Ready to File Your State Taxes? Here Are the Details Form

Understanding the Louisiana IT-540B Form

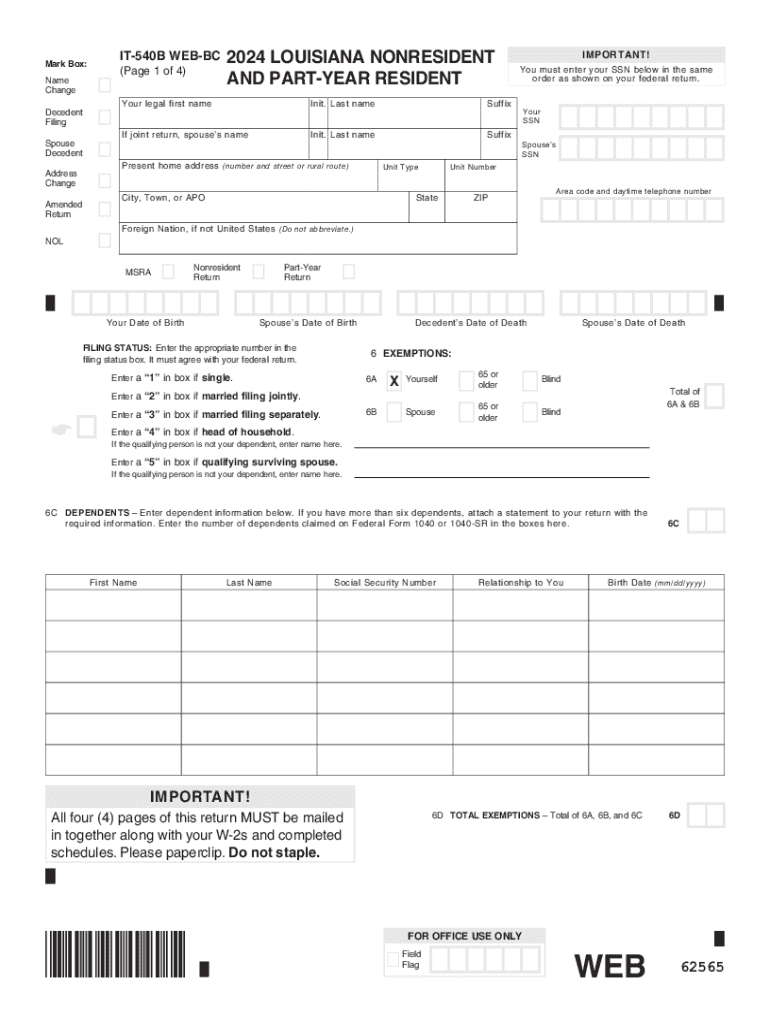

The Louisiana IT-540B form is specifically designed for non-residents and part-year residents to report their income earned within the state. This form is essential for individuals who have earned income in Louisiana but do not meet the criteria for full residency. It ensures that taxpayers fulfill their obligations while accurately reflecting their income sources. The IT-540B allows for the proper calculation of state taxes owed based on Louisiana income, which is crucial for compliance with state tax laws.

Steps to Complete the Louisiana IT-540B Form

Completing the Louisiana IT-540B form involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements.

- Determine your residency status for the tax year, identifying whether you are a non-resident or a part-year resident.

- Fill out the personal information section accurately, including your name, address, and Social Security number.

- Report your Louisiana-source income on the form, ensuring you only include income earned while residing or working in the state.

- Calculate your tax liability using the provided tax tables and instructions included with the form.

- Review the completed form for accuracy before submission.

Required Documents for Filing the IT-540B

When preparing to file the Louisiana IT-540B form, certain documents are essential to ensure accurate reporting:

- W-2 forms from employers that detail your earnings.

- 1099 forms for any freelance or contract work performed.

- Records of any other income earned in Louisiana, such as rental income or business profits.

- Documentation of any deductions or credits you plan to claim.

Filing Deadlines for the IT-540B Form

It is important to be aware of the filing deadlines for the Louisiana IT-540B form to avoid penalties:

- The standard deadline for filing is typically April fifteenth of the following year.

- If you are unable to meet this deadline, you may request an extension, which can provide additional time to file.

Submission Methods for the IT-540B Form

The Louisiana IT-540B form can be submitted through various methods, providing flexibility for taxpayers:

- Online submission through the Louisiana Department of Revenue's website, which is often the quickest method.

- Mailing a paper copy of the completed form to the appropriate address specified in the form instructions.

- In-person submission at designated tax offices, which may offer assistance with the filing process.

Penalties for Non-Compliance with the IT-540B

Failure to comply with the filing requirements for the Louisiana IT-540B can result in significant penalties:

- Late filing penalties may apply if the form is submitted after the deadline without an approved extension.

- Failure to pay any taxes owed can lead to additional interest charges and penalties.

- In severe cases, continued non-compliance may result in legal action by the state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ready to file your state taxes here are the details

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the louisiana it 540b and how does it relate to airSlate SignNow?

The louisiana it 540b is a specific tax form used by residents of Louisiana for filing their state income tax. airSlate SignNow provides an efficient way to eSign and send this form securely, ensuring that your tax documents are handled with ease and compliance.

-

How can airSlate SignNow help with completing the louisiana it 540b?

With airSlate SignNow, you can easily fill out the louisiana it 540b form online, add your electronic signature, and send it directly to the appropriate tax authorities. This streamlines the process, saving you time and reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for the louisiana it 540b?

airSlate SignNow offers various pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a cost-effective solution to manage your louisiana it 540b and other documents efficiently.

-

Are there any features specifically designed for the louisiana it 540b in airSlate SignNow?

Yes, airSlate SignNow includes features such as customizable templates and automated workflows that can be tailored for the louisiana it 540b. These features enhance the user experience and ensure that your tax documents are processed smoothly.

-

What benefits does airSlate SignNow provide for managing the louisiana it 540b?

Using airSlate SignNow for the louisiana it 540b offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can track the status of your documents in real-time, ensuring that your tax filings are submitted on time.

-

Can I integrate airSlate SignNow with other software for handling the louisiana it 540b?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your louisiana it 540b alongside your other business tools. This integration helps streamline your workflow and improves overall productivity.

-

Is airSlate SignNow compliant with Louisiana state regulations for the louisiana it 540b?

Yes, airSlate SignNow is designed to comply with all relevant state regulations, including those for the louisiana it 540b. This ensures that your electronic signatures and document submissions meet legal standards, providing peace of mind.

Get more for Ready To File Your State Taxes? Here Are The Details

- Wwwellenbrotmanlawcomattorney discipline faqsyou receive a phone call from the office of disciplinary form

- Campbellsville university transcript request form

- Gang stalking information archiveblogspotcomhttpsstatic1squarespacecomstatic

- Wwwpdffillercom502941143 cegat order form2019 cegat order form germline tumor syndromes fill online

- Wwwusbirthcertificatescomarticleswhatwhat information is on a birth certificate us birth

- Cosmmdexhibitor infoexhibit information cosm

- Fillable online new patient registration form todays date

- Employer application 51 illinois form

Find out other Ready To File Your State Taxes? Here Are The Details

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe