*Caution the Amount Shown May OMB No Apps Irs 2020

What is the Caution The Amount Shown May OMB No Apps Irs

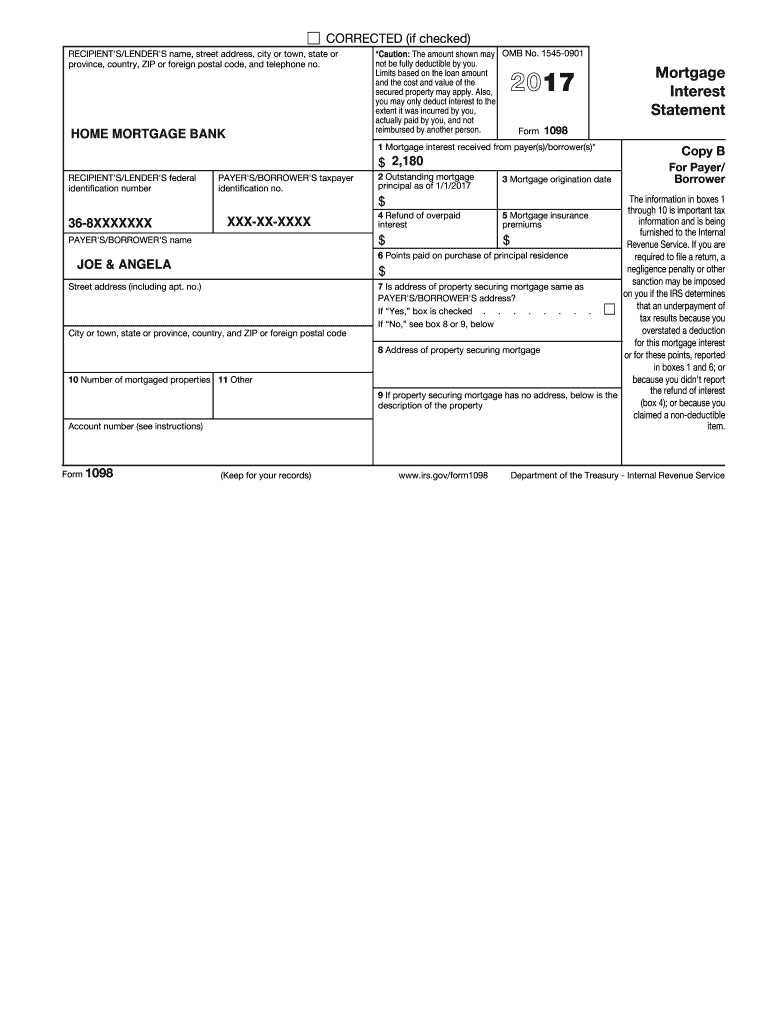

The Caution The Amount Shown May OMB No Apps Irs is a specific form used in the United States for various tax-related purposes. This form is often associated with reporting income, deductions, or other financial information to the Internal Revenue Service (IRS). It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal tax regulations.

How to use the Caution The Amount Shown May OMB No Apps Irs

Using the Caution The Amount Shown May OMB No Apps Irs involves several steps. First, gather all necessary financial documents, such as W-2s, 1099s, and other relevant income statements. Next, fill out the form accurately, ensuring that all amounts are correctly reported. It is crucial to double-check the information before submission to avoid errors that could lead to penalties.

Steps to complete the Caution The Amount Shown May OMB No Apps Irs

Completing the Caution The Amount Shown May OMB No Apps Irs requires careful attention to detail. Follow these steps:

- Review the instructions provided with the form.

- Collect all relevant financial documents.

- Fill out the form, ensuring all fields are completed accurately.

- Verify that the amounts reported match your financial records.

- Sign and date the form before submission.

Legal use of the Caution The Amount Shown May OMB No Apps Irs

The Caution The Amount Shown May OMB No Apps Irs must be used in accordance with IRS guidelines. Legal use of this form involves accurately reporting financial information as required by law. Failing to comply with these regulations can result in penalties, including fines or additional scrutiny from the IRS.

Key elements of the Caution The Amount Shown May OMB No Apps Irs

Key elements of the Caution The Amount Shown May OMB No Apps Irs include:

- Identification of the taxpayer or business entity.

- Accurate reporting of income and deductions.

- Signature and date of the individual completing the form.

- Any additional documentation required to support the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Caution The Amount Shown May OMB No Apps Irs are critical to avoid penalties. Typically, forms must be submitted by April fifteenth of each year for individual taxpayers. However, businesses may have different deadlines based on their fiscal year. It is essential to stay informed about these dates to ensure timely submission.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Caution The Amount Shown May OMB No Apps Irs can lead to various penalties. These may include monetary fines, interest on unpaid taxes, or even legal action in severe cases. Understanding the implications of not adhering to the regulations is vital for all taxpayers.

Create this form in 5 minutes or less

Find and fill out the correct caution the amount shown may omb no apps irs

Create this form in 5 minutes!

How to create an eSignature for the caution the amount shown may omb no apps irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'Caution The Amount Shown May OMB No Apps Irs' mean in relation to airSlate SignNow?

'Caution The Amount Shown May OMB No Apps Irs' refers to important IRS guidelines that users should be aware of when managing their documents. airSlate SignNow ensures that all eSigned documents comply with these regulations, providing peace of mind for businesses handling sensitive information.

-

How does airSlate SignNow help with IRS document compliance?

airSlate SignNow offers features that ensure your documents meet IRS standards, including secure eSigning and document tracking. By using our platform, you can confidently manage documents that include 'Caution The Amount Shown May OMB No Apps Irs' notices, ensuring compliance and reducing the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Our plans are designed to be cost-effective, allowing you to choose the best option that fits your budget while ensuring compliance with regulations like 'Caution The Amount Shown May OMB No Apps Irs.'

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow. This integration capability allows you to manage documents that may include 'Caution The Amount Shown May OMB No Apps Irs' notices alongside your existing tools, streamlining your processes.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features including eSigning, document templates, and real-time tracking. These features are designed to help you manage documents efficiently, especially those that require attention to details like 'Caution The Amount Shown May OMB No Apps Irs.'

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses. Our platform helps small businesses manage important documents, including those with 'Caution The Amount Shown May OMB No Apps Irs' notices, without the need for extensive resources.

-

How secure is airSlate SignNow for handling sensitive documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect your documents, including those that may contain 'Caution The Amount Shown May OMB No Apps Irs' information, ensuring that your data remains safe and confidential.

Get more for *Caution The Amount Shown May OMB No Apps Irs

Find out other *Caution The Amount Shown May OMB No Apps Irs

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT