BPT V TY 20256 26 24F PDF Form

What is the BPT V TY 20256 26 24F PDF?

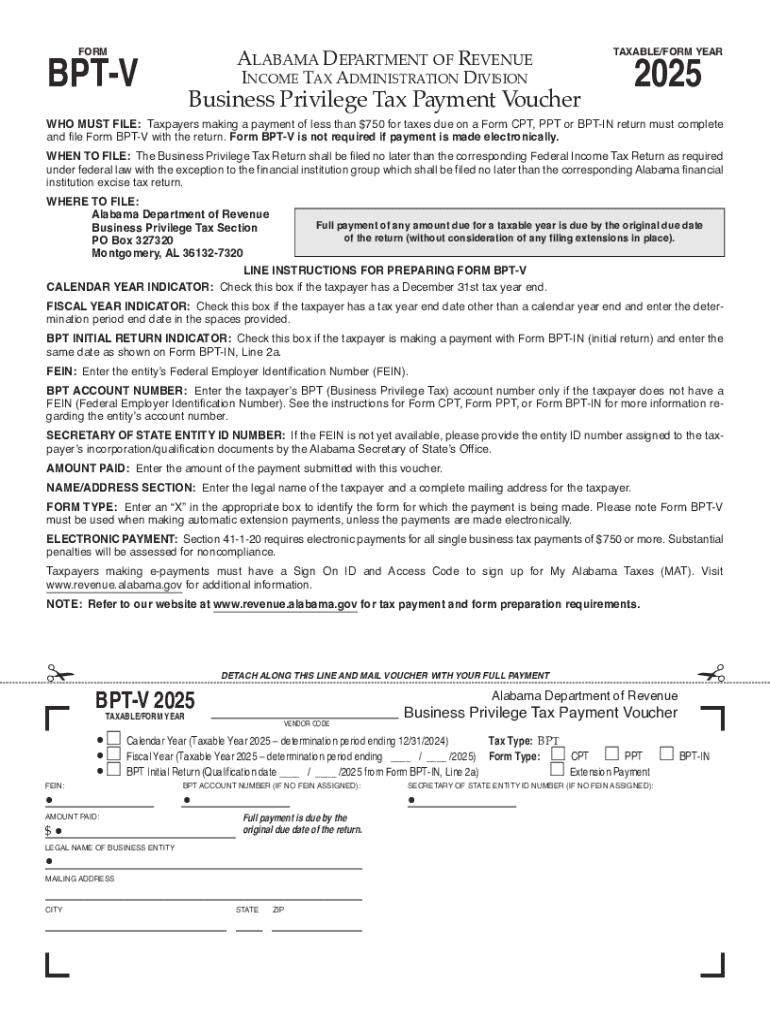

The BPT V TY 20256 26 24F PDF is a specific form used for reporting and paying the Alabama Business Privilege Tax (BPT). This tax applies to businesses operating within the state of Alabama, and the form serves as a critical document for compliance with state tax regulations. It includes essential information about the business's financial status and tax obligations.

How to Use the BPT V TY 20256 26 24F PDF

To effectively use the BPT V TY 20256 26 24F PDF, businesses must first download the form from the appropriate state resources. Once downloaded, the form should be filled out with accurate financial information, including gross receipts and other relevant data. After completing the form, businesses can submit it either electronically or by mail, following the guidelines provided by the Alabama Department of Revenue.

Steps to Complete the BPT V TY 20256 26 24F PDF

Completing the BPT V TY 20256 26 24F PDF involves several key steps:

- Download the form from the Alabama Department of Revenue website.

- Gather necessary financial documents, including income statements and balance sheets.

- Fill in the required fields accurately, ensuring all information is complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline, either online or via mail.

Legal Use of the BPT V TY 20256 26 24F PDF

The BPT V TY 20256 26 24F PDF is legally required for businesses subject to the Alabama Business Privilege Tax. Proper completion and timely submission of this form ensure compliance with state tax laws. Failure to submit the form can result in penalties, including fines or additional tax assessments.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of filing deadlines associated with the BPT V TY 20256 26 24F PDF. Typically, the form must be filed annually, and the specific due date may vary based on the business's fiscal year. Businesses should consult the Alabama Department of Revenue for the most current deadlines to avoid late fees.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the BPT V TY 20256 26 24F PDF can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to stay informed and ensure timely submission of their tax forms to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bpt v ty 20256 26 24f pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of bpt v alabama in the context of electronic signatures?

The bpt v alabama case highlights the legal validity of electronic signatures, affirming their acceptance in various legal contexts. This ruling ensures that businesses using airSlate SignNow can confidently eSign documents, knowing they are compliant with legal standards. Understanding this case can help users appreciate the importance of secure and reliable eSigning solutions.

-

How does airSlate SignNow support businesses involved in bpt v alabama?

airSlate SignNow provides a robust platform for businesses navigating the implications of bpt v alabama. With features like secure document storage and audit trails, users can ensure their eSigned documents are legally binding. This support is crucial for companies looking to maintain compliance while streamlining their signing processes.

-

What are the pricing options for airSlate SignNow for businesses dealing with bpt v alabama?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses, including those involved in bpt v alabama. Users can choose from various subscription tiers, ensuring they only pay for the features they need. This cost-effective solution helps businesses manage their document signing efficiently without overspending.

-

What features does airSlate SignNow offer that are relevant to bpt v alabama?

Key features of airSlate SignNow include customizable templates, secure eSigning, and real-time tracking, all of which are essential for businesses impacted by bpt v alabama. These tools enhance the signing experience and ensure that documents are processed quickly and securely. By leveraging these features, users can navigate legal requirements with ease.

-

How can airSlate SignNow benefit businesses in light of bpt v alabama?

Businesses can benefit from airSlate SignNow by ensuring their electronic signatures are legally recognized, as established by bpt v alabama. This platform simplifies the signing process, reduces turnaround times, and enhances overall efficiency. By adopting airSlate SignNow, companies can focus on their core operations while maintaining compliance.

-

Does airSlate SignNow integrate with other tools for businesses concerned with bpt v alabama?

Yes, airSlate SignNow offers integrations with various business tools, making it easier for companies dealing with bpt v alabama to streamline their workflows. These integrations allow users to connect their eSigning processes with CRM systems, document management software, and more. This seamless connectivity enhances productivity and ensures a smooth signing experience.

-

Is airSlate SignNow user-friendly for those unfamiliar with bpt v alabama?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for individuals unfamiliar with bpt v alabama. The intuitive interface allows users to easily navigate the platform and manage their eSigning needs without extensive training. This ease of use is crucial for businesses looking to adopt electronic signatures quickly.

Get more for BPT V TY 20256 26 24F pdf

- Rias hcm access request form rias rutgers integrated bb rias rutgers

- Form fp 11 application by one party for order dissolving justice govt

- Caymanian status amp permanent residency board application for form

- Da form 2062 excel

- Nsea international claim nsea form

- Chapter 4 test geneva area city schools genevaschools form

- Abcte missouri reviews form

- Data collection form pdf adult fitness test adultfitnesstest

Find out other BPT V TY 20256 26 24F pdf

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement