Form it 370 Application for Automatic Six Month Extension of Time to File for Individuals Tax Year

Understanding the Form IT 370 for Tax Extensions

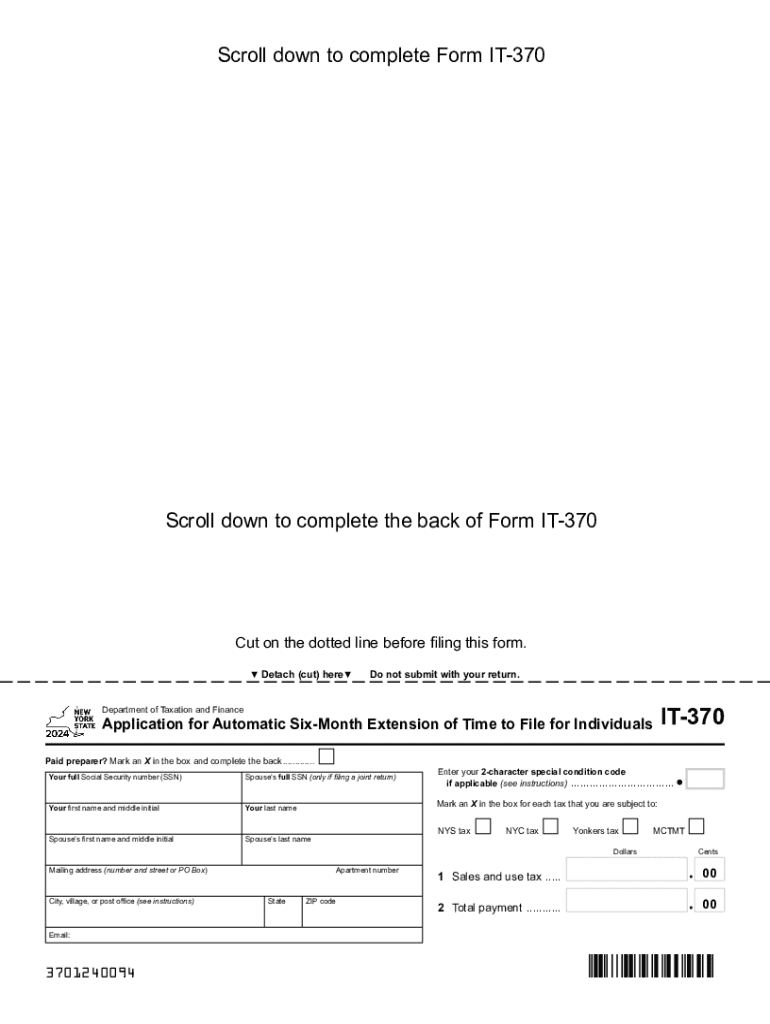

The NYS income tax extension form IT 370 is an application for an automatic six-month extension of time to file individual income tax returns. This form allows taxpayers to extend their filing deadline without incurring penalties, provided they pay any due taxes by the original due date. The extension applies to personal income tax returns, ensuring individuals have additional time to prepare their filings accurately.

Steps to Complete the Form IT 370

Completing the IT 370 form involves several straightforward steps:

- Download the form from the New York State Department of Taxation and Finance website or obtain it through authorized channels.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your estimated tax liability for the year to ensure proper processing.

- Sign and date the form to validate your application.

Once completed, submit the form to the appropriate address provided in the instructions. Ensure you file it before the original tax deadline to avoid penalties.

Eligibility Criteria for Form IT 370

To qualify for an extension using the IT 370 form, you must meet specific criteria. This includes being an individual taxpayer who is required to file a New York State personal income tax return. Additionally, you should have a valid reason for needing the extension, such as unforeseen circumstances that hinder timely filing. It's important to note that this extension does not apply to any taxes owed; you must still pay estimated taxes by the original due date to avoid interest and penalties.

Important Filing Deadlines

The filing deadline for the IT 370 form typically coincides with the original due date for personal income tax returns, which is usually April fifteenth. If this date falls on a weekend or holiday, the deadline may be adjusted. Filing the IT 370 form on or before this date is crucial for securing your extension. Remember, while the extension allows more time to file, it does not extend the time to pay any taxes owed.

Form Submission Methods

You can submit the IT 370 form through various methods. The most common options include:

- Online submission via the New York State Department of Taxation and Finance portal, if available.

- Mailing the completed form to the designated address for tax extensions.

- In-person submission at local tax offices, where applicable.

Choose the method that best suits your needs, ensuring that you allow enough time for processing before the deadline.

Key Elements of the IT 370 Form

The IT 370 form contains several key elements that are essential for proper completion:

- Personal identification information, including name and Social Security number.

- Estimated tax liability for the year, which helps the tax department assess your situation.

- Signature and date, confirming your request for an extension.

Each of these components plays a vital role in the processing of your extension request, so accuracy is important.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 370 application for automatic six month extension of time to file for individuals tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYS income tax extension form IT 370?

The NYS income tax extension form IT 370 is a document that allows taxpayers in New York State to request an extension for filing their income tax returns. By submitting this form, you can extend your filing deadline, giving you additional time to prepare your taxes without incurring penalties.

-

How can airSlate SignNow help with the NYS income tax extension form IT 370?

airSlate SignNow simplifies the process of completing and submitting the NYS income tax extension form IT 370. With our platform, you can easily fill out the form electronically, eSign it, and send it directly to the appropriate tax authorities, ensuring a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the NYS income tax extension form IT 370?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our cost-effective solutions ensure that you can manage your documents, including the NYS income tax extension form IT 370, without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for managing the NYS income tax extension form IT 370?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the NYS income tax extension form IT 370. These tools enhance your efficiency and ensure that your tax documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for filing the NYS income tax extension form IT 370?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easy to manage your NYS income tax extension form IT 370 alongside your other financial documents. This seamless integration helps streamline your workflow.

-

What are the benefits of using airSlate SignNow for the NYS income tax extension form IT 370?

Using airSlate SignNow for the NYS income tax extension form IT 370 provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are processed quickly and safely, allowing you to focus on other important tasks.

-

How secure is airSlate SignNow when handling the NYS income tax extension form IT 370?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your data while handling the NYS income tax extension form IT 370. You can trust that your sensitive information is safe with us.

Get more for Form IT 370 Application For Automatic Six Month Extension Of Time To File For Individuals Tax Year

- Pet license renewal morristown new jersey form

- Microblading lips amp eyeliner form

- Burlington county custodian of records co burlington nj form

- 101812 readington township code enforcement appl form

- Age birthdate sex ss form

- Pupil registration form fonddulac k12 wi

- U s senator tammy baldwin service academy nomination form

- City of gainesville public utilities department residential application gainesville form

Find out other Form IT 370 Application For Automatic Six Month Extension Of Time To File For Individuals Tax Year

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple