STATE of ARKANSAS Estimated Tax Declaration Vouche Form

Understanding the 2025 AR Estimated Tax Form

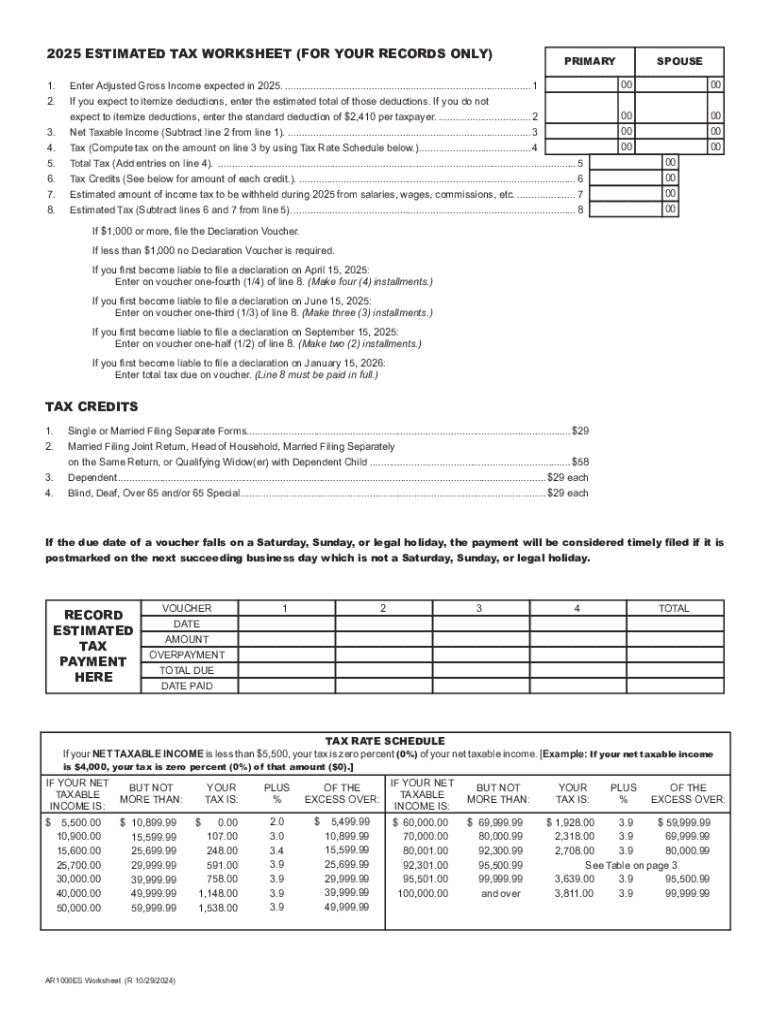

The 2025 AR Estimated Tax Form, also known as the AR1000ES form, is essential for Arkansas taxpayers who expect to owe tax of $1,000 or more when filing their annual tax return. This form allows individuals and businesses to make estimated tax payments throughout the year, helping to avoid penalties for underpayment. It is designed for various taxpayer scenarios, including self-employed individuals, retirees, and those with investment income.

Steps to Complete the 2025 AR Estimated Tax Form

Filling out the 2025 AR Estimated Tax Form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your expected income for the year to determine your estimated tax liability.

- Fill out the AR1000ES form with your personal information and estimated tax amounts.

- Review your calculations for accuracy before submission.

- Submit the form along with your estimated tax payment by the due date.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the 2025 AR Estimated Tax Form. Generally, estimated tax payments are due on the 15th of April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes. Taxpayers should mark their calendars to ensure timely submissions.

Who Issues the Form

The 2025 AR Estimated Tax Form is issued by the Arkansas Department of Finance and Administration. This state agency is responsible for tax collection and ensuring compliance with state tax laws. Taxpayers can access the form directly from the agency's official website or through authorized tax preparation services.

Legal Use of the 2025 AR Estimated Tax Form

The AR1000ES form is legally recognized for making estimated tax payments in Arkansas. Taxpayers must use this form to report and pay their estimated taxes to avoid penalties for underpayment. It is important to adhere to all state regulations when completing and submitting the form to ensure compliance with Arkansas tax laws.

Required Documents for the 2025 AR Estimated Tax Form

To accurately complete the 2025 AR Estimated Tax Form, taxpayers should gather several key documents, including:

- Previous year’s tax return for reference.

- Income statements such as W-2s or 1099s.

- Records of any other income sources, including rental or investment income.

- Documentation of deductions and credits that may apply.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of arkansas estimated tax declaration vouche

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2025 AR estimated tax form?

The 2025 AR estimated tax form is a document used by Arkansas residents to report and pay estimated taxes for the year 2025. It helps taxpayers calculate their expected tax liability and make timely payments to avoid penalties. Understanding this form is crucial for effective tax planning.

-

How can airSlate SignNow help with the 2025 AR estimated tax form?

airSlate SignNow simplifies the process of preparing and signing the 2025 AR estimated tax form. Our platform allows users to easily fill out, eSign, and send documents securely. This streamlines the tax filing process, ensuring you meet deadlines without hassle.

-

What features does airSlate SignNow offer for managing the 2025 AR estimated tax form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for the 2025 AR estimated tax form. These tools enhance efficiency and ensure that all necessary steps are completed accurately. Users can also collaborate in real-time, making it easier to gather required signatures.

-

Is airSlate SignNow cost-effective for filing the 2025 AR estimated tax form?

Yes, airSlate SignNow provides a cost-effective solution for filing the 2025 AR estimated tax form. With various pricing plans, users can choose an option that fits their budget while still accessing essential features. This affordability makes it an attractive choice for both individuals and businesses.

-

Can I integrate airSlate SignNow with other software for the 2025 AR estimated tax form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for the 2025 AR estimated tax form. This integration allows for easy data transfer and ensures that all your documents are in one place, simplifying the filing process.

-

What are the benefits of using airSlate SignNow for the 2025 AR estimated tax form?

Using airSlate SignNow for the 2025 AR estimated tax form offers numerous benefits, including time savings, enhanced security, and improved accuracy. The platform's user-friendly interface makes it easy to navigate, while its robust security measures protect sensitive information. This ensures a smooth and secure filing experience.

-

How do I get started with airSlate SignNow for the 2025 AR estimated tax form?

Getting started with airSlate SignNow for the 2025 AR estimated tax form is simple. Sign up for an account, choose a pricing plan, and access our library of templates. From there, you can easily create, eSign, and send your estimated tax forms without any hassle.

Get more for STATE OF ARKANSAS Estimated Tax Declaration Vouche

- Ihq chapter officers form 50 omega psi phi fraternity inc

- Education service commission form

- Childrens product certificate template form

- Official ncaa volleyball box score fs ncaa form

- K9 angels small dog rescue k9angels form

- Food waiver clientdoc sportsrd form

- Prayer notebook gina garland form

- Awana record keeping forms

Find out other STATE OF ARKANSAS Estimated Tax Declaration Vouche

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo