Authorized Representative for Withholding Agent Form

Understanding the Authorized Representative for Withholding Agent

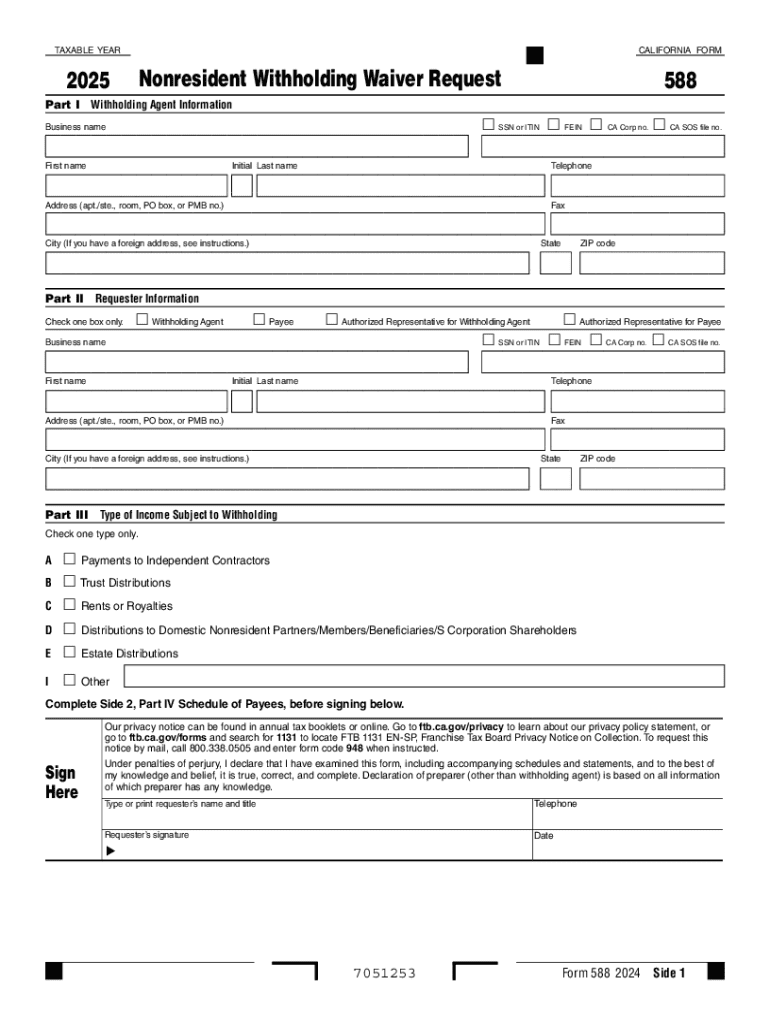

The Authorized Representative for Withholding Agent is a crucial role in the context of California Form 588. This individual or entity is designated to act on behalf of the withholding agent, which is typically responsible for withholding taxes from payments made to nonresidents. The representative can be an attorney, accountant, or another qualified individual who can manage tax-related matters, ensuring compliance with California tax regulations.

Steps to Complete the Authorized Representative for Withholding Agent

Completing the Authorized Representative section of California Form 588 involves several key steps:

- Identify the withholding agent and the representative.

- Provide necessary contact information for both parties.

- Ensure that the representative has the authority to act on behalf of the withholding agent.

- Sign and date the form to validate the appointment.

It is important to ensure that all information is accurate to avoid delays in processing and potential penalties.

Legal Use of the Authorized Representative for Withholding Agent

The legal framework surrounding the Authorized Representative for Withholding Agent is defined by California tax laws. This representative must adhere to specific regulations that govern the withholding of taxes from payments made to nonresidents. Proper use of this designation can facilitate smoother tax compliance and communication with the California Franchise Tax Board (FTB).

Filing Deadlines and Important Dates

When dealing with California Form 588, it is essential to be aware of important filing deadlines. Generally, the form must be submitted to the FTB by the time payments are made to nonresidents. Failing to meet these deadlines can result in penalties and interest on unpaid taxes. Keeping track of these dates ensures compliance and helps avoid unnecessary complications.

Required Documents for Submission

To complete California Form 588, several documents may be required. These typically include:

- Proof of the representative's authority.

- Identification information for both the withholding agent and the representative.

- Any previous correspondence with the FTB regarding withholding matters.

Having these documents ready can streamline the process and facilitate accurate submissions.

Penalties for Non-Compliance

Non-compliance with the requirements associated with California Form 588 can lead to significant penalties. These may include fines for late submissions, interest on unpaid taxes, and potential legal action from the FTB. Understanding these consequences can motivate timely and accurate completion of the form, ensuring adherence to California tax laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the authorized representative for withholding agent

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California Form 588?

California Form 588 is a tax form used by businesses to report and pay withholding taxes for non-resident partners. It is essential for compliance with California tax regulations. Using airSlate SignNow, you can easily eSign and submit California Form 588, streamlining your tax filing process.

-

How can airSlate SignNow help with California Form 588?

airSlate SignNow provides a user-friendly platform to eSign California Form 588 quickly and securely. Our solution simplifies the document management process, allowing you to focus on your business while ensuring compliance with California tax laws. Plus, you can track the status of your forms in real-time.

-

Is there a cost associated with using airSlate SignNow for California Form 588?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are cost-effective and designed to provide value, especially for those frequently handling documents like California Form 588. You can choose a plan that fits your budget and usage requirements.

-

What features does airSlate SignNow offer for managing California Form 588?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of California Form 588. These features ensure that your documents are processed efficiently and securely, reducing the risk of errors and delays.

-

Can I integrate airSlate SignNow with other software for California Form 588?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage California Form 588 alongside your existing tools. This seamless integration helps streamline your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for California Form 588?

Using airSlate SignNow for California Form 588 provides numerous benefits, including increased efficiency, enhanced security, and reduced paperwork. Our platform allows you to eSign documents from anywhere, saving you time and ensuring that your forms are submitted on time.

-

Is airSlate SignNow compliant with California regulations for Form 588?

Yes, airSlate SignNow is designed to comply with California regulations regarding Form 588. Our platform adheres to the latest security standards and legal requirements, ensuring that your eSigned documents are valid and recognized by the state.

Get more for Authorized Representative For Withholding Agent

Find out other Authorized Representative For Withholding Agent

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation