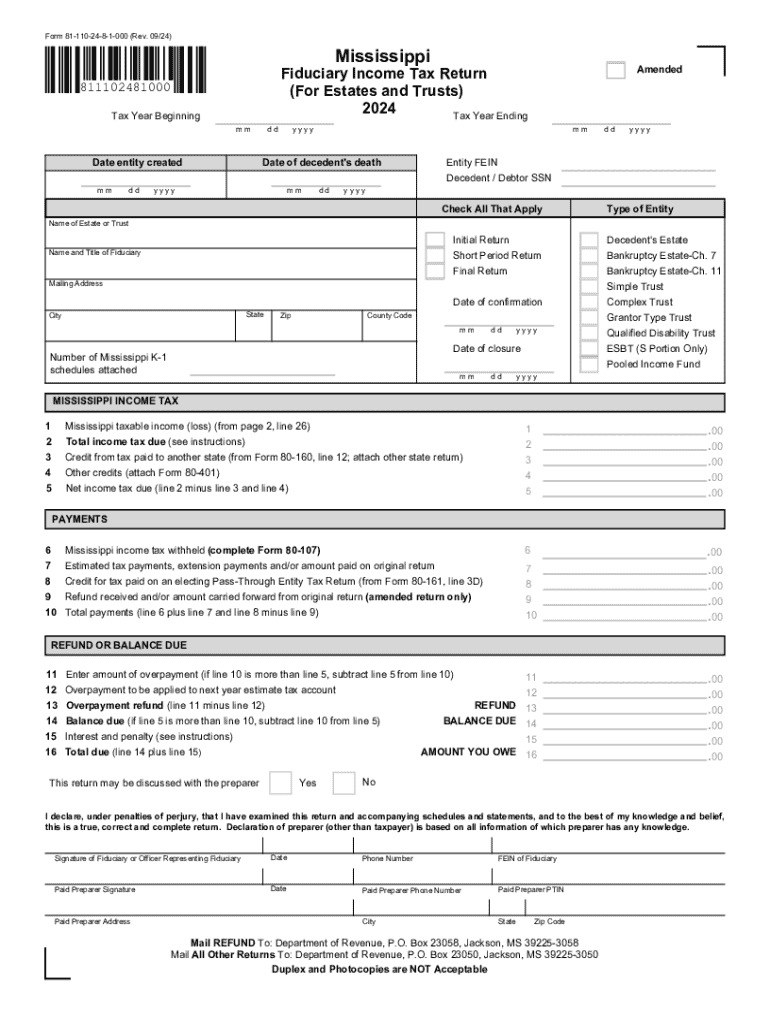

The Form 81 fillable is a tax document used primarily for reporting income in specific situations, such as fiduciary income tax returns. This form is essential for individuals and entities that need to report income received on behalf of another party, ensuring compliance with state tax regulations. The fillable version allows users to complete the form digitally, facilitating easier data entry and submission.

How to use the Form 81 Fillable

Using the Form 81 fillable involves several steps to ensure accurate completion. First, download the form from a reliable source. After downloading, open the form in a compatible PDF reader that supports fillable fields. Enter the required information, such as the income details and the taxpayer identification number. Once completed, review the form for accuracy before saving and submitting it as per the guidelines provided by the state tax authority.

Steps to complete the Form 81 Fillable

Completing the Form 81 fillable requires careful attention to detail. Follow these steps:

- Download the latest version of the Form 81 from an official source.

- Open the form in a PDF reader that supports fillable forms.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Report all applicable income sources accurately, ensuring all figures are correct.

- Double-check all entries for accuracy and completeness.

- Save the completed form to your device.

- Submit the form according to the state’s filing instructions, either online or via mail.

Legal use of the Form 81 Fillable

The legal use of the Form 81 fillable is crucial for compliance with state tax laws. This form must be filed by fiduciaries, such as trustees or executors, who are responsible for managing income on behalf of beneficiaries. Proper use of the form ensures that all income is reported accurately, helping to avoid potential legal issues or penalties associated with non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 81 fillable can vary based on the specific circumstances of the taxpayer. Generally, fiduciaries must file the form by the due date of the income tax return for the entity or individual they represent. It is essential to check the state tax authority's website for specific deadlines to ensure timely submission and avoid penalties.

Required Documents

To complete the Form 81 fillable, certain documents may be required. These typically include:

- Taxpayer identification number (TIN) for the fiduciary and beneficiaries.

- Documentation of all income sources being reported.

- Previous tax returns or financial statements that may support the income claims.

Having these documents ready can streamline the completion process and ensure accuracy in reporting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 81 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 81 income print feature in airSlate SignNow?

The 81 income print feature in airSlate SignNow allows users to easily generate and manage income-related documents. This feature streamlines the process of creating, signing, and storing important financial documents, ensuring compliance and accuracy.

-

How does airSlate SignNow help with the 81 income print process?

airSlate SignNow simplifies the 81 income print process by providing a user-friendly interface for document creation and eSigning. With customizable templates and automated workflows, businesses can efficiently handle their income documentation needs.

-

What are the pricing options for using airSlate SignNow for 81 income print?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for the 81 income print feature. You can choose from monthly or annual subscriptions, ensuring you get the best value for your document management requirements.

-

Can I integrate airSlate SignNow with other tools for 81 income print?

Yes, airSlate SignNow supports integrations with various third-party applications, enhancing the 81 income print experience. This allows users to connect their existing tools and streamline workflows, making document management even more efficient.

-

What are the benefits of using airSlate SignNow for 81 income print?

Using airSlate SignNow for 81 income print offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your income documents are easily accessible and securely stored, improving overall productivity.

-

Is airSlate SignNow secure for handling 81 income print documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your 81 income print documents. You can trust that your sensitive information is safe while using our platform.

-

How can I get started with airSlate SignNow for 81 income print?

Getting started with airSlate SignNow for 81 income print is easy. Simply sign up for an account, explore our templates, and begin creating your income documents. Our intuitive platform guides you through the process, making it accessible for everyone.

Get more for Form 81 Fillable

- How does debt affect military security clearances debtorg form

- Module 2 introduction to forms state controllers office

- Reconciliation of sale of government owned personal gsa form

- Comnavcruitcominst 1140 navy tribe form

- Rhode island fire safety welcome form

- Solved are packaging costs considered part of inventory costs form

- Daily accounting cycle form

- Seligers quick guide to developing federal grant budgets form

Find out other Form 81 Fillable

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe