CT CT W4P Fill Out Tax Template Online Form

Understanding the CT W-4P Form

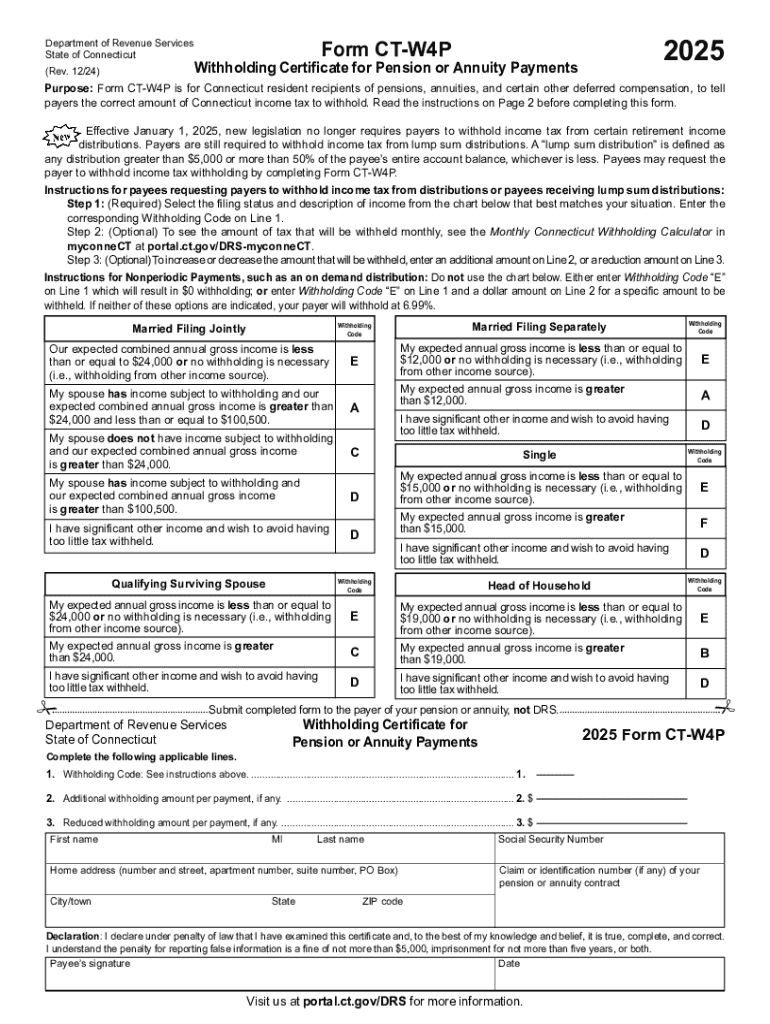

The 2025 CT withholding form, also known as the CT W-4P, is a crucial document for individuals receiving pension or annuity payments in Connecticut. This form allows recipients to specify the amount of state income tax to withhold from their payments. Understanding its purpose is essential for accurate tax planning and compliance with state regulations.

Steps to Complete the CT W-4P Form

Filling out the CT W-4P form involves several straightforward steps:

- Personal Information: Begin by providing your name, address, and Social Security number at the top of the form.

- Withholding Allowances: Indicate the number of allowances you wish to claim. This will affect the amount of tax withheld from your payments.

- Additional Withholding: If you want an additional amount withheld, specify that amount in the designated section.

- Signature and Date: Finally, sign and date the form to validate your information.

Legal Use of the CT W-4P Form

The CT W-4P form is legally required for Connecticut residents receiving pension or annuity payments. By submitting this form, you ensure that the correct amount of state income tax is withheld, helping you avoid underpayment penalties. It is important to keep the information updated, especially if your personal circumstances change, such as a change in marital status or income level.

Filing Deadlines and Important Dates

Understanding the deadlines for submitting the CT W-4P form is essential for compliance. Generally, the form should be submitted to your pension provider before the first payment is made. If you need to make changes to your withholding, it is advisable to submit the updated form as soon as possible to ensure the correct withholding amount is applied in subsequent payments.

Form Submission Methods

The CT W-4P form can be submitted in several ways, depending on your pension provider's preferences:

- Online Submission: Many pension providers offer online portals where you can upload your completed form.

- Mail: You can print the completed form and send it via postal mail to your pension provider.

- In-Person: Some individuals may prefer to deliver the form in person, especially if they have questions or need assistance.

Key Elements of the CT W-4P Form

When completing the CT W-4P form, several key elements must be considered:

- Allowances: The number of allowances you claim directly affects your withholding amount.

- Additional Withholding: You can specify an extra amount to be withheld if you anticipate owing more taxes.

- Accuracy: Ensure all personal information is accurate to avoid issues with your pension payments.

Handy tips for filling out CT CT W4P Fill Out Tax Template Online online

Quick steps to complete and e-sign CT CT W4P Fill Out Tax Template Online online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Get access to a GDPR and HIPAA compliant platform for optimum simpleness. Use signNow to electronically sign and send out CT CT W4P Fill Out Tax Template Online for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct ct w4p fill out tax template online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2025 ct withholding form?

The 2025 ct withholding form is a document used by employers in Connecticut to report and withhold state income taxes from employee wages. It is essential for ensuring compliance with state tax regulations. Understanding this form is crucial for businesses to avoid penalties and ensure accurate tax reporting.

-

How can airSlate SignNow help with the 2025 ct withholding form?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign the 2025 ct withholding form. Our solution simplifies the process, ensuring that all necessary signatures are obtained quickly and securely. This streamlines your payroll process and helps maintain compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the 2025 ct withholding form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our cost-effective solutions ensure that you can manage the 2025 ct withholding form and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 2025 ct withholding form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the 2025 ct withholding form. These features enhance efficiency and ensure that your documents are processed smoothly. Additionally, our platform allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other software for the 2025 ct withholding form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the 2025 ct withholding form alongside your existing tools. This seamless integration helps streamline your workflow and ensures that all your documents are in one place, enhancing productivity.

-

What are the benefits of using airSlate SignNow for the 2025 ct withholding form?

Using airSlate SignNow for the 2025 ct withholding form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning, which speeds up the process of obtaining necessary approvals. Additionally, you can access your documents anytime, anywhere, ensuring flexibility.

-

How secure is airSlate SignNow when handling the 2025 ct withholding form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your documents, including the 2025 ct withholding form. You can trust that your sensitive information is safe and secure while using our platform.

Get more for CT CT W4P Fill Out Tax Template Online

Find out other CT CT W4P Fill Out Tax Template Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer