Davie Business Tax Receipt Form

What is the Davie Business Tax Receipt

The Davie Business Tax Receipt is a legal document required for businesses operating within the Town of Davie, Florida. This receipt serves as proof that a business has paid its annual business tax, which is mandated by local ordinances. It is essential for compliance with local regulations and is often required for various business activities, including leasing commercial space and applying for permits.

How to Obtain the Davie Business Tax Receipt

To obtain a Davie Business Tax Receipt, businesses must first complete an application form, which can typically be found on the Town of Davie's official website. The application requires details such as the business name, address, and type of business. After submitting the application, the business owner must pay the applicable fee, which varies based on the business type and size. Once processed, the receipt will be issued, confirming that the business is authorized to operate within the town.

Steps to Complete the Davie Business Tax Receipt

Completing the Davie Business Tax Receipt involves several key steps:

- Gather necessary information, including business name, address, and ownership details.

- Access the application form from the Town of Davie's website or local government office.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form along with the required fee to the appropriate department.

- Receive confirmation of your application and await the issuance of the receipt.

Legal Use of the Davie Business Tax Receipt

The Davie Business Tax Receipt is legally recognized as proof of compliance with local business regulations. It is necessary for various legal and financial transactions, such as opening a business bank account, applying for loans, and securing contracts. Failure to obtain or renew this receipt can result in fines and other penalties, making it crucial for business owners to maintain compliance.

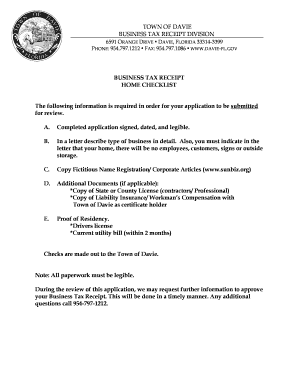

Required Documents

When applying for the Davie Business Tax Receipt, several documents may be required. These typically include:

- A completed application form.

- Proof of identification, such as a driver's license or state ID.

- Documentation of the business's legal structure, such as articles of incorporation for corporations or a partnership agreement.

- Any additional permits or licenses specific to the business type.

Penalties for Non-Compliance

Businesses that fail to obtain or renew their Davie Business Tax Receipt may face several penalties. These can include fines, additional fees for late renewal, and potential legal action. Moreover, operating without a valid receipt can hinder a business's ability to secure contracts, leases, or loans, impacting overall operations and growth.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the davie business tax receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a town of Davie business tax receipt?

A town of Davie business tax receipt is a document that certifies a business is authorized to operate within the town. It is essential for compliance with local regulations and ensures that businesses are contributing to the local economy. Obtaining this receipt is a crucial step for any business owner in Davie.

-

How can I apply for a town of Davie business tax receipt?

To apply for a town of Davie business tax receipt, you need to complete the application process through the town's official website or visit the local business tax office. The application typically requires information about your business, including its name, address, and type of services offered. Once submitted, you will receive further instructions on the next steps.

-

What are the costs associated with obtaining a town of Davie business tax receipt?

The costs for obtaining a town of Davie business tax receipt can vary based on the type of business and its size. Generally, there is an application fee that must be paid at the time of submission. It's advisable to check the town's official website for the most current fee schedule and any additional costs that may apply.

-

How long does it take to receive a town of Davie business tax receipt?

The processing time for a town of Davie business tax receipt can vary, but it typically takes a few weeks. Factors such as the completeness of your application and the volume of applications being processed can affect the timeline. It's best to apply well in advance of your intended business start date to avoid delays.

-

What documents do I need to provide for a town of Davie business tax receipt?

When applying for a town of Davie business tax receipt, you will need to provide several documents, including proof of identity, business registration documents, and any necessary licenses or permits. Additionally, you may need to submit a zoning verification if your business operates from a specific location. Ensure all documents are current and accurate to facilitate a smooth application process.

-

Can I renew my town of Davie business tax receipt online?

Yes, you can renew your town of Davie business tax receipt online through the town's official website. The online portal allows for a convenient renewal process, where you can submit any required documentation and payment electronically. Make sure to renew your receipt before it expires to avoid any penalties.

-

What are the benefits of having a town of Davie business tax receipt?

Having a town of Davie business tax receipt provides several benefits, including legal authorization to operate your business and access to local resources. It also enhances your business's credibility with customers and partners. Additionally, it ensures compliance with local regulations, helping you avoid potential fines or legal issues.

Get more for Davie Business Tax Receipt

- Panfoundation org dmrform

- Reparatur formular

- Tlc medical form 403911725

- Application for refund of franking credits for individuals form

- Chirp form

- Sag aftra performers production time report

- Master service for software development agreement template form

- Master service oil and gas agreement template form

Find out other Davie Business Tax Receipt

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online