STATE of ARKANSAS Composite Estimated Tax Declarat 2025-2026

Understanding the STATE OF ARKANSAS Composite Estimated Tax Declaration

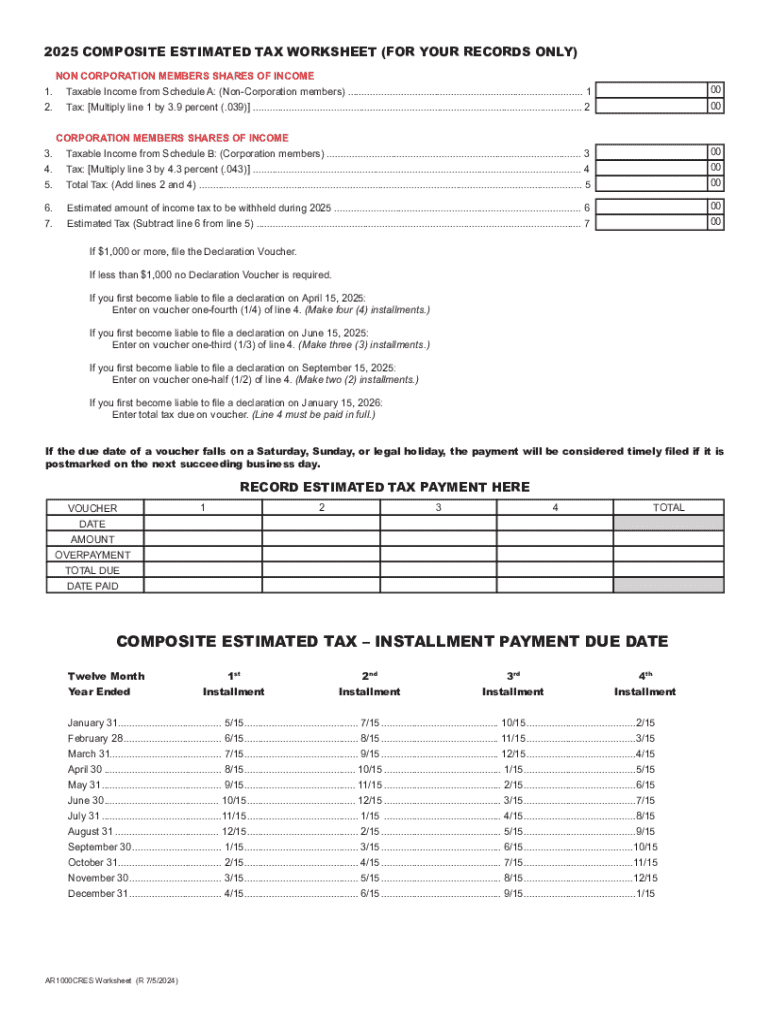

The STATE OF ARKANSAS Composite Estimated Tax Declaration, commonly referred to as the ar1000cres, is a vital document for individuals and businesses that need to estimate their state tax obligations. This form is specifically designed for non-resident partners in partnerships and shareholders in S-corporations who earn income in Arkansas. It allows these entities to report their estimated tax liabilities and make timely payments to avoid penalties.

Steps to Complete the STATE OF ARKANSAS Composite Estimated Tax Declaration

Completing the ar1000cres involves several key steps:

- Gather necessary information, including income details, deductions, and previous tax filings.

- Calculate your estimated tax liability based on Arkansas tax rates and your projected income.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid any penalties.

Legal Use of the STATE OF ARKANSAS Composite Estimated Tax Declaration

The ar1000cres serves a legal purpose in ensuring compliance with Arkansas tax laws. It is essential for non-resident entities to file this form to report their income accurately and fulfill their tax obligations. Failing to submit the form can lead to penalties, interest charges, and potential legal action from the state.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the ar1000cres. Typically, estimated tax payments are due quarterly. The specific dates may vary, so it is advisable to consult the Arkansas Department of Finance and Administration for the most current deadlines to ensure timely submissions.

Required Documents for Filing

When preparing to file the ar1000cres, gather the following documents:

- Previous year’s tax return for reference.

- Documentation of all income sources, including W-2s and 1099s.

- Records of any deductions or credits you plan to claim.

- Any correspondence from the Arkansas Department of Finance and Administration.

Form Submission Methods

The ar1000cres can be submitted through various methods to accommodate different preferences:

- Online: Use the Arkansas Department of Finance and Administration’s online portal for electronic submission.

- Mail: Send a completed paper form to the appropriate state address.

- In-Person: Deliver the form directly to a local Arkansas Department of Finance and Administration office.

Examples of Using the STATE OF ARKANSAS Composite Estimated Tax Declaration

Consider a scenario where a non-resident partner in a partnership earns income from an Arkansas-based business. This partner must file the ar1000cres to report their share of the partnership income and pay estimated taxes accordingly. Another example includes an S-corporation shareholder who receives dividends from an Arkansas corporation, necessitating the use of this form to ensure compliance with state tax regulations.

Create this form in 5 minutes or less

Find and fill out the correct state of arkansas composite estimated tax declarat

Create this form in 5 minutes!

How to create an eSignature for the state of arkansas composite estimated tax declarat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ar1000cres and how does it benefit my business?

ar1000cres is a powerful feature within airSlate SignNow that allows businesses to streamline their document signing processes. By utilizing ar1000cres, you can enhance efficiency, reduce turnaround times, and improve overall workflow. This feature is designed to empower teams to manage documents seamlessly.

-

How much does it cost to use ar1000cres?

The pricing for ar1000cres is competitive and designed to fit various business needs. airSlate SignNow offers flexible plans that include access to ar1000cres, ensuring you get the best value for your investment. For detailed pricing information, visit our pricing page.

-

What features are included with ar1000cres?

ar1000cres includes a range of features such as customizable templates, real-time tracking, and secure eSigning capabilities. These features are designed to enhance user experience and ensure that your document management is efficient and secure. With ar1000cres, you can easily manage all your signing needs in one place.

-

Can I integrate ar1000cres with other software?

Yes, ar1000cres offers seamless integrations with various software applications, including CRM and project management tools. This allows you to enhance your existing workflows and improve productivity. By integrating ar1000cres, you can ensure that your document processes are aligned with your business operations.

-

Is ar1000cres secure for sensitive documents?

Absolutely, ar1000cres prioritizes security and compliance, ensuring that your sensitive documents are protected. With features like encryption and secure access controls, you can trust that your data is safe. airSlate SignNow adheres to industry standards to provide a secure eSigning experience.

-

How does ar1000cres improve document turnaround times?

ar1000cres signNowly reduces document turnaround times by enabling quick eSigning and real-time tracking. This means that you can send, sign, and receive documents faster than traditional methods. By using ar1000cres, businesses can enhance their operational efficiency and responsiveness.

-

What types of documents can I manage with ar1000cres?

With ar1000cres, you can manage a wide variety of documents, including contracts, agreements, and forms. The platform is versatile and can accommodate different document types, making it suitable for various industries. This flexibility allows businesses to streamline their document workflows effectively.

Get more for STATE OF ARKANSAS Composite Estimated Tax Declarat

Find out other STATE OF ARKANSAS Composite Estimated Tax Declarat

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template