Form it 637 Alternative Fuels and Electric Vehicle Recharging Property Credit Tax Year

Understanding the IT 637 Form for Alternative Fuels and Electric Vehicle Recharging Property Credit

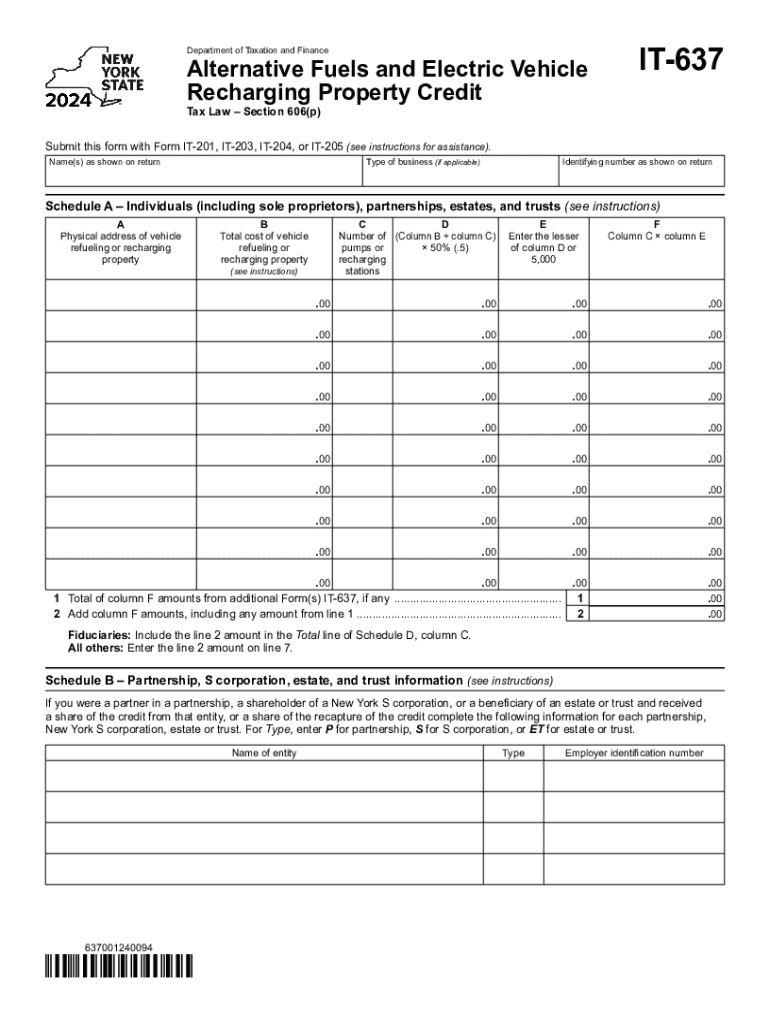

The IT 637 form is designed for taxpayers in New York who wish to claim a credit for investments made in alternative fuels and electric vehicle recharging property. This form allows individuals and businesses to receive tax benefits for adopting environmentally friendly technologies. The credit is applicable for property placed in service during the tax year and is intended to encourage the use of cleaner energy sources in the state.

Steps to Complete the IT 637 Form

Filling out the IT 637 form requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including receipts for purchases related to alternative fuels and electric vehicle charging stations.

- Complete the identification section, providing your name, address, and taxpayer identification number.

- Detail the property for which you are claiming the credit, including the type of property and the date it was placed in service.

- Calculate the credit amount based on the eligible expenses incurred during the tax year.

- Review the completed form for accuracy and completeness before submission.

Eligibility Criteria for the IT 637 Form

To qualify for the credit claimed through the IT 637 form, taxpayers must meet specific eligibility criteria. The property must be used for alternative fuels or electric vehicle recharging and must be located in New York State. Additionally, the taxpayer must have incurred eligible expenses during the tax year for the property being claimed. It is important to ensure that the property meets all state regulations regarding alternative energy use.

Required Documents for Filing the IT 637 Form

When filing the IT 637 form, certain documents are necessary to support your claim. These include:

- Invoices or receipts for the purchase of alternative fuels or electric vehicle charging equipment.

- Proof of installation, such as contracts or service agreements.

- Any additional documentation that demonstrates the property's eligibility for the credit.

Filing Deadlines for the IT 637 Form

It is crucial to be aware of the filing deadlines for the IT 637 form. Typically, the form must be submitted by the due date of your tax return for the year in which the property was placed in service. If you are filing for a prior tax year, ensure that you adhere to any applicable deadlines for amended returns. Keeping track of these dates helps prevent any potential penalties or missed opportunities for tax credits.

Submission Methods for the IT 637 Form

The IT 637 form can be submitted through various methods, depending on your preference. Taxpayers may choose to file electronically using approved tax software, which often streamlines the process and reduces errors. Alternatively, the form can be printed and mailed to the appropriate tax authority. Ensure that you keep a copy of the submitted form and any supporting documents for your records.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 637 alternative fuels and electric vehicle recharging property credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 637 form and why is it important?

The IT 637 form is a tax form used for claiming certain tax credits in New York State. It is important because it helps businesses and individuals maximize their tax benefits, ensuring compliance with state regulations while potentially reducing their tax liability.

-

How can airSlate SignNow help with the IT 637 form?

airSlate SignNow streamlines the process of completing and submitting the IT 637 form by providing an easy-to-use platform for eSigning and document management. This ensures that your forms are filled out accurately and submitted on time, reducing the risk of errors and delays.

-

Is there a cost associated with using airSlate SignNow for the IT 637 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that simplify the completion and submission of the IT 637 form, making it a cost-effective solution for managing your documents.

-

What features does airSlate SignNow offer for managing the IT 637 form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the IT 637 form. These features ensure that your documents are organized, easily accessible, and compliant with legal standards.

-

Can I integrate airSlate SignNow with other software for the IT 637 form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow when handling the IT 637 form. This integration helps you connect your existing tools, making document management more efficient.

-

What are the benefits of using airSlate SignNow for the IT 637 form?

Using airSlate SignNow for the IT 637 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing your document processes, you can save time and ensure that your sensitive information is protected.

-

How secure is airSlate SignNow when handling the IT 637 form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data when handling the IT 637 form. This ensures that your information remains confidential and secure throughout the signing and submission process.

Get more for Form IT 637 Alternative Fuels And Electric Vehicle Recharging Property Credit Tax Year

- Sale firearm form

- Confidentiality and nondisclosure agreement evaluation materials form

- Release of liability personal injury waiver of claims assumption of risk and indemnity agreement with regard to mountain biking form

- Consent to release of employment information and release

- Caregiver form application

- Release financial form

- Bill sale motorcycle form

- Sample complimentary hotel form

Find out other Form IT 637 Alternative Fuels And Electric Vehicle Recharging Property Credit Tax Year

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template