Schedule CA 540 California Adjustments Residents , Schedule CA 540, California Adjustments Residents Form

What is the Schedule CA 540 California Adjustments for Residents

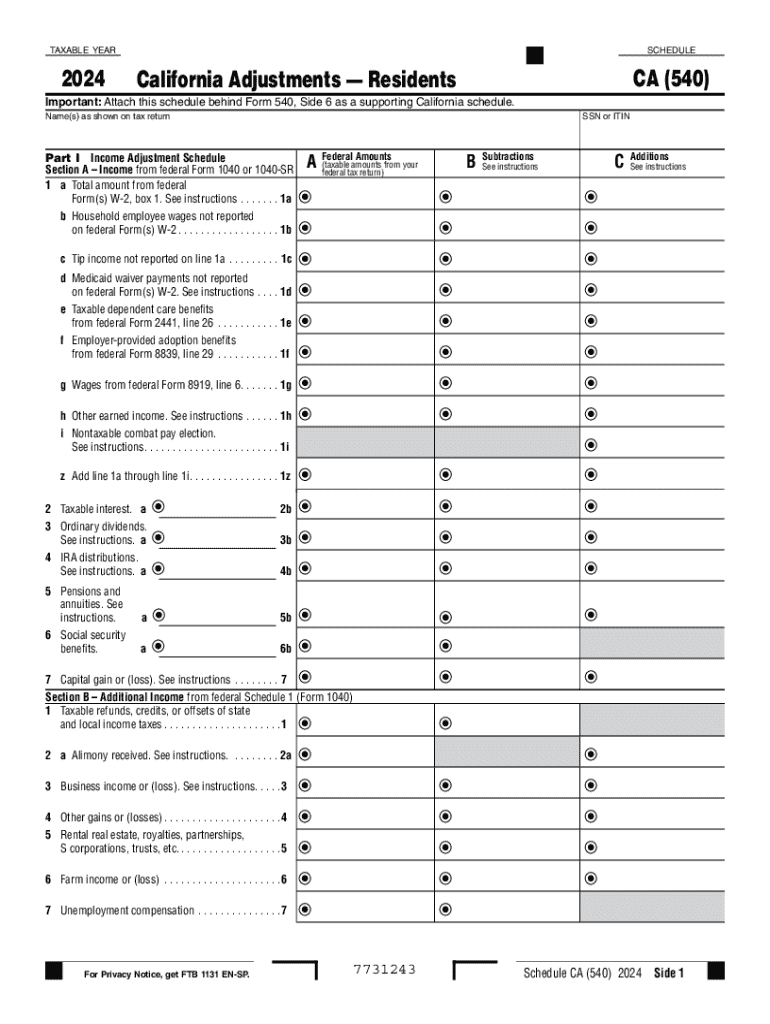

The Schedule CA 540 is a crucial form for California residents filing their state income tax returns. It allows taxpayers to report adjustments to their income and deductions that differ from federal tax calculations. This form is specifically designed for individuals who need to make adjustments due to California-specific tax laws, ensuring compliance with state regulations. By accurately completing the Schedule CA 540, taxpayers can determine their taxable income and the amount of tax owed or refund due.

Steps to Complete the Schedule CA 540 California Adjustments for Residents

Completing the Schedule CA 540 involves several key steps:

- Gather necessary documents: Collect your federal tax return, W-2s, 1099s, and any other relevant financial documents.

- Identify adjustments: Review your federal return to determine which items need adjustments, such as state-specific deductions or credits.

- Fill out the form: Input the required information on the Schedule CA 540, ensuring accuracy in reporting your income and adjustments.

- Review and verify: Check your entries for any errors or omissions before finalizing the form.

- Submit the form: File your completed Schedule CA 540 along with your California tax return by the deadline.

Key Elements of the Schedule CA 540 California Adjustments for Residents

The Schedule CA 540 includes several key elements that are essential for accurate tax reporting:

- Income adjustments: This section allows taxpayers to report any income that is taxable at the federal level but exempt from California tax.

- Deductions: Taxpayers can adjust their deductions based on California law, which may differ from federal deductions.

- Tax credits: The form includes sections for claiming California-specific tax credits that can reduce the overall tax liability.

- Signature and date: Taxpayers must sign and date the form to certify that the information provided is accurate and complete.

How to Obtain the Schedule CA 540 California Adjustments for Residents

Taxpayers can obtain the Schedule CA 540 by visiting the California Franchise Tax Board (FTB) website, where the form is available for download. Additionally, physical copies can be requested from the FTB office or obtained at various tax preparation offices throughout California. It is important to ensure that you are using the most current version of the form to comply with any recent tax law changes.

State-Specific Rules for the Schedule CA 540 California Adjustments for Residents

California has unique tax laws that affect how residents complete the Schedule CA 540. Some important state-specific rules include:

- Different tax rates: California's tax rates may differ from federal rates, impacting the overall tax calculation.

- Exemptions and deductions: Certain exemptions and deductions that are available federally may not apply in California, necessitating adjustments on the Schedule CA 540.

- Credits unique to California: Taxpayers may qualify for state-specific credits that are not available on the federal level, which can further affect their tax liability.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule ca 540 california adjustments residents schedule ca 540 california adjustments residents 771882700

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule CA 540?

Schedule CA 540 is a form used by California residents to report their income and calculate their state tax liability. It is an essential part of the California tax return process, allowing taxpayers to adjust their federal income to reflect state-specific deductions and credits.

-

How do I fill out Schedule CA 540?

To fill out Schedule CA 540, you need to gather your federal tax return and any relevant California tax documents. The form requires you to report your income, adjustments, and deductions specific to California, ensuring you accurately reflect your tax situation in the state.

-

What are the benefits of using Schedule CA 540?

Using Schedule CA 540 allows you to accurately report your income and claim deductions specific to California, which can lead to potential tax savings. It ensures compliance with state tax laws and helps you avoid penalties associated with incorrect filings.

-

Is there a cost associated with filing Schedule CA 540?

Filing Schedule CA 540 itself does not have a direct cost, but you may incur fees if you use tax preparation software or hire a tax professional. Many online platforms offer affordable solutions to help you complete your California tax return efficiently.

-

Can I eFile Schedule CA 540?

Yes, you can eFile Schedule CA 540 through various tax preparation software that supports California tax forms. eFiling is a convenient option that allows for faster processing and quicker refunds, making it a popular choice among taxpayers.

-

What documents do I need to complete Schedule CA 540?

To complete Schedule CA 540, you will need your federal tax return, W-2 forms, 1099 forms, and any documentation for deductions or credits you plan to claim. Having these documents ready will streamline the process and ensure accurate reporting.

-

Are there any common mistakes to avoid when filing Schedule CA 540?

Common mistakes when filing Schedule CA 540 include incorrect income reporting, failing to include all necessary forms, and overlooking state-specific deductions. Carefully reviewing your information and using reliable tax software can help minimize these errors.

Get more for Schedule CA 540 California Adjustments Residents , Schedule CA 540, California Adjustments Residents

- Caregiver timesheet form

- Print application for employment perry lutheran home perrylutheranhome form

- Right of first refusal real estate template form

- Hoa variance request form

- Tndc complaint ampamp grievance form

- Contact usnational fair housing alliance form

- Membership application 2015 calendar year form

- Application for client participation in housing education amp leasing partnership h eladacap form

Find out other Schedule CA 540 California Adjustments Residents , Schedule CA 540, California Adjustments Residents

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free