Form 590 P Nonresident Withholding Exemption Certificate for Previously Reported Income

Understanding the Form 590 P Nonresident Withholding Exemption Certificate

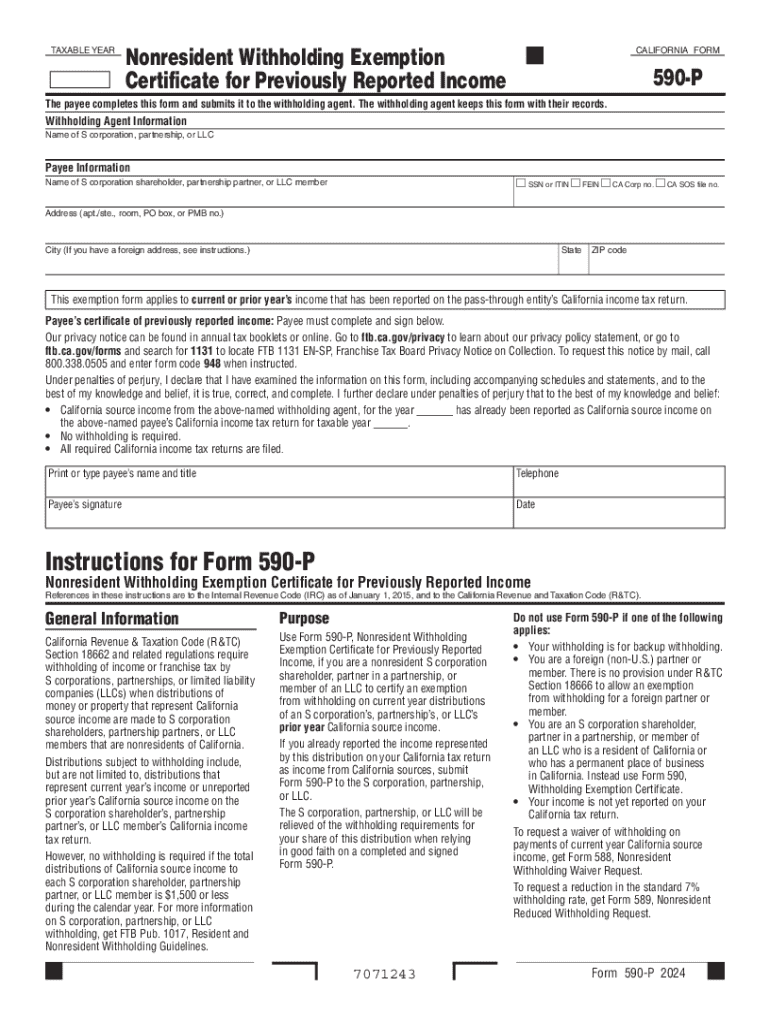

The Form 590 P is a crucial document for nonresidents in the United States seeking to claim an exemption from withholding on income that has already been reported. This form is specifically designed for nonresidents who have received income from California sources and wish to avoid unnecessary withholding on that income. By submitting this certificate, individuals can ensure that they are not overtaxed on funds that have already been reported to the state.

Steps to Complete the Form 590 P

Completing the Form 590 P involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your name, address, and taxpayer identification number. Next, provide details about the income for which you are claiming the exemption. It is important to clearly indicate the type of income and the amount that has already been reported. Finally, sign and date the form to certify that the information provided is correct. Ensure that you keep a copy for your records.

Eligibility Criteria for the Form 590 P

To qualify for the Form 590 P, you must meet specific eligibility criteria. Primarily, this form is intended for nonresidents who have received income from California sources. Additionally, the income must have been previously reported to the California Franchise Tax Board. It is essential to ensure that you are not subject to other withholding requirements that may apply to your situation. Review the guidelines carefully to confirm your eligibility before submitting the form.

Key Elements of the Form 590 P

The Form 590 P includes several key elements that must be accurately completed. These elements consist of personal identification information, details about the income being reported, and the specific exemption being claimed. Additionally, the form requires a declaration that the information provided is true and correct. Understanding these components is vital for ensuring that your submission is processed without delays or complications.

How to Obtain the Form 590 P

The Form 590 P can be obtained through the California Franchise Tax Board's official website. It is available for download in a printable format, allowing you to fill it out at your convenience. Alternatively, you may request a physical copy through mail if you prefer a hard copy. Ensure you have the most current version of the form to avoid any issues during submission.

Filing Deadlines for the Form 590 P

It is important to be aware of the filing deadlines associated with the Form 590 P. Typically, the form should be submitted prior to the date when the income is paid to you or reported to the tax authorities. This timing is critical to ensure that withholding does not occur unnecessarily. Check the California Franchise Tax Board's guidelines for specific dates and any updates that may affect your filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 590 p nonresident withholding exemption certificate for previously reported income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 590 p and how can airSlate SignNow help?

Form 590 p is a California tax form used for reporting withholding exemptions. airSlate SignNow simplifies the process of completing and eSigning form 590 p, ensuring that your documents are securely managed and easily accessible.

-

How much does it cost to use airSlate SignNow for form 590 p?

airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that fits your budget while ensuring you can efficiently manage and eSign form 590 p and other important documents.

-

What features does airSlate SignNow provide for managing form 590 p?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for forms like form 590 p. These features streamline the process, making it easier to manage your tax documentation.

-

Can I integrate airSlate SignNow with other applications for form 590 p?

Yes, airSlate SignNow offers integrations with various applications, allowing you to seamlessly manage form 590 p alongside your other business tools. This enhances productivity and ensures that your workflow remains efficient.

-

What are the benefits of using airSlate SignNow for form 590 p?

Using airSlate SignNow for form 590 p provides numerous benefits, including time savings, enhanced security, and improved accuracy. The platform ensures that your documents are handled efficiently, reducing the risk of errors in your tax submissions.

-

Is airSlate SignNow user-friendly for completing form 590 p?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete and eSign form 590 p. The intuitive interface allows users to navigate the platform effortlessly, regardless of their technical skills.

-

How does airSlate SignNow ensure the security of my form 590 p documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your form 590 p documents. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income

Find out other Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself