Form it 204 1 New York Corporate Partners Schedule K Tax Year

What is the Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year

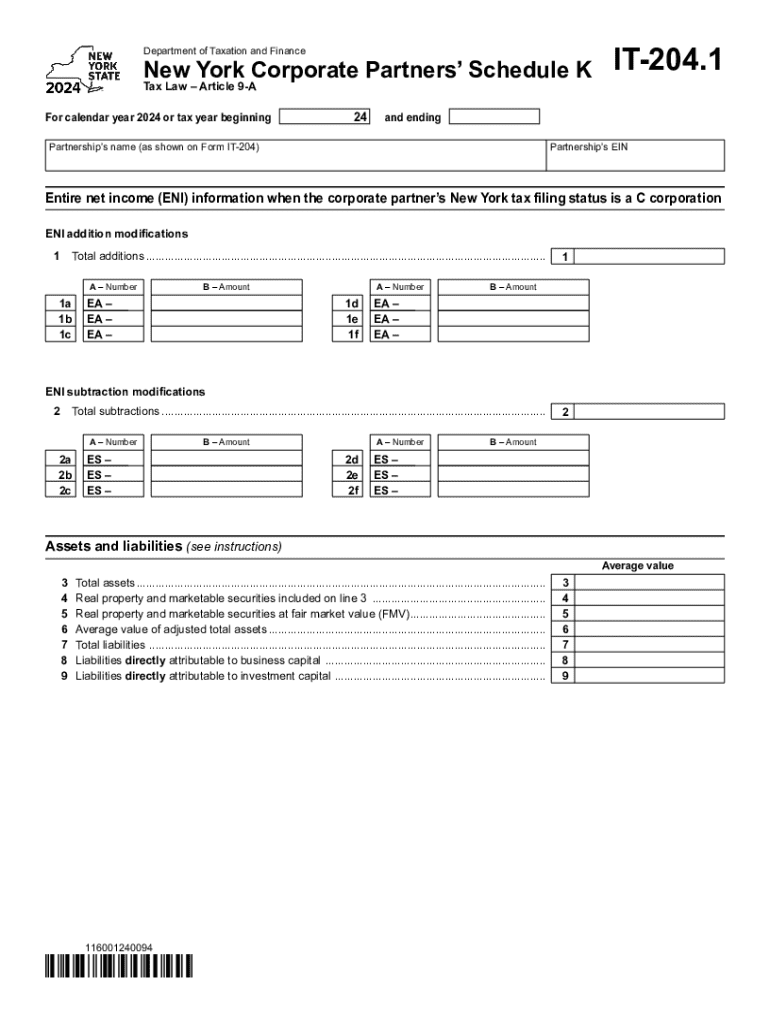

The Form IT 204 1 is a crucial document for corporate partners in New York, specifically designed to report income, deductions, and credits for partnerships. This form serves as a Schedule K, which details each partner's share of the partnership's income, deductions, and other tax-related items for the tax year. It is essential for ensuring accurate tax reporting and compliance with state tax regulations.

How to use the Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year

To effectively use the Form IT 204 1, corporate partners must first gather all relevant financial information from the partnership. This includes income statements, expense reports, and any applicable deductions. Once the necessary data is compiled, partners can fill out the form, ensuring that each section accurately reflects their share of the partnership's financial activities. Proper completion of this form is vital for accurate tax filings and to avoid potential penalties.

Steps to complete the Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year

Completing the Form IT 204 1 involves several key steps:

- Gather all financial documents related to the partnership.

- Fill in the partnership's name, address, and identification number at the top of the form.

- Report the total income, deductions, and credits as detailed in the partnership's financial statements.

- Allocate the amounts to each partner based on their ownership percentage.

- Review the completed form for accuracy before submission.

Key elements of the Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year

The Form IT 204 1 comprises several key elements that are critical for accurate reporting. These include:

- Partnership identification details, including name and tax identification number.

- Income and loss allocations for each partner.

- Deductions specific to the partnership, such as business expenses.

- Credits that partners may be eligible for based on their share of the partnership.

Filing Deadlines / Important Dates

It is essential for corporate partners to be aware of the filing deadlines associated with the Form IT 204 1. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is April 15. Missing this deadline can result in penalties, so timely submission is crucial.

Penalties for Non-Compliance

Failure to file the Form IT 204 1 or inaccuracies in reporting can lead to significant penalties. The New York State Department of Taxation and Finance may impose fines for late filings, which can increase over time. Additionally, partners may face interest charges on any unpaid taxes resulting from incorrect reporting. It is advisable to ensure compliance to avoid these financial repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 204 1 new york corporate partners schedule k tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year?

Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year is a tax form used by corporate partners in New York to report their share of income, deductions, and credits from partnerships. This form is essential for ensuring compliance with New York tax regulations and accurately reporting partnership income.

-

How can airSlate SignNow help with Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year. Our user-friendly interface simplifies the document management process, ensuring that all necessary signatures are obtained quickly and securely.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you need basic eSigning capabilities or advanced features for managing Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year, we have a plan that fits your budget.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features specifically designed for tax document management, such as templates for Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year, automated reminders for signatures, and secure storage for all your tax documents. These features streamline the process and help ensure compliance.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, allowing you to manage Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year alongside your other financial documents. This integration enhances workflow efficiency and ensures that all your data is synchronized.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform reduces the risk of errors and ensures that your documents are processed quickly and efficiently.

-

Is airSlate SignNow compliant with New York tax regulations?

Yes, airSlate SignNow is designed to comply with New York tax regulations, including those related to Form IT 204 1 New York Corporate Partners’ Schedule K Tax Year. Our platform ensures that your documents meet all necessary legal requirements, providing peace of mind for your business.

Get more for Form IT 204 1 New York Corporate Partners Schedule K Tax Year

- Maryland lead paint disclosure form

- Printable legal form terminate parental rights

- Upitnik za poslodavce a1 form

- Central coast energy services heap application form

- Chapter 17 section 2 skillbuilder practice interpreting charts answers form

- Residential parking permit cost form

- Central government health scheme modified check form

- Ct 248 form

Find out other Form IT 204 1 New York Corporate Partners Schedule K Tax Year

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form