Form 590 Withholding Exemption Certificate , Form 590, Withholding Exemption Certificate

Understanding the Form 590 Withholding Exemption Certificate

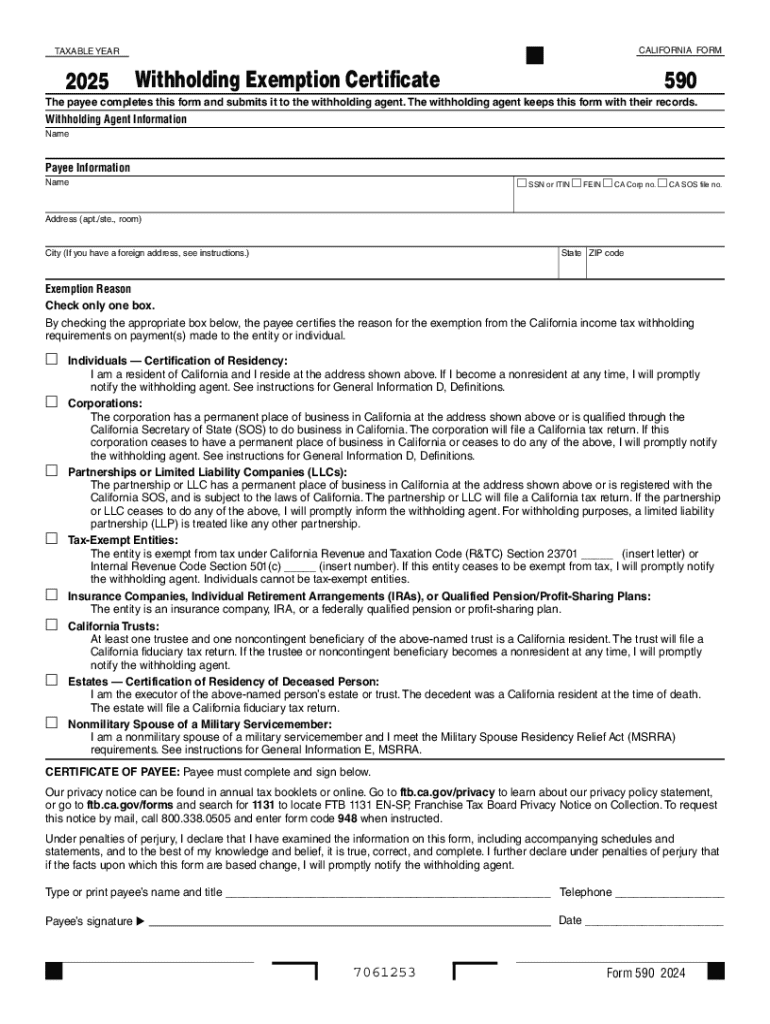

The Form 590 is a Withholding Exemption Certificate used in California to claim an exemption from state income tax withholding. This form is particularly relevant for individuals or entities that expect to have no tax liability for the year. By submitting this certificate, taxpayers can ensure that their income is not subject to unnecessary withholding, allowing them to retain more of their earnings throughout the year.

It is essential for recipients of certain payments, such as independent contractors or those receiving rental income, to understand their eligibility for this exemption. The form helps streamline the tax process and can be beneficial for managing cash flow.

Steps to Complete the Form 590 Withholding Exemption Certificate

Completing the Form 590 involves several key steps to ensure accuracy and compliance with California tax regulations. Here are the basic steps:

- Download the Form 590 from the California Franchise Tax Board website or obtain a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Indicate the type of income you receive and the reason for claiming the exemption.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the payer or withholding agent, not to the state.

It is advisable to keep a copy of the submitted form for your records, as this can be useful for future reference or in case of audits.

Key Elements of the Form 590 Withholding Exemption Certificate

The Form 590 includes several important sections that must be completed accurately. Key elements include:

- Personal Information: This section requires your name, address, and taxpayer identification number.

- Income Type: Indicate the type of income for which you are claiming the exemption, such as wages or rental income.

- Exemption Reason: Clearly state the reason for claiming the withholding exemption, ensuring it aligns with California tax laws.

- Signature: Your signature certifies that the information provided is true and correct, which is crucial for legal compliance.

Legal Use of the Form 590 Withholding Exemption Certificate

The Form 590 is legally recognized by the state of California and is designed to comply with state tax laws. It is important for individuals and businesses to understand that misuse of this form can lead to penalties. The form should only be used when there is a legitimate basis for claiming an exemption from withholding. Taxpayers should be aware of the legal implications of providing false information on the form, as this can result in fines or other legal consequences.

How to Obtain the Form 590 Withholding Exemption Certificate

Obtaining the Form 590 is straightforward. It can be downloaded directly from the California Franchise Tax Board's website, where the most current version is available. Additionally, physical copies may be requested from tax professionals or local tax offices. Ensure that you are using the most recent version of the form to avoid any issues with your exemption claim.

Examples of Using the Form 590 Withholding Exemption Certificate

There are various scenarios in which the Form 590 can be utilized effectively. For instance:

- A freelancer providing services to a client may submit the Form 590 to avoid having state taxes withheld from their payments.

- A landlord receiving rental income can use the form to ensure that their tenants do not withhold taxes if they qualify for the exemption.

- Individuals who anticipate having no tax liability for the year, such as students or retirees with limited income, can also benefit from submitting this form.

These examples illustrate the practical applications of the Form 590 in managing tax obligations and maximizing income retention.

Handy tips for filling out Form 590 Withholding Exemption Certificate , Form 590, Withholding Exemption Certificate online

Quick steps to complete and e-sign Form 590 Withholding Exemption Certificate , Form 590, Withholding Exemption Certificate online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Get access to a GDPR and HIPAA compliant service for maximum simpleness. Use signNow to electronically sign and send Form 590 Withholding Exemption Certificate , Form 590, Withholding Exemption Certificate for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 590 withholding exemption certificate form 590 withholding exemption certificate 771777434

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the pricing options for airSlate SignNow in 2025?

In 2025, airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, with discounts available for long-term commitments. Each plan includes essential features to streamline your document signing process.

-

What features does airSlate SignNow provide for document signing in 2025?

In 2025, airSlate SignNow includes a variety of features designed to enhance your document signing experience. These features include customizable templates, real-time tracking, and advanced security options to ensure your documents are safe. The platform is user-friendly, making it easy for anyone to navigate.

-

How can airSlate SignNow benefit my business in 2025?

Using airSlate SignNow in 2025 can signNowly improve your business's efficiency by reducing the time spent on document management. The platform allows for quick and secure eSigning, which can lead to faster transaction times and improved customer satisfaction. Additionally, it helps in minimizing paper usage, contributing to a more sustainable business model.

-

What integrations does airSlate SignNow offer in 2025?

In 2025, airSlate SignNow integrates seamlessly with various popular applications, including CRM systems, cloud storage services, and productivity tools. This allows you to streamline your workflow and manage documents more effectively. The integration capabilities enhance collaboration and ensure that your team can work efficiently across different platforms.

-

Is airSlate SignNow compliant with legal standards in 2025?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures in 2025. The platform adheres to regulations such as the ESIGN Act and UETA, ensuring that your eSigned documents are legally binding. This compliance provides peace of mind for businesses and their clients when handling sensitive documents.

-

Can I customize my documents with airSlate SignNow in 2025?

Absolutely! In 2025, airSlate SignNow allows users to customize documents with various templates and branding options. You can add your logo, adjust the layout, and include specific fields to meet your business needs. This customization helps maintain your brand identity while ensuring a professional appearance.

-

What support options are available for airSlate SignNow users in 2025?

In 2025, airSlate SignNow provides comprehensive support options for its users, including live chat, email support, and an extensive knowledge base. Whether you have questions about features or need assistance with troubleshooting, the support team is ready to help. This ensures that you can maximize the benefits of the platform without any interruptions.

Get more for Form 590 Withholding Exemption Certificate , Form 590, Withholding Exemption Certificate

Find out other Form 590 Withholding Exemption Certificate , Form 590, Withholding Exemption Certificate

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple