Microsoft Word Tc208 1213 Form

Understanding Form TC208

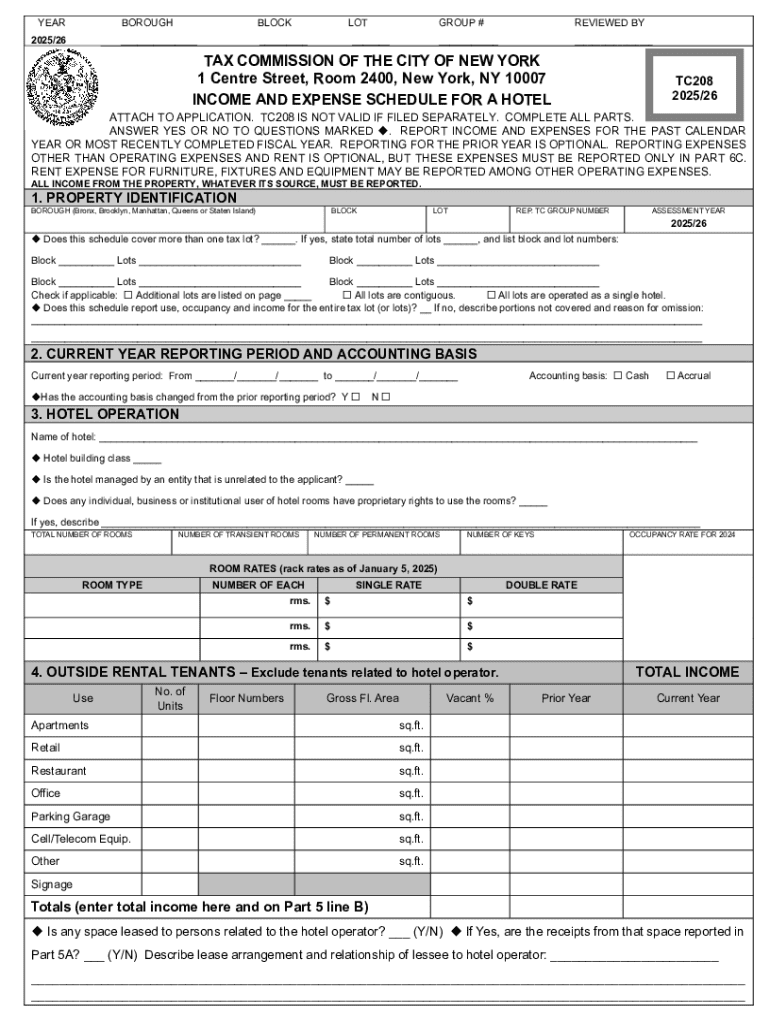

Form TC208, also known as the New York State Income and Expense Schedule, is primarily used by hotel operators in New York to report income and expenses related to their business operations. This form is essential for compliance with state tax regulations and helps ensure accurate reporting of financial information to the New York Tax Commission.

Steps to Complete Form TC208

Completing Form TC208 involves several key steps:

- Gather all necessary financial documents, including income statements and expense receipts related to hotel operations.

- Fill in the required sections, detailing income sources such as room rentals and additional services offered.

- Document all relevant expenses, including utilities, maintenance, and employee wages.

- Review the completed form for accuracy, ensuring all figures are correctly calculated and documented.

- Submit the form by the designated deadline to avoid penalties.

Required Documents for Form TC208

To successfully complete Form TC208, you will need to provide various supporting documents:

- Income statements that detail revenue generated from hotel operations.

- Expense receipts for all operational costs, including maintenance, utilities, and employee salaries.

- Any additional documentation that supports claims made on the form, such as contracts or service agreements.

Legal Use of Form TC208

Form TC208 must be used in accordance with New York State tax laws. It is a legal requirement for hotel operators to accurately report their income and expenses to ensure compliance with state regulations. Failure to submit this form or providing false information can lead to penalties or legal repercussions.

Filing Deadlines for Form TC208

Timely submission of Form TC208 is crucial. The filing deadlines are typically aligned with the annual tax return deadlines for businesses in New York. It is important to check the New York Tax Commission's official calendar for specific dates to ensure compliance and avoid any late fees.

Form Submission Methods

Form TC208 can be submitted through various methods, including:

- Online submission via the New York Tax Commission's electronic filing system.

- Mailing a printed version of the form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Penalties for Non-Compliance

Failure to file Form TC208 or inaccuracies in the information provided can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by the New York Tax Commission. It is essential for hotel operators to adhere strictly to the filing requirements to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the microsoft word tc208 1213

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form tc208 and how can it benefit my business?

The form tc208 is a crucial document for various business processes, allowing for efficient data collection and management. By utilizing airSlate SignNow, you can easily create, send, and eSign the form tc208, streamlining your workflow and enhancing productivity.

-

How much does it cost to use airSlate SignNow for the form tc208?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring you have all the necessary features to manage the form tc208 effectively.

-

Can I integrate the form tc208 with other applications?

Yes, airSlate SignNow allows seamless integration with various applications, making it easy to manage the form tc208 alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are easily accessible.

-

What features does airSlate SignNow offer for managing the form tc208?

airSlate SignNow provides a range of features for managing the form tc208, including customizable templates, automated workflows, and secure eSigning options. These features help you streamline the document process and ensure compliance.

-

Is it easy to eSign the form tc208 using airSlate SignNow?

Absolutely! airSlate SignNow offers a user-friendly interface that makes eSigning the form tc208 quick and straightforward. Users can sign documents from any device, ensuring convenience and efficiency.

-

What are the security measures in place for the form tc208?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your form tc208 and other documents. This ensures that your sensitive information remains safe and secure throughout the signing process.

-

Can I track the status of the form tc208 once it's sent?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of the form tc208 after it has been sent. You will receive notifications when the document is viewed, signed, or completed, keeping you informed throughout the process.

Get more for Microsoft Word Tc208 1213

- Thinking report examples form

- Police lansing form

- Eqp1735 public swimming pool inspection report form

- Oath of office michigan townships association form

- Standard loan contract template form

- Standard for service contract template form

- Standard occupation contract template form

- Standard model contract template form

Find out other Microsoft Word Tc208 1213

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple