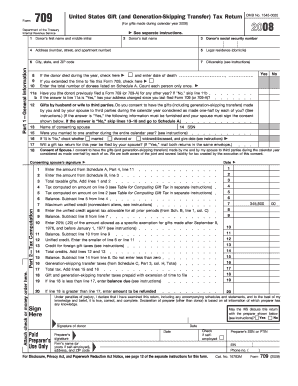

Sample Completed Irs Form 709

What is the Sample Completed IRS Form 709

The IRS Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is used to report gifts made during the tax year that exceed the annual exclusion amount. This form is crucial for individuals who wish to ensure compliance with federal tax laws regarding gifts. The completed form provides details about the donor, the recipient, and the value of the gifts. It is important to understand that this form is not only for reporting gifts but also for calculating any potential gift tax liability.

Steps to Complete the Sample Completed IRS Form 709

Completing the IRS Form 709 involves several key steps:

- Gather necessary information: Collect details about the gifts, including the names of recipients, their relationship to you, and the fair market value of the gifts at the time of transfer.

- Fill out personal information: Provide your name, address, and taxpayer identification number (TIN) at the top of the form.

- Report gifts: Use Part 1 of the form to list each gift, including the date of the gift, description, and value.

- Calculate any tax owed: If your gifts exceed the annual exclusion amount, calculate the total gift tax using the provided tables in the form instructions.

- Sign and date the form: Ensure that you sign and date the form before submission to validate it.

Legal Use of the Sample Completed IRS Form 709

The legal use of the completed IRS Form 709 is essential for compliance with federal tax regulations. Filing this form accurately ensures that you report any gifts that exceed the annual exclusion limit, which can help avoid penalties or audits from the IRS. The form serves as a formal declaration of your gift transactions and is used by the IRS to assess any applicable gift taxes. Additionally, maintaining a copy of this form is important for your records and future reference.

Key Elements of the Sample Completed IRS Form 709

Several key elements must be included in the completed IRS Form 709 to ensure it is valid:

- Donor information: Name, address, and TIN of the individual making the gifts.

- Recipient details: Names and relationships of the individuals receiving the gifts.

- Gift descriptions: Clear descriptions of each gift, including its fair market value.

- Annual exclusion amount: Ensure to note the applicable exclusion for the tax year.

- Signature: The donor must sign and date the form to validate it legally.

Filing Deadlines / Important Dates

The IRS Form 709 must be filed by April fifteenth of the year following the calendar year in which the gifts were made. If April fifteenth falls on a weekend or holiday, the deadline is extended to the next business day. It is important to be aware of these deadlines to avoid late filing penalties. If you are unable to meet the deadline, you may apply for an extension, but this does not extend the time to pay any taxes owed.

Form Submission Methods

There are various methods for submitting the completed IRS Form 709:

- Mail: You can send the completed form to the appropriate IRS address based on your location.

- In-person: You may also choose to deliver the form directly to your local IRS office.

- Electronic filing: While Form 709 cannot be filed electronically, you can prepare it using tax software that supports the form and print it for submission.

Quick guide on how to complete sample completed irs form 709 1653710

Handle Sample Completed Irs Form 709 effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Sample Completed Irs Form 709 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Sample Completed Irs Form 709 with ease

- Locate Sample Completed Irs Form 709 and click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious document searching, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Sample Completed Irs Form 709 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample completed irs form 709 1653710

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample completed IRS Form 709?

A sample completed IRS Form 709 is a reference document that illustrates how to accurately fill out the form used for U.S. gift tax purposes. This form is essential for taxpayers who need to report gifts made during the year, and reviewing a sample can ensure that all required details are included.

-

How can airSlate SignNow help with completing IRS Form 709?

airSlate SignNow offers an intuitive platform that allows users to easily upload, fill out, and eSign documents like the IRS Form 709. With our user-friendly interface, you can ensure that your completed form meets all IRS requirements, simplifying the filing process.

-

Is there a cost associated with using airSlate SignNow for IRS Form 709?

Yes, there is a pricing structure for using airSlate SignNow, which offers various subscription plans tailored to different needs. Each plan provides features designed to help you manage important documents, including sample completed IRS Form 709, efficiently and affordably.

-

What features does airSlate SignNow offer for completing IRS Form 709?

airSlate SignNow includes features such as document templates, advanced editing tools, and secure eSigning capabilities. These features make it easy to prepare a sample completed IRS Form 709 independently, minimizing the potential for errors.

-

Can I integrate airSlate SignNow with other software to manage IRS Form 709?

Absolutely! airSlate SignNow supports integrations with popular software applications, allowing you to streamline your workflow when managing IRS Form 709. By integrating with your existing tools, you can improve efficiency and accessibility.

-

What benefits does airSlate SignNow provide for managing IRS Form 709?

Using airSlate SignNow for IRS Form 709 offers numerous benefits, including enhanced security for sensitive information and the convenience of cloud storage. Additionally, it allows for easy collaboration among multiple signers, reducing the time it takes to get documents finalized.

-

Is technical support available for using airSlate SignNow with IRS Form 709?

Yes, airSlate SignNow provides comprehensive technical support to assist users with any issues related to completing IRS Form 709. Our support team is available to help troubleshoot and guide you through the process to ensure your documents are processed without hassle.

Get more for Sample Completed Irs Form 709

- Mesc samoa exam papers 475990763 form

- Proposed plan of supervision lac nj form

- Ceac login form

- New student enrollment checklist 201516 local id bisd campus bowie isd new student registration requirements 20152016 last form

- Spiritual attitude and involvement list sail form

- What to press to fill forms to abroad

- Module 17 adding and subtracting polynomials form

- Waap asthma form

Find out other Sample Completed Irs Form 709

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word