Sales Tax Filing Options Louisiana Department of Revenue Form

Understanding the Sales Tax Filing Options for Louisiana

The Louisiana Department of Revenue provides several options for filing sales tax returns. Taxpayers can choose to file online, by mail, or in person. Each method has its own advantages, allowing businesses to select the most convenient option for their needs. Online filing is often the quickest and most efficient, enabling immediate submission and confirmation of receipt. Mail submissions, while traditional, may take longer to process. In-person filing may be suitable for those who prefer direct interaction or have specific questions regarding their returns.

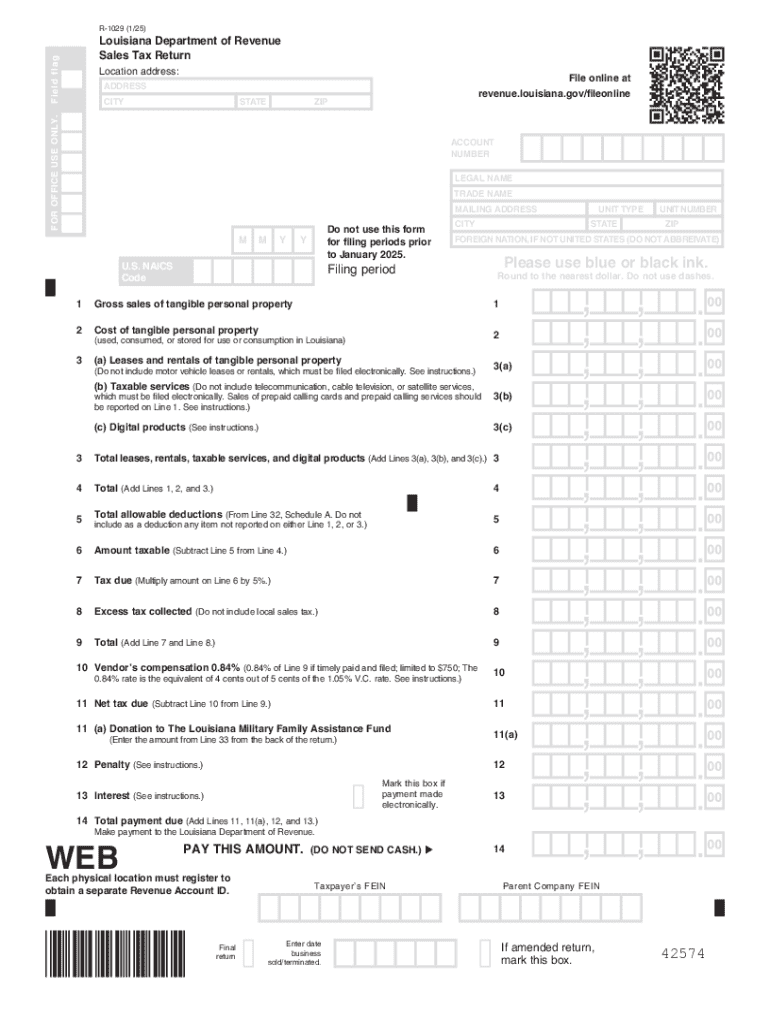

Steps to Complete the Louisiana Sales Tax Form R-1029

Completing the R-1029 sales tax form involves several key steps. First, gather all necessary documentation, including sales records and any applicable exemptions. Next, accurately fill out the form, ensuring all required fields are completed. Pay close attention to the calculation of total sales and tax due, as errors can lead to penalties. After completing the form, review it for accuracy before submitting it through the chosen filing method. Keeping a copy for your records is also advisable.

Legal Use of the R-1029 Sales Tax Form

The R-1029 sales tax form is legally required for businesses operating in Louisiana to report and remit sales tax collected during a specified period. Compliance with state regulations is essential, as failure to file or inaccuracies in reporting can result in penalties and interest charges. Understanding the legal implications of the form helps ensure that businesses remain compliant with Louisiana tax laws and avoid potential legal issues.

Filing Deadlines for the R-1029 Sales Tax Form

Filing deadlines for the R-1029 sales tax form are crucial for compliance. Typically, businesses must file their sales tax returns on a monthly or quarterly basis, depending on their sales volume. The Louisiana Department of Revenue sets specific due dates for each filing period. It is important for businesses to be aware of these dates to avoid late fees and penalties associated with non-compliance.

Required Documents for Filing the R-1029 Sales Tax Form

When preparing to file the R-1029 sales tax form, businesses should gather several key documents. These include sales records, invoices, and any exemption certificates that may apply. Accurate documentation is essential for completing the form correctly and ensuring that all sales tax collected is reported. Having these documents ready can streamline the filing process and help prevent errors.

Penalties for Non-Compliance with Sales Tax Filing

Non-compliance with the filing of the R-1029 sales tax form can lead to significant penalties. The Louisiana Department of Revenue may impose fines for late submissions, inaccurate reporting, or failure to file altogether. These penalties can accumulate quickly, making it critical for businesses to adhere to filing requirements. Understanding these consequences can motivate timely and accurate submissions, safeguarding businesses from unnecessary financial burdens.

Examples of Using the R-1029 Sales Tax Form

Businesses across various sectors utilize the R-1029 sales tax form to report their sales tax obligations. For instance, a retail store must report sales tax collected from customers on a monthly basis. Similarly, a service provider that charges sales tax for certain services will also need to file the R-1029. Each business scenario may involve different calculations and exemptions, highlighting the form's versatility in accommodating diverse business models within Louisiana.

Handy tips for filling out Sales Tax Filing Options Louisiana Department Of Revenue online

Quick steps to complete and e-sign Sales Tax Filing Options Louisiana Department Of Revenue online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Get access to a GDPR and HIPAA compliant service for maximum straightforwardness. Use signNow to e-sign and send Sales Tax Filing Options Louisiana Department Of Revenue for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax filing options louisiana department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the r 1029 sales tax form?

The r 1029 sales tax form is a document used by businesses in certain jurisdictions to report and remit sales tax. It provides a standardized way to calculate the amount of sales tax owed based on sales made during a specific period. Understanding this form is crucial for compliance with local tax regulations.

-

How can airSlate SignNow help with the r 1029 sales tax form?

airSlate SignNow simplifies the process of completing and submitting the r 1029 sales tax form by allowing users to eSign and send documents securely. Our platform ensures that your forms are filled out correctly and submitted on time, reducing the risk of errors and penalties. This makes tax season less stressful for businesses.

-

Is there a cost associated with using airSlate SignNow for the r 1029 sales tax form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the completion of the r 1029 sales tax form, including eSigning and document management. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the r 1029 sales tax form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the r 1029 sales tax form. These tools help ensure that your forms are accurate and submitted promptly. Additionally, our user-friendly interface makes it easy to navigate the process.

-

Can I integrate airSlate SignNow with other software for the r 1029 sales tax form?

Absolutely! airSlate SignNow offers integrations with various accounting and business management software, making it easier to manage the r 1029 sales tax form alongside your other financial documents. This seamless integration helps streamline your workflow and ensures that all your data is synchronized.

-

What are the benefits of using airSlate SignNow for the r 1029 sales tax form?

Using airSlate SignNow for the r 1029 sales tax form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and easy document sharing, which can save your business valuable time during tax season. Additionally, you can access your documents from anywhere, ensuring flexibility.

-

Is airSlate SignNow secure for handling the r 1029 sales tax form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your r 1029 sales tax form and other sensitive documents are protected. We use advanced encryption and secure storage solutions to safeguard your data. You can trust that your information is safe while using our platform.

Get more for Sales Tax Filing Options Louisiana Department Of Revenue

- Reference request for applicants to the public health ihs form

- Uk form capital gains

- Search marriage licenses indianamarriage recordsidph dphillinoisgovvital records obtaining certified copies of marriage form

- Nevada title form

- Particulars charge form

- Commissioner of revenue senior deputy commissioner bulletin form

- Severe pulmonary disease associated with e cigarette use form

- Ke kzkwkd ampamphe ke zk ddedz dsk e zhk form

Find out other Sales Tax Filing Options Louisiana Department Of Revenue

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document