Form CT 399 Depreciation Adjustment Schedule Tax Year

Understanding Form CT 399 Depreciation Adjustment Schedule

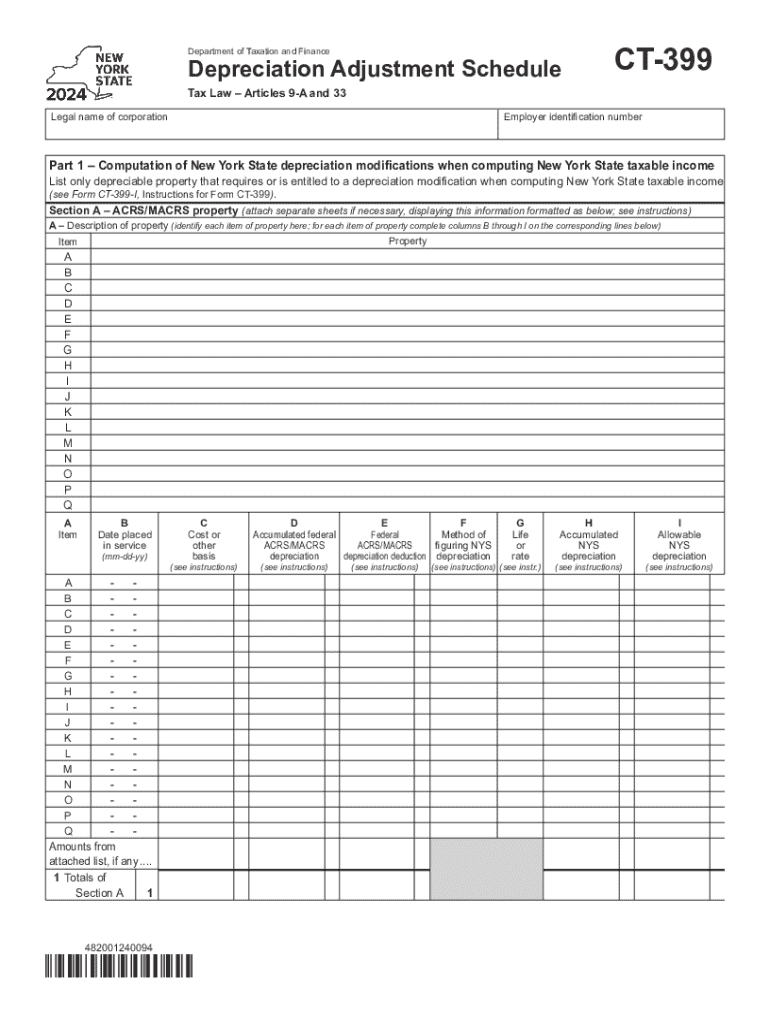

The CT 399 form, known as the Depreciation Adjustment Schedule, is a crucial document used for reporting depreciation adjustments for tax purposes. This form is specifically designed for businesses operating in Connecticut, enabling them to accurately calculate and report depreciation on their assets. It is essential for ensuring compliance with state tax regulations and for accurately reflecting the financial status of a business.

Steps to Complete Form CT 399

Completing Form CT 399 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records related to your assets, including purchase dates, costs, and prior depreciation amounts. Next, fill out the form by entering the required information in each section, which typically includes details about the asset, its depreciation method, and any adjustments that need to be made. Be sure to double-check your entries for accuracy before submitting the form.

Obtaining Form CT 399

Form CT 399 can be obtained through the Connecticut Department of Revenue Services (DRS) website or by contacting their office directly. The form is available in both printable and fillable formats, making it accessible for businesses to complete electronically or by hand. Ensuring you have the most current version of the form is important for compliance with state regulations.

Key Elements of Form CT 399

Form CT 399 includes several important elements that must be accurately reported. These elements typically consist of the taxpayer's identification information, details of the asset being depreciated, the depreciation method used, and any adjustments that are necessary. Understanding these components is essential for completing the form correctly and ensuring that all depreciation is reported accurately.

Legal Use of Form CT 399

The legal use of Form CT 399 is governed by Connecticut state tax laws. Businesses are required to use this form to report depreciation adjustments to avoid penalties and ensure compliance with tax regulations. Failure to accurately complete and submit this form can result in legal repercussions, including fines or audits by the state tax authority.

Filing Deadlines for Form CT 399

It is important to be aware of the filing deadlines for Form CT 399 to avoid any late penalties. Generally, the form must be submitted along with the business's annual tax return. Specific deadlines may vary based on the business entity type and tax year, so consulting the Connecticut DRS website or a tax professional for the most current deadlines is advisable.

Examples of Using Form CT 399

Form CT 399 is commonly used by various business entities, including corporations, partnerships, and limited liability companies (LLCs). For instance, a manufacturing company may use this form to report depreciation on machinery, while a retail business might report adjustments on store fixtures. Each scenario requires careful consideration of the specific assets and applicable depreciation methods to ensure accurate reporting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 399 depreciation adjustment schedule tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the ct 399 instructions for using airSlate SignNow?

The ct 399 instructions for airSlate SignNow guide users on how to effectively utilize the platform for electronic signatures and document management. These instructions cover the essential steps for uploading documents, adding signers, and sending out for signatures. Following these guidelines ensures a smooth and efficient signing process.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, with options suitable for individuals and businesses. Each plan includes access to features that simplify the signing process, including the ct 399 instructions. For detailed pricing information, visit our pricing page.

-

What features does airSlate SignNow offer?

airSlate SignNow offers a range of features designed to enhance document management and eSigning. Key features include customizable templates, real-time tracking, and the ability to follow the ct 399 instructions for seamless document processing. These tools help streamline workflows and improve efficiency.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can signNowly reduce the time and resources spent on document signing. The platform's user-friendly interface and adherence to the ct 399 instructions make it easy for teams to collaborate and finalize documents quickly. This leads to faster transactions and improved customer satisfaction.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow integrates with various software applications, enhancing its functionality and usability. These integrations allow users to connect their existing tools with airSlate SignNow, making it easier to follow the ct 399 instructions within their preferred workflows. Check our integrations page for a full list of compatible applications.

-

Is airSlate SignNow secure for document signing?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents signed through the platform are protected. By following the ct 399 instructions, users can confidently manage sensitive information while adhering to industry standards for data protection.

-

Can I use airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing users to sign documents on the go. The mobile app provides access to all features, including the ct 399 instructions, ensuring that you can manage your documents anytime, anywhere. This flexibility enhances productivity for busy professionals.

Get more for Form CT 399 Depreciation Adjustment Schedule Tax Year

- Gas pressure test form

- Weekly progress report welcome to ms sanchez form

- Schedule 2 form 8849

- Taxi scrapping forms

- Blank credit report 100060961 form

- How to fill antrag auf steuerklassenwechsel bei ehegatten form

- Obrazec pooblastilo pravna oseba za vsa vozilapoob form

- Foreign worker medical examination registration formv2 15062023

Find out other Form CT 399 Depreciation Adjustment Schedule Tax Year

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word