Application for Extension for Filing Individual Income Tax Return Form

What is the Application for Extension for Filing Individual Income Tax Return

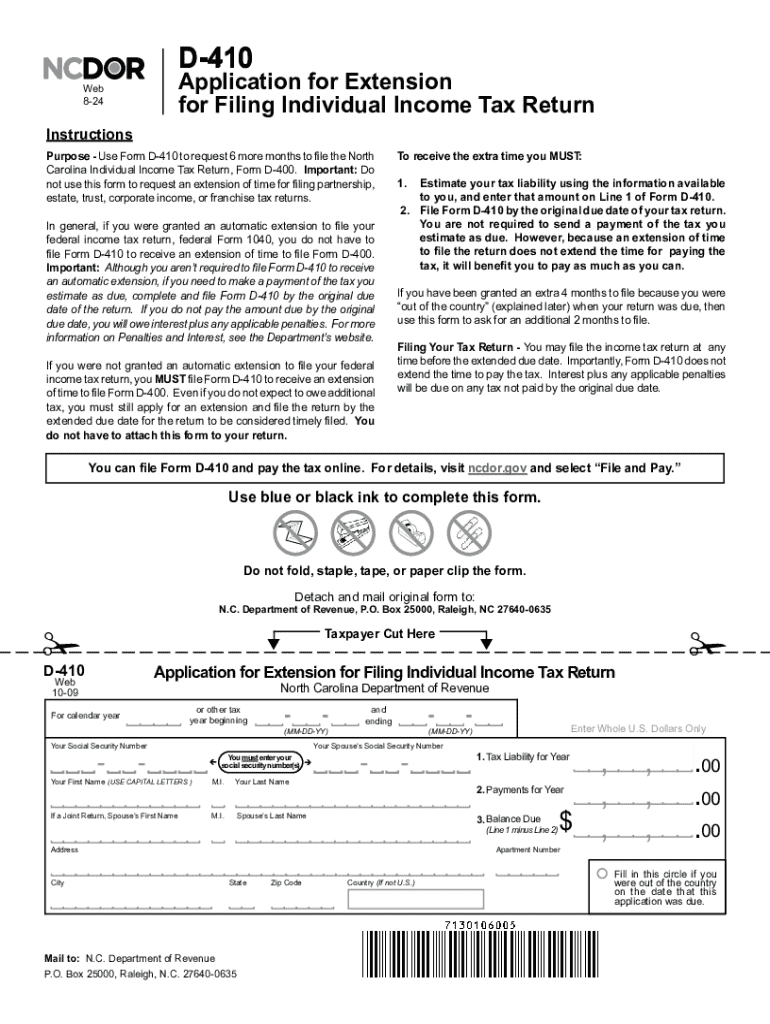

The D-410 form, also known as the North Carolina Application for Extension for Filing Individual Income Tax Return, is designed for taxpayers who need additional time to file their state income tax returns. This form allows individuals to request an automatic six-month extension, providing them with the necessary time to gather their financial documents and complete their tax filings accurately. It is important to note that while the form grants an extension for filing, it does not extend the deadline for paying any taxes owed.

Steps to Complete the Application for Extension for Filing Individual Income Tax Return

Completing the D-410 form involves several straightforward steps:

- Begin by downloading the D-410 form from the North Carolina Department of Revenue website or accessing it through a digital platform.

- Fill out your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are requesting the extension.

- Estimate your tax liability for the year and provide any payments made to date.

- Sign and date the form to validate your request.

- Submit the completed form either online, by mail, or in person, depending on your preference.

Filing Deadlines / Important Dates

Understanding the deadlines associated with the D-410 form is crucial for compliance. The application must be submitted by the original due date of the tax return, typically April 15 for individual income tax returns. If the deadline falls on a weekend or holiday, it is extended to the next business day. Failure to submit the form by this date may result in penalties, so timely submission is essential.

Eligibility Criteria

To qualify for an extension using the D-410 form, taxpayers must meet certain criteria. This form is available to individual taxpayers who expect to owe taxes but are unable to file their returns by the original deadline. It is important to accurately estimate your tax liability, as underpayment may lead to penalties and interest charges. Additionally, the extension is typically granted only for individual income tax returns, not for corporate or business taxes.

Form Submission Methods

The D-410 form can be submitted through various methods to accommodate different preferences:

- Online: Many taxpayers prefer to submit their forms electronically through the North Carolina Department of Revenue's online portal.

- By Mail: Completed forms can be printed and mailed to the appropriate address provided on the form.

- In-Person: Taxpayers may also choose to deliver their forms directly to a local Department of Revenue office.

Penalties for Non-Compliance

Failing to file the D-410 form by the deadline can result in significant penalties. If the extension is not requested on time, taxpayers may be subject to late filing penalties, which can accumulate over time. Additionally, any taxes owed that are not paid by the original deadline may incur interest and further penalties. It is advisable to ensure compliance with all filing requirements to avoid these financial repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for extension for filing individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the d 410 form and how can airSlate SignNow help?

The d 410 form is a document used for various administrative purposes. With airSlate SignNow, you can easily create, send, and eSign the d 410 form, streamlining your workflow and ensuring compliance. Our platform simplifies the process, making it accessible for businesses of all sizes.

-

Is there a cost associated with using airSlate SignNow for the d 410 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can choose a plan that fits your budget while efficiently managing the d 410 form and other documents. Our cost-effective solution ensures you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the d 410 form?

airSlate SignNow provides a range of features for the d 410 form, including customizable templates, secure eSigning, and real-time tracking. These features enhance your document management process, making it easier to handle the d 410 form efficiently. Additionally, our user-friendly interface ensures a smooth experience.

-

Can I integrate airSlate SignNow with other applications for the d 410 form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage the d 410 form alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are easily accessible in one place.

-

How does airSlate SignNow ensure the security of the d 410 form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your d 410 form and other sensitive documents. Our platform complies with industry standards, ensuring that your data remains safe and confidential.

-

What are the benefits of using airSlate SignNow for the d 410 form?

Using airSlate SignNow for the d 410 form offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced collaboration. Our platform simplifies the eSigning process, allowing you to focus on your core business activities while ensuring that your documents are processed quickly.

-

Is there customer support available for issues related to the d 410 form?

Yes, airSlate SignNow provides dedicated customer support to assist you with any issues related to the d 410 form. Our support team is available to help you navigate the platform and resolve any questions you may have. We are committed to ensuring your experience is smooth and satisfactory.

Get more for Application For Extension For Filing Individual Income Tax Return

- Instructions for petition for order of form

- Question 1 40 points 476792712 form

- Federal jursidiction and procedure form

- Georgia department of human resources dfcs dhs georgia form

- Customer acknowledgement form

- 2709 mail service center ncdhhs form

- Link to notice 5000 1401 for sba form 912 sba form 1081

- Form approved 07072015

Find out other Application For Extension For Filing Individual Income Tax Return

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now