Form 592 Resident and Nonresident Withholding Statement

What is the Form 592 Resident And Nonresident Withholding Statement

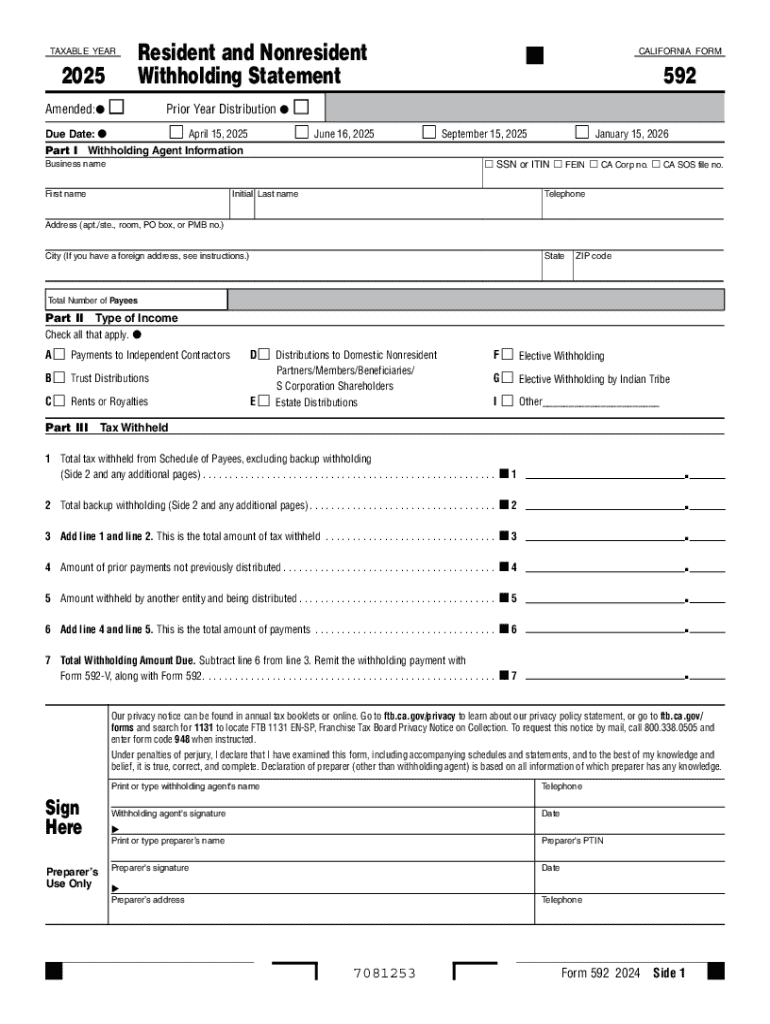

The Franchise Tax Board Form 592 is a crucial document used in California for reporting withholding tax on payments made to nonresidents and residents. This form is essential for entities that make payments subject to withholding, such as partnerships, LLCs, and corporations. It helps ensure that the appropriate amount of state tax is withheld from payments to individuals or entities that are not residents of California. The form captures vital information, including the amount withheld, the recipient's details, and the payer's information.

Steps to complete the Form 592 Resident And Nonresident Withholding Statement

Completing the Form 592 requires careful attention to detail. Here are the key steps:

- Begin by entering the payer's name, address, and identification number at the top of the form.

- Provide the recipient's information, including their name, address, and identification number.

- Indicate the type of payment being made and the total amount subject to withholding.

- Calculate the withholding amount based on the applicable rate and enter it in the designated section.

- Sign and date the form to certify its accuracy before submission.

How to obtain the Form 592 Resident And Nonresident Withholding Statement

The Form 592 can be easily obtained through the California Franchise Tax Board's official website. It is available as a downloadable PDF, allowing users to print and fill it out manually. Additionally, the form may also be accessible through various tax preparation software that supports California tax forms, providing a fillable format for convenience.

Filing Deadlines / Important Dates

Timely submission of Form 592 is essential to avoid penalties. The form must be filed by the last day of the month following the end of the quarter in which the withholding occurred. For example, if withholding occurred in the first quarter, the form would be due by April 30. It is important to keep track of these deadlines to ensure compliance with California tax regulations.

Key elements of the Form 592 Resident And Nonresident Withholding Statement

Key elements of Form 592 include:

- Payer's information: Name, address, and identification number.

- Recipient's information: Name, address, and identification number.

- Payment details: Type of payment and total amount.

- Withholding amount: Calculated based on the applicable rate.

- Certification: Signature and date to confirm the accuracy of the information provided.

Legal use of the Form 592 Resident And Nonresident Withholding Statement

The legal use of Form 592 is mandated by California tax law for any entity making payments that require withholding. It serves as a formal declaration of the amounts withheld and ensures compliance with state tax obligations. Proper use of this form protects both the payer and the recipient from potential tax liabilities and penalties associated with underreporting or failing to withhold the required taxes.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 592 resident and nonresident withholding statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the franchise tax board form 592?

The franchise tax board form 592 is a tax form used in California for reporting withholding on payments made to non-residents. It is essential for businesses to comply with state tax regulations and ensure proper reporting of income. Understanding this form is crucial for accurate tax filing and avoiding penalties.

-

How can airSlate SignNow help with the franchise tax board form 592?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send the franchise tax board form 592. With its user-friendly interface, you can streamline the document management process, ensuring timely submission and compliance with tax regulations. This saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the franchise tax board form 592?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that simplify the completion and submission of the franchise tax board form 592. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for airSlate SignNow when handling the franchise tax board form 592?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when managing the franchise tax board form 592. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document storage and sharing. This integration helps maintain organization and efficiency.

-

What features does airSlate SignNow offer for the franchise tax board form 592?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for the franchise tax board form 592. These tools help ensure that your documents are completed accurately and efficiently. Additionally, you can automate reminders for signers to expedite the process.

-

How does airSlate SignNow ensure the security of the franchise tax board form 592?

Security is a top priority for airSlate SignNow, which employs advanced encryption and compliance measures to protect the franchise tax board form 592. Your documents are stored securely, and access is controlled to prevent unauthorized viewing. This ensures that sensitive tax information remains confidential.

-

Can I track the status of my franchise tax board form 592 with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for the franchise tax board form 592, allowing you to monitor the status of your documents. You will receive notifications when the form is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Form 592 Resident And Nonresident Withholding Statement

Find out other Form 592 Resident And Nonresident Withholding Statement

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document