CPT FY Print Version6 13 24F PDF Form

Understanding the Alabama Business Privilege Tax

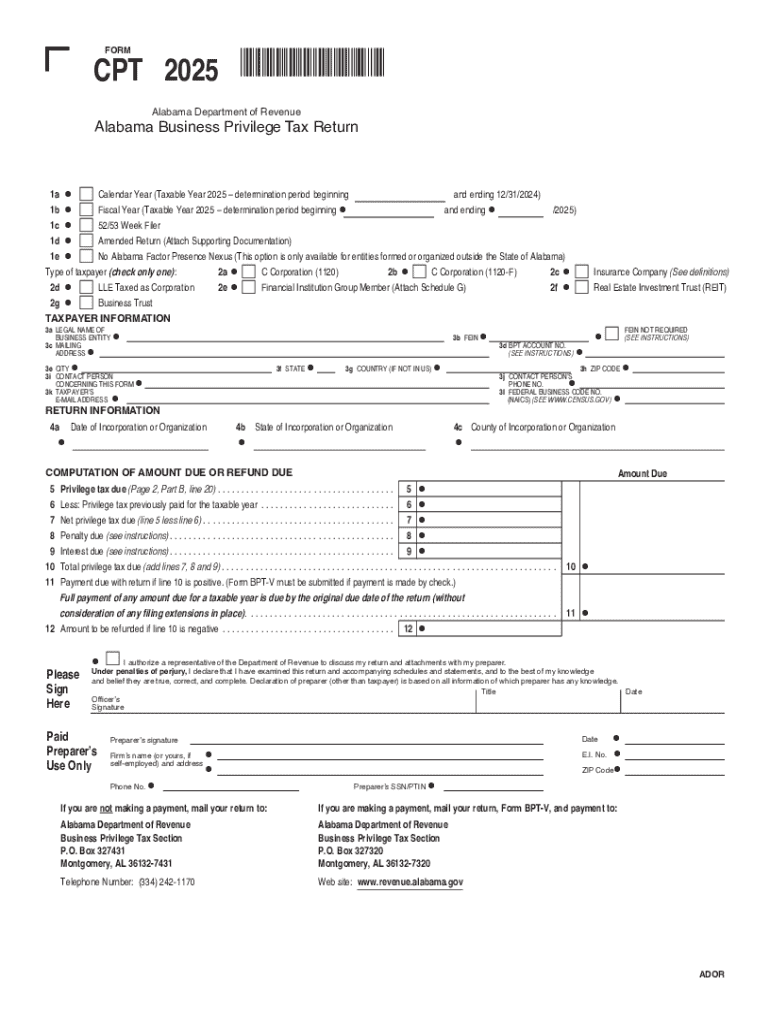

The Alabama business privilege tax is a tax imposed on businesses operating within the state. It is calculated based on the net worth of the business and applies to various business entities, including corporations, limited liability companies (LLCs), and partnerships. Each entity type has specific guidelines for calculating the tax, making it essential for business owners to understand their obligations.

Filing Requirements for the Alabama Business Privilege Tax Return

To comply with Alabama tax regulations, businesses must file an Alabama business privilege tax return annually. The return must be submitted to the Alabama Department of Revenue, detailing the business's net worth and the corresponding tax due. It is crucial to ensure that all required information is accurate to avoid penalties. Businesses should also keep records of their financial statements, as these will support the figures reported on the return.

Important Deadlines for Filing

Businesses must be aware of the filing deadlines associated with the Alabama business privilege tax. Typically, the tax return is due on the fifteenth day of the third month following the end of the business's fiscal year. For corporations operating on a calendar year, this means the return is due by March 15. Late submissions may incur penalties and interest, so timely filing is essential.

Methods for Submitting the Alabama Business Privilege Tax Return

Businesses can submit their Alabama business privilege tax return through various methods. The return can be filed online via the Alabama Department of Revenue's website, which offers a streamlined process for electronic submission. Alternatively, businesses can choose to mail their returns or deliver them in person at designated offices. Each method has its advantages, and businesses should select the one that best suits their needs.

Penalties for Non-Compliance

Failure to comply with the Alabama business privilege tax requirements can lead to significant penalties. These may include fines based on the amount of tax owed and interest on late payments. Additionally, businesses may face legal actions or restrictions on their ability to operate within the state. It is important for business owners to stay informed about their tax obligations to avoid these consequences.

Eligibility Criteria for the Alabama Business Privilege Tax

Not all businesses are subject to the Alabama business privilege tax. Eligibility typically depends on the type of business entity and its net worth. For instance, corporations and LLCs with a net worth exceeding a specific threshold are required to file. Understanding these criteria helps business owners determine their tax obligations and ensures compliance with state laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cpt fy print version6 13 24f pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alabama business privilege tax?

The Alabama business privilege tax is a tax imposed on businesses operating in Alabama, based on their net worth. It is essential for businesses to understand this tax to ensure compliance and avoid penalties. airSlate SignNow can help streamline document management related to tax filings.

-

How does airSlate SignNow assist with Alabama business privilege tax documentation?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning documents related to the Alabama business privilege tax. This simplifies the process of preparing and submitting necessary paperwork, ensuring that your business stays compliant. Our solution is designed to save you time and reduce errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan includes features that can help with managing Alabama business privilege tax documents efficiently. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing taxes?

airSlate SignNow includes features such as document templates, automated workflows, and secure eSigning, which are beneficial for managing Alabama business privilege tax documents. These features help streamline the tax filing process and ensure that all necessary documents are completed accurately and on time.

-

Can airSlate SignNow integrate with accounting software for tax purposes?

Yes, airSlate SignNow can integrate with various accounting software solutions, making it easier to manage your Alabama business privilege tax filings. This integration allows for seamless data transfer and ensures that your financial records are up-to-date. It enhances efficiency and reduces the risk of errors in tax documentation.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for the Alabama business privilege tax, offers numerous benefits. It enhances collaboration, reduces paperwork, and speeds up the signing process. Additionally, our platform ensures that your documents are secure and easily accessible.

-

Is airSlate SignNow suitable for small businesses dealing with Alabama business privilege tax?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing the Alabama business privilege tax. Our user-friendly interface and cost-effective solutions make it an ideal choice for small business owners looking to simplify their tax documentation process.

Get more for CPT FY Print Version6 13 24F pdf

- Summary of repair history form nh

- Automobile club of southern california verification of form

- Non magi www2 illinois form

- Form ri 2848_layout 1 tax ri

- Va form 21 0958 2015

- State of michigan form cfj 515 2011 2019

- Article estates and trusts section 17 202 maryland code form

- Escrow closing notice form

Find out other CPT FY Print Version6 13 24F pdf

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself