Form it 201 Resident Income Tax Return Tax Year

What is the Form IT 201 Resident Income Tax Return Tax Year

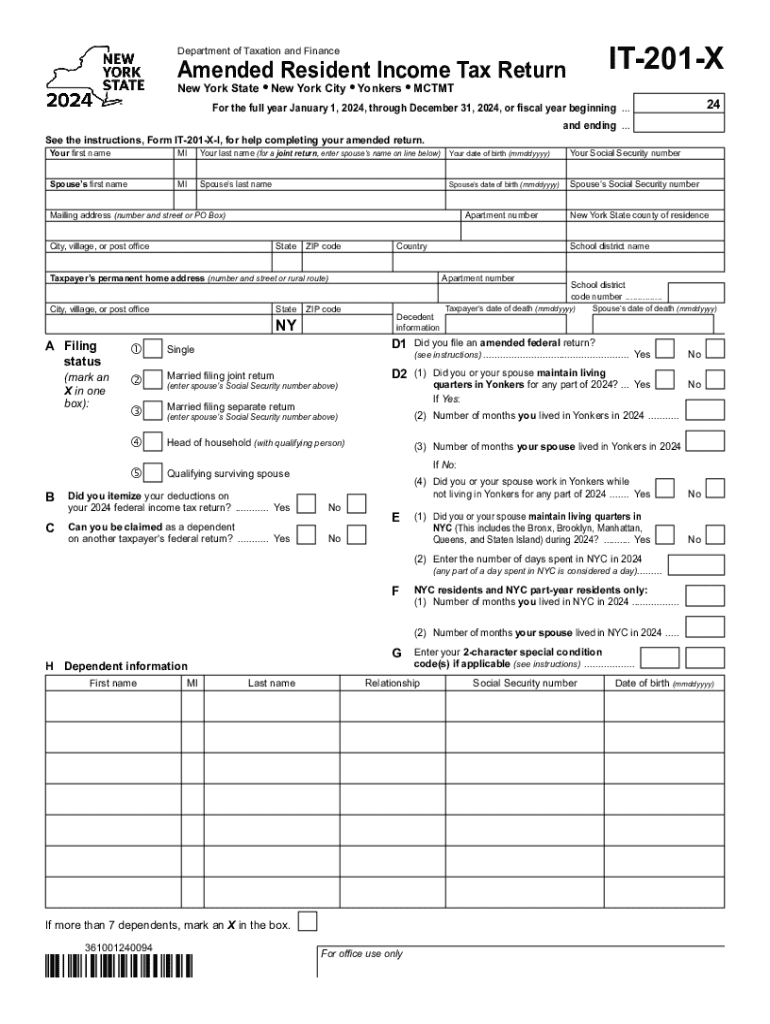

The Form IT 201 is the Resident Income Tax Return used by individuals in New York State to report their annual income and calculate their state tax liability. This form is essential for residents who earn income within New York and need to comply with state tax regulations. It is specifically designed for the tax year, which typically runs from January first to December thirty-first. Understanding the purpose and requirements of this form is crucial for accurate tax reporting.

Steps to complete the Form IT 201 Resident Income Tax Return Tax Year

Completing the Form IT 201 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income from all sources.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the income reported.

- Determine if you owe additional taxes or are due a refund.

- Sign and date the form before submission.

Each section of the form is designed to guide you through the process, ensuring that you provide all necessary information for accurate tax assessment.

How to obtain the Form IT 201 Resident Income Tax Return Tax Year

The Form IT 201 can be easily obtained through various methods. It is available for download on the New York State Department of Taxation and Finance website. Additionally, you can request a physical copy by contacting the department directly. Many tax preparation offices also provide this form as part of their services, ensuring you have access to the necessary documents for filing your taxes.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form IT 201. Typically, the deadline for submitting your New York State income tax return is April fifteenth of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, if you need more time to file, you can request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Key elements of the Form IT 201 Resident Income Tax Return Tax Year

The Form IT 201 includes several key elements that are essential for accurately reporting income and calculating taxes. These elements include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Total income from various sources.

- Deductions and Credits: Applicable deductions that reduce taxable income.

- Tax Calculation: Total tax liability based on reported income.

- Signature: Required to validate the form.

Understanding these elements helps ensure that all necessary information is provided, reducing the risk of errors during the filing process.

Legal use of the Form IT 201 Resident Income Tax Return Tax Year

The Form IT 201 is legally required for New York State residents who earn income. Filing this form accurately is essential to comply with state tax laws. Failure to file or inaccuracies in the information provided can lead to penalties, including fines and interest on unpaid taxes. It is important to ensure that the form is filled out correctly and submitted by the deadline to maintain compliance with legal obligations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 201 resident income tax return tax year 772083194

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 201 NYS tax form?

What is the New York State Tax Form 201? The State Tax Form 201, also known as IT-201, is the standard income tax return form for New York State residents. This form is used to report income, calculate tax liability, and claim credits or deductions. Think of it as the New York equivalent of the federal Form 1040.

-

What are the NY state tax tiers?

New York state income tax rates Tax rateSingle; married filing separatelyMarried filing jointly; surviving spouse 4.5% $8,501 to $11,700. $17,151 to $23,600. 5.25% $11,701 to $13,900. $23,601 to $27,900. 5.5% $13,901 to $80,650. $27,901 to $161,550. 6% $80,651 to $215,400. $161,551 to $323,200.6 more rows • 5 days ago

-

What is NY tax form 203?

To determine how much tax you owe, use Form IT-203, Nonresident and Part‑Year Resident Income Tax Return. You will calculate a base tax as if you were a full-year resident, then determine the percentage of your income that is subject to New York State tax and the amount of tax apportioned to New York State.

-

Is it 203 or 201 for NY state tax return?

New York Form IT – 201 – Personal Income Tax Return for Residents. New York Form IT – 201ATT – Other Tax Credits and Taxes – Pg 1. New York Form IT – 203 – Personal Income Tax Return for Nonresidents and Part-Year Residents.

-

Who qualifies for the New York City school tax credit?

The New York City School Tax credit is available to New York City residents or part-year residents who cannot be claimed as a dependent on another taxpayer's federal income tax return. The credit amounts vary. This credit must be claimed directly on the New York State personal income tax return.

-

Do I have to file a NY state tax return for nonresident?

ing to Form IT-203-I, you must file a New York part-year or nonresident return if: You have any income from a New York source and your New York AGI exceeds your New York State standard deduction. You want to claim a refund for any New York State, New York City, or Yonkers taxes that were withheld from your pay.

-

What is the difference between NYS IT-201 and 203?

If one of you was a New York State resident and the other was a nonresident or part-year resident, you must each file a separate New York return. The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203.

-

What is the residency rule for New York State tax?

You are a New York State resident if your domicile is New York State OR: you maintain a permanent place of abode in New York State for substantially all of the taxable year; and. you spend 184 days or more in New York State during the taxable year.

Get more for Form IT 201 Resident Income Tax Return Tax Year

- Notice of entry of judgment and decree of divorce south dakota form

- Commercial sublease south dakota form

- Residential lease renewal agreement south dakota form

- Notice to lessor exercising option to purchase south dakota form

- Assignment of lease and rent from borrower to lender south dakota form

- Assignment of lease from lessor with notice of assignment south dakota form

- Letter from landlord to tenant as notice of abandoned personal property south dakota form

- Guaranty or guarantee of payment of rent south dakota form

Find out other Form IT 201 Resident Income Tax Return Tax Year

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy