Interest on Underpayment of Estimated Tax by Individuals, Estates, and Trusts Form

Understanding Interest on Underpayment of Estimated Tax

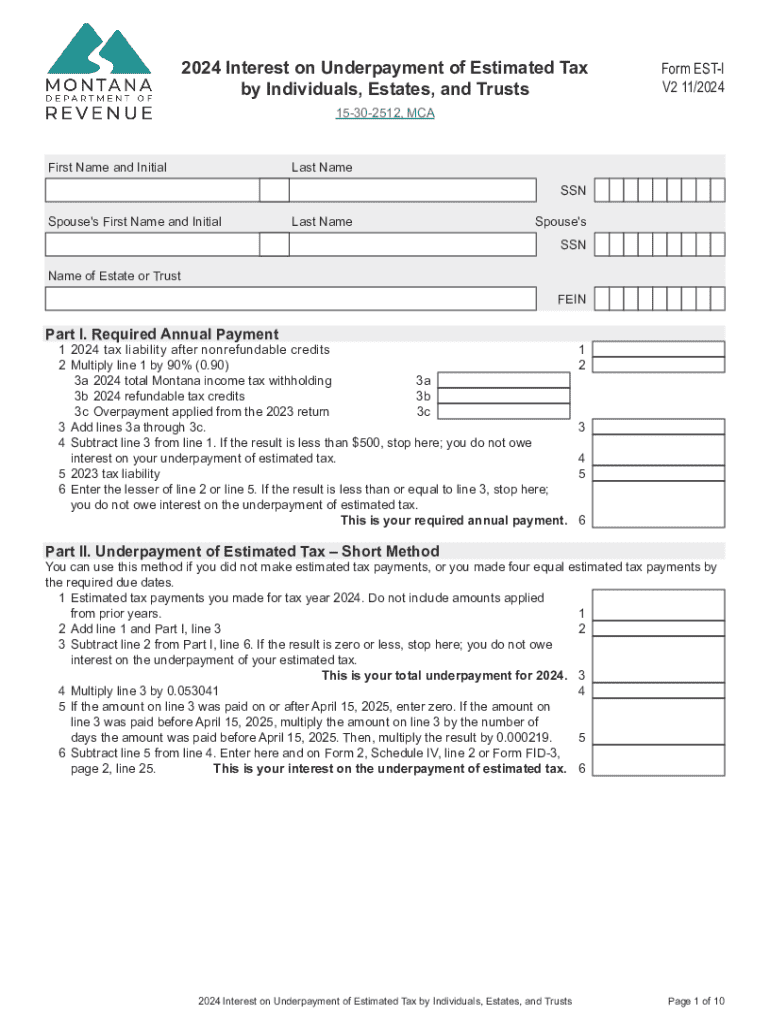

The interest on underpayment of estimated tax by individuals, estates, and trusts refers to the charges incurred when taxpayers do not pay enough estimated tax throughout the year. This underpayment can lead to penalties, which are calculated based on the amount owed and the duration of the underpayment. The IRS sets specific rates for this interest, which can change quarterly. Understanding these rates is essential for taxpayers to avoid unexpected financial burdens.

How to Calculate Interest on Underpayment

To calculate the interest on underpayment of estimated tax, taxpayers need to determine the total amount of tax owed and the payments made throughout the year. The IRS provides a worksheet that helps in calculating the estimated tax due and any potential penalties. The interest is typically compounded daily, so it is important to keep accurate records of payment dates and amounts. Taxpayers can use IRS Form 2210 to assist in this calculation.

Filing Deadlines for Estimated Tax Payments

Estimated tax payments are generally due quarterly. For individuals, the deadlines typically fall on April 15, June 15, September 15, and January 15 of the following year. Estates and trusts have similar deadlines but may differ based on their specific tax year. Missing these deadlines can result in interest charges, so it is crucial to adhere to the schedule to avoid penalties.

IRS Guidelines for Interest on Underpayment

The IRS provides guidelines regarding interest on underpayment of estimated tax, including the rates applicable for each quarter. Taxpayers should refer to the IRS website or publications for the most current rates and rules. The IRS also outlines specific exceptions and waivers for certain taxpayers, such as those facing extraordinary circumstances, which can help mitigate penalties.

Examples of Interest Calculations

Understanding how interest on underpayment is calculated can help taxpayers better manage their tax obligations. For instance, if a taxpayer owes $1,000 in estimated taxes but only pays $800 by the due date, the IRS will charge interest on the $200 shortfall. If the interest rate is set at three percent, the taxpayer will incur interest on that amount until it is paid. Real-world examples can illustrate how different payment amounts and timelines affect the total interest incurred.

Penalties for Non-Compliance

Failing to pay estimated taxes on time can lead to significant penalties. The IRS may impose a penalty for underpayment, which is calculated based on the amount underpaid and the number of days the payment is late. Understanding the potential penalties can motivate taxpayers to stay current with their estimated tax payments and avoid unnecessary financial strain.

Eligibility Criteria for Waivers

There are specific eligibility criteria for taxpayers who may qualify for waivers of interest and penalties on underpayment of estimated tax. For example, individuals who had no tax liability in the previous year or whose total tax owed is below a certain threshold may be exempt. Additionally, those who experienced unforeseen circumstances, such as natural disasters or serious illness, may also qualify for relief. It is important to review IRS guidelines to determine eligibility for these waivers.

Create this form in 5 minutes or less

Related searches to Interest On Underpayment Of Estimated Tax By Individuals, Estates, And Trusts

Create this form in 5 minutes!

How to create an eSignature for the interest on underpayment of estimated tax by individuals estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Interest On Underpayment Of Estimated Tax By Individuals, Estates, And Trusts?

The Interest On Underpayment Of Estimated Tax By Individuals, Estates, And Trusts refers to the penalties incurred when taxpayers do not pay enough estimated tax throughout the year. This interest accumulates on the unpaid balance, making it crucial for individuals and entities to understand their tax obligations. Utilizing tools like airSlate SignNow can help streamline document management related to tax filings.

-

How can airSlate SignNow assist with managing estimated tax payments?

airSlate SignNow offers a user-friendly platform that allows individuals, estates, and trusts to easily manage and eSign documents related to estimated tax payments. By simplifying the documentation process, users can ensure timely submissions and avoid the Interest On Underpayment Of Estimated Tax By Individuals, Estates, And Trusts. This efficiency can lead to better compliance and reduced penalties.

-

What features does airSlate SignNow provide for tax-related documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax-related documents. These features help ensure that all necessary forms are completed accurately and submitted on time, minimizing the risk of incurring Interest On Underpayment Of Estimated Tax By Individuals, Estates, And Trusts. This makes it an ideal solution for tax professionals and individuals alike.

-

Is airSlate SignNow cost-effective for individuals and small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for individuals and small businesses. With flexible pricing plans, users can choose the option that best fits their needs without overspending. This affordability allows users to focus on avoiding penalties like the Interest On Underpayment Of Estimated Tax By Individuals, Estates, And Trusts while managing their documentation efficiently.

-

Can airSlate SignNow integrate with other financial software?

Absolutely! airSlate SignNow offers integrations with various financial and accounting software, enhancing its functionality for users. This integration capability allows for seamless data transfer and document management, which is crucial for tracking estimated tax payments and avoiding the Interest On Underpayment Of Estimated Tax By Individuals, Estates, And Trusts. Users can streamline their workflows and improve efficiency.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing the signing process, users can ensure that their documents are processed quickly, helping to avoid the Interest On Underpayment Of Estimated Tax By Individuals, Estates, And Trusts. This leads to a smoother tax filing experience overall.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security with advanced encryption and secure cloud storage. This ensures that sensitive tax-related documents are protected from unauthorized access, which is vital for individuals, estates, and trusts managing their tax obligations. By safeguarding documents, users can focus on avoiding penalties like the Interest On Underpayment Of Estimated Tax By Individuals, Estates, And Trusts.

Get more for Interest On Underpayment Of Estimated Tax By Individuals, Estates, And Trusts

Find out other Interest On Underpayment Of Estimated Tax By Individuals, Estates, And Trusts

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure