NYC Office Sharing Agreements and Commercial Rent Tax Form

Understanding the New York Commercial Rent Tax

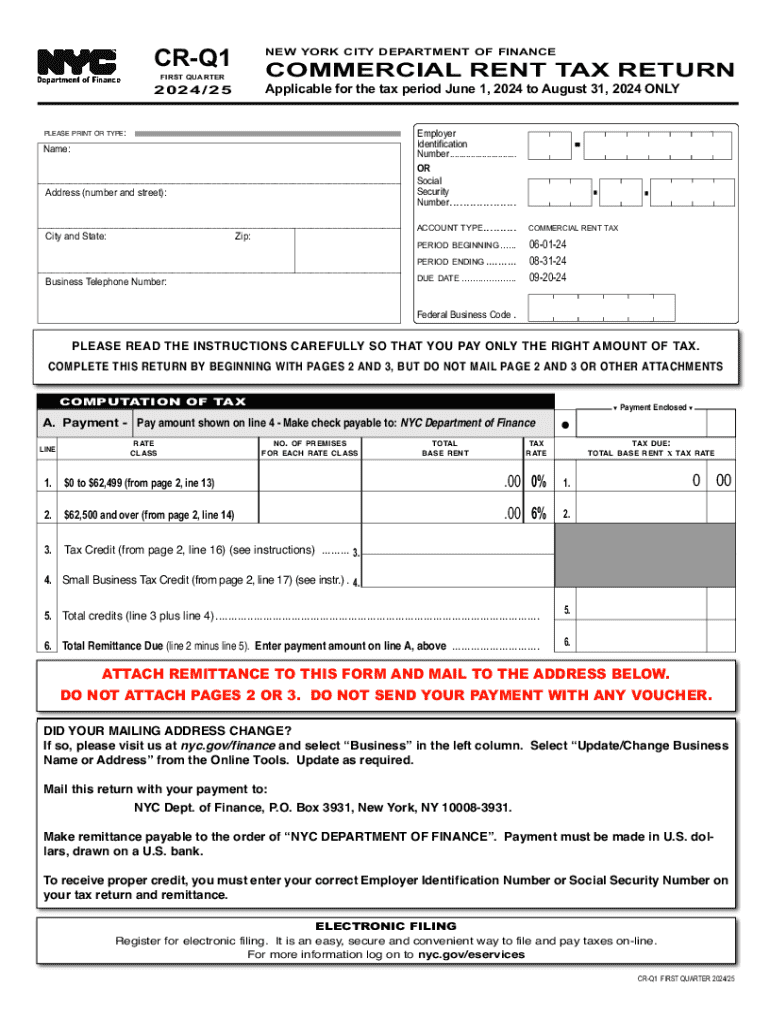

The New York Commercial Rent Tax is a tax imposed on commercial tenants in Manhattan who pay more than $250,000 in annual rent. This tax applies to businesses operating in specific areas of Manhattan, particularly below 96th Street. The tax rate is based on the total rent paid, and it is essential for businesses to understand their obligations to ensure compliance. The tax is calculated as a percentage of the rent, and tenants must file a return annually to report their rental payments.

Steps to Complete the New York Commercial Rent Tax Return

Completing the New York Commercial Rent Tax return involves several key steps:

- Gather all necessary documents, including lease agreements and payment records.

- Determine the total rent paid during the tax year, ensuring to include all applicable charges.

- Calculate the tax owed based on the current rate applicable to your rent amount.

- Fill out the required forms, specifically the CR-Q1, ensuring all information is accurate.

- Submit the completed form either online or via mail to the appropriate tax authority.

Required Documents for Filing

When filing the New York Commercial Rent Tax, certain documents are essential to ensure accurate reporting and compliance:

- Lease agreements detailing rental terms and conditions.

- Records of all rent payments made during the year.

- Previous tax returns, if applicable, for reference.

- Any correspondence with tax authorities regarding the commercial rent tax.

Filing Deadlines and Important Dates

Timely filing is crucial to avoid penalties. The New York Commercial Rent Tax return is typically due on the 15th day of the fourth month following the end of the tax year. For most businesses, this means the return is due on April 15. It is important to stay informed about any changes to deadlines or additional requirements that may arise.

Penalties for Non-Compliance

Failure to comply with the New York Commercial Rent Tax regulations can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action. It is essential for tenants to file their returns accurately and on time to avoid these consequences. Understanding the implications of non-compliance can help businesses maintain good standing and avoid unnecessary financial burdens.

Eligibility Criteria for the New York Commercial Rent Tax

To be subject to the New York Commercial Rent Tax, a business must meet specific criteria. Primarily, the business must be located in Manhattan below 96th Street and pay more than $250,000 in annual rent. Additionally, the nature of the business operations may influence tax obligations, so it is advisable for tenants to review their eligibility periodically to ensure compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc office sharing agreements and commercial rent tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new york commercial rent tax?

The New York commercial rent tax is a tax imposed on businesses renting commercial space in Manhattan. It applies to tenants whose annual rent exceeds a certain threshold. Understanding this tax is crucial for businesses to ensure compliance and avoid penalties.

-

How can airSlate SignNow help with new york commercial rent tax documentation?

airSlate SignNow provides a streamlined solution for managing documents related to the New York commercial rent tax. With our eSigning capabilities, businesses can easily sign and send tax-related documents securely and efficiently, ensuring timely submissions.

-

What are the benefits of using airSlate SignNow for new york commercial rent tax forms?

Using airSlate SignNow for New York commercial rent tax forms simplifies the process of filling out and submitting necessary documents. Our platform enhances collaboration, reduces paperwork, and ensures that all forms are completed accurately and on time, helping businesses stay compliant.

-

Is airSlate SignNow cost-effective for managing new york commercial rent tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing New York commercial rent tax documents. Our pricing plans are designed to fit various business sizes and needs, allowing you to save on administrative costs while ensuring compliance with tax regulations.

-

Can airSlate SignNow integrate with other tools for new york commercial rent tax management?

Absolutely! airSlate SignNow offers integrations with various business tools that can assist in managing New York commercial rent tax processes. This allows for seamless data transfer and improved workflow efficiency, making tax management easier for your business.

-

What features does airSlate SignNow offer for new york commercial rent tax compliance?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are essential for New York commercial rent tax compliance. These features help ensure that your documents are properly managed and submitted on time.

-

How does airSlate SignNow ensure the security of new york commercial rent tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your New York commercial rent tax documents, ensuring that sensitive information remains confidential and secure throughout the signing process.

Get more for NYC Office Sharing Agreements And Commercial Rent Tax

Find out other NYC Office Sharing Agreements And Commercial Rent Tax

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation