Visit MyconneCT at Portal Form

What is the CT 941 Form?

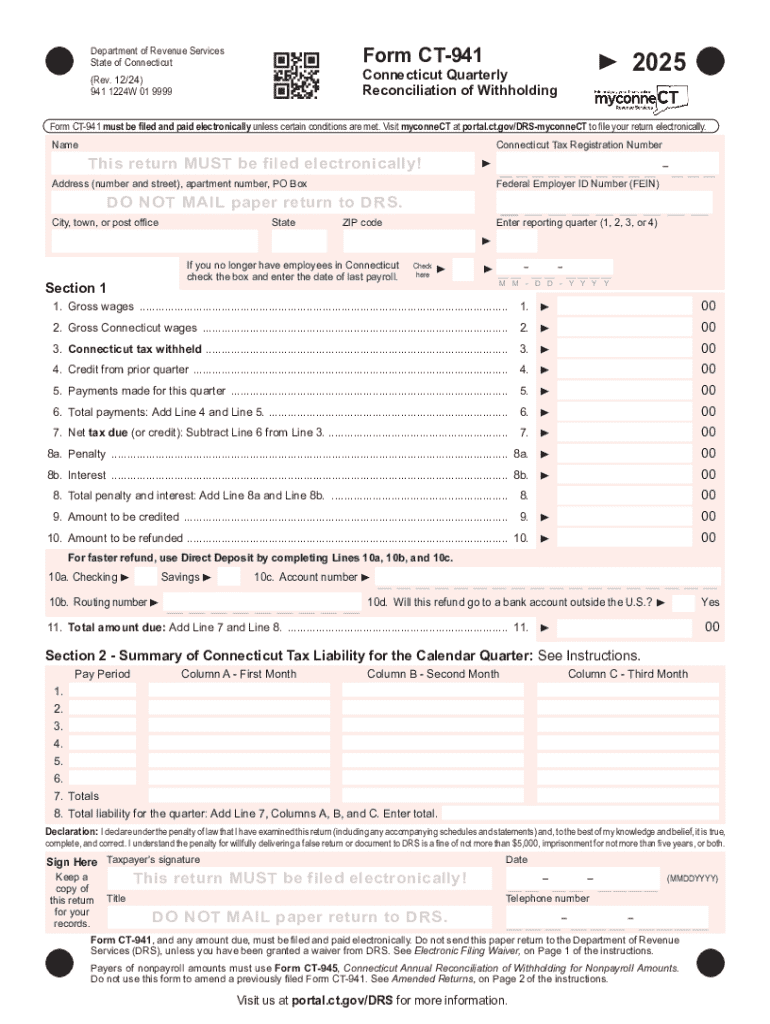

The CT 941 form, also known as the Connecticut Quarterly Reconciliation of Withholding, is a state tax form used by employers in Connecticut. This form is essential for reporting the amount of income tax withheld from employees' wages during a quarter. It helps ensure that the state receives the correct amount of withholding tax, which is crucial for maintaining compliance with Connecticut tax laws.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for submitting the CT 941 form. The form is due on the last day of the month following the end of each quarter. For example, the deadlines for the 2025 CT 941 form are as follows:

- First Quarter (January - March): Due April 30

- Second Quarter (April - June): Due July 31

- Third Quarter (July - September): Due October 31

- Fourth Quarter (October - December): Due January 31 of the following year

Steps to Complete the CT 941 Form

Completing the CT 941 form involves several key steps:

- Gather all necessary payroll records for the quarter, including total wages paid and taxes withheld.

- Fill in the employer information section, including your business name, address, and federal employer identification number (FEIN).

- Report the total wages paid to employees and the total Connecticut income tax withheld.

- Calculate any adjustments or credits that apply to your business.

- Review the form for accuracy before submission.

Form Submission Methods

The CT 941 form can be submitted in several ways to accommodate different preferences:

- Online: Employers can file the form electronically through the Connecticut Department of Revenue Services website.

- Mail: The form can also be printed and mailed to the appropriate address provided by the state.

- In-Person: Employers may choose to deliver the form in person at designated state offices.

Penalties for Non-Compliance

Failure to file the CT 941 form on time can result in penalties. Employers may face fines based on the amount of tax owed and the length of the delay. Additionally, interest may accrue on any unpaid taxes, increasing the total amount due. It is essential for businesses to adhere to filing deadlines to avoid these financial consequences.

Who Issues the Form

The CT 941 form is issued by the Connecticut Department of Revenue Services. This state agency is responsible for overseeing tax compliance and ensuring that employers fulfill their withholding obligations. Employers can find the form and related instructions on the department's official website.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the visit myconnect at portal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 941 and how does it relate to airSlate SignNow?

CT 941 is a form used for reporting payroll taxes in Connecticut. airSlate SignNow simplifies the process of signing and submitting CT 941 forms electronically, ensuring compliance and efficiency for businesses.

-

How much does airSlate SignNow cost for managing CT 941 forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while efficiently managing your CT 941 forms and other document workflows.

-

What features does airSlate SignNow provide for CT 941 document management?

airSlate SignNow includes features like eSignature, document templates, and secure cloud storage, all of which enhance the management of CT 941 forms. These features streamline the signing process and ensure your documents are easily accessible.

-

Can I integrate airSlate SignNow with other software for CT 941 processing?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to streamline your CT 941 processing. This ensures that your workflow remains efficient and connected with your existing tools.

-

What are the benefits of using airSlate SignNow for CT 941 submissions?

Using airSlate SignNow for CT 941 submissions provides numerous benefits, including faster processing times and reduced paperwork. The platform's user-friendly interface makes it easy for businesses to manage their tax forms efficiently.

-

Is airSlate SignNow secure for handling sensitive CT 941 information?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive information, including CT 941 data. Your documents are encrypted and stored securely, ensuring compliance with data protection regulations.

-

How can airSlate SignNow help with compliance for CT 941 forms?

airSlate SignNow helps ensure compliance with CT 941 requirements by providing templates and reminders for deadlines. This reduces the risk of errors and ensures that your submissions are timely and accurate.

Get more for Visit MyconneCT At Portal

- San diego ca 92101 form

- Lbr 7016 1a2 form

- Reporting forms california state controller ca gov

- Petition for clemency form

- Certification of military exemption from jury service form

- Maryland statement of charges form fill online printable

- Complaint and summons against tenant in breach of lease mdcourts gov form

- Receipt and waiver of mechanics39 lien rights triad builders form

Find out other Visit MyconneCT At Portal

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template