Rhode Island Announces New Estate Tax Forms and Filing

Understanding the Rhode Island 1041 Form

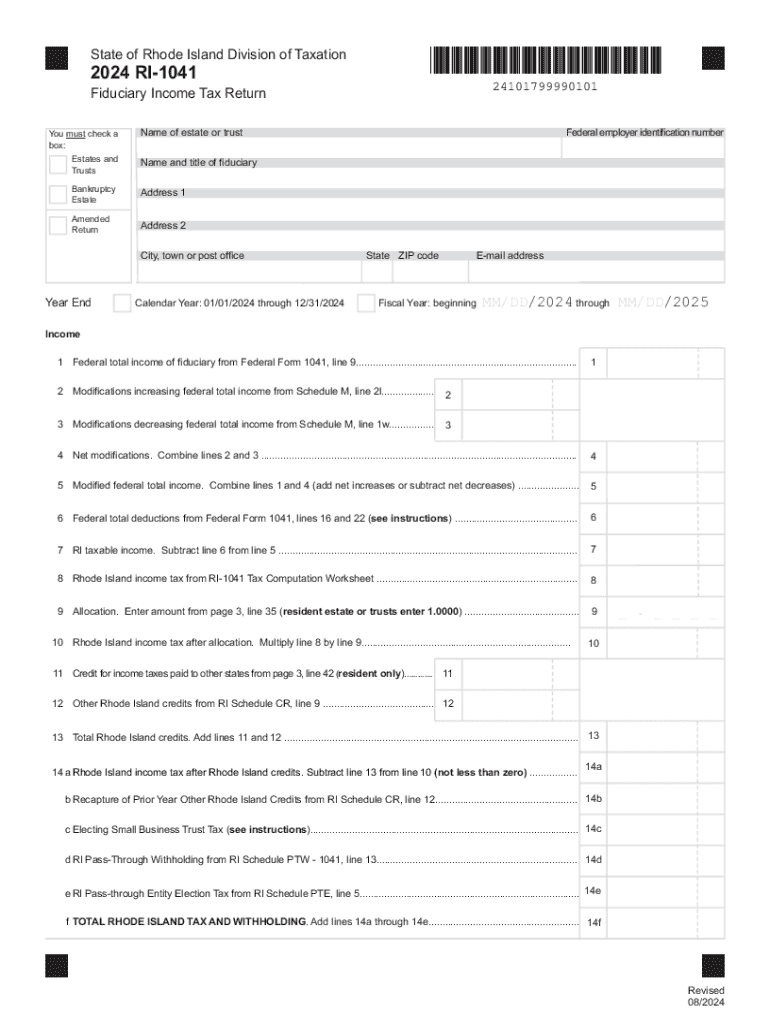

The Rhode Island 1041 form, also known as the RI 1041, is a tax document used by fiduciaries to report income, deductions, and credits for estates and trusts. This form is essential for ensuring compliance with state tax laws. It is crucial for fiduciaries to accurately complete this form to reflect the financial activities of the estate or trust during the tax year. The form captures various financial details, including income generated by the estate, distributions to beneficiaries, and any applicable deductions.

Steps to Complete the Rhode Island 1041 Form

Completing the RI 1041 form involves several key steps:

- Gather necessary financial documents related to the estate or trust.

- Report all income received by the estate or trust during the tax year.

- Include any deductions that the estate or trust is eligible for, such as administrative expenses or distributions to beneficiaries.

- Ensure that all calculations are accurate and that the form is filled out completely.

- Sign and date the form before submission.

Filing Deadlines for the Rhode Island 1041 Form

The filing deadline for the Rhode Island 1041 form typically aligns with the federal tax return deadlines. Generally, fiduciaries must file the form by the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April 15. It is important to keep track of these deadlines to avoid penalties.

Required Documents for Filing the Rhode Island 1041 Form

To successfully file the RI 1041 form, fiduciaries must collect several key documents:

- Financial statements for the estate or trust, including bank statements and investment income.

- Records of any distributions made to beneficiaries.

- Documentation of any deductions claimed, such as receipts for administrative expenses.

- Previous tax returns, if applicable, to ensure consistency in reporting.

Who Issues the Rhode Island 1041 Form

The Rhode Island Division of Taxation is responsible for issuing the 1041 form. This state agency oversees the collection of taxes and ensures compliance with state tax laws. Fiduciaries can obtain the form directly from the Division of Taxation's website or through authorized tax professionals.

Legal Use of the Rhode Island 1041 Form

The RI 1041 form must be used in accordance with Rhode Island tax laws. It is legally required for fiduciaries managing estates and trusts to report income accurately. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is essential for fiduciaries to understand their legal obligations when completing this form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rhode island announces new estate tax forms and filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ri 1041 search feature in airSlate SignNow?

The ri 1041 search feature in airSlate SignNow allows users to quickly locate and manage their documents related to the RI 1041 tax form. This functionality streamlines the process of finding essential documents, ensuring that users can efficiently handle their tax-related paperwork.

-

How does airSlate SignNow support the ri 1041 search process?

airSlate SignNow enhances the ri 1041 search process by providing advanced search capabilities and organized document storage. Users can easily filter and search for specific documents, making it simpler to access the information they need for tax preparation and filing.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for individuals and teams. Each plan provides access to features that enhance the ri 1041 search experience, ensuring that users can find and manage their documents efficiently.

-

Can I integrate airSlate SignNow with other applications for better ri 1041 search?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing the ri 1041 search process. By connecting with tools like Google Drive and Dropbox, users can easily access and manage their documents, making tax preparation more efficient.

-

What benefits does airSlate SignNow provide for managing RI 1041 documents?

Using airSlate SignNow for managing RI 1041 documents offers numerous benefits, including improved organization and faster access to important files. The platform's user-friendly interface simplifies the ri 1041 search process, allowing users to focus on completing their tax filings accurately and on time.

-

Is airSlate SignNow secure for handling sensitive RI 1041 documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive RI 1041 documents. Users can confidently manage their tax-related paperwork, knowing that their information is safe and secure.

-

How can I get started with airSlate SignNow for my RI 1041 needs?

Getting started with airSlate SignNow for your RI 1041 needs is easy. Simply sign up for an account, explore the features designed to enhance the ri 1041 search process, and begin uploading your documents. Our user-friendly platform will guide you through the setup.

Get more for Rhode Island Announces New Estate Tax Forms And Filing

- Commercial bank guarantee application form

- Employee behavior documentation template form

- Insurance research request form reimbursement solutions

- Parent empowerment and efficacy measure form

- Medical certificate template nsw form

- Marquette method pdf form

- Fantastic lifestyle checklist form

- Steps to completing your community form

Find out other Rhode Island Announces New Estate Tax Forms And Filing

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later