Form it 249 Claim for Long Term Care Insurance Credit Tax Year

What is the Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

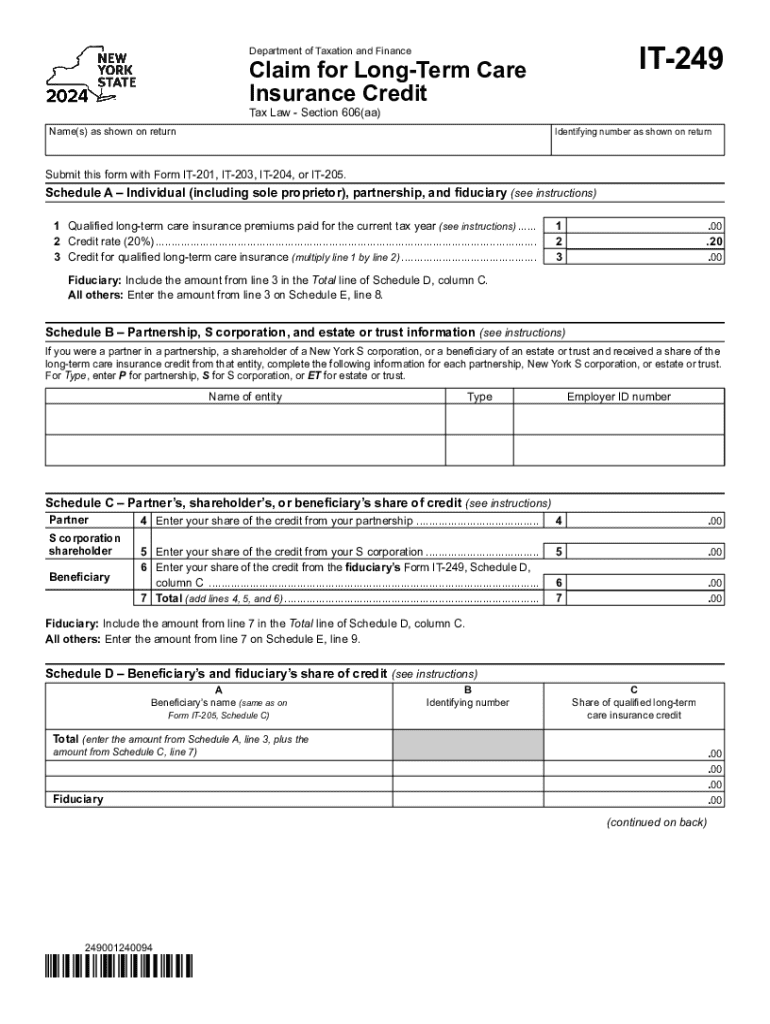

The Form IT 249 is a tax form used in New York State for claiming a credit for long-term care insurance premiums. This form allows taxpayers to receive a credit against their state income tax liability for qualifying long-term care insurance expenses incurred during the tax year. The credit is designed to help alleviate the financial burden of long-term care, which can be significant for individuals and families. Understanding the specifics of this form is essential for those seeking to maximize their tax benefits related to long-term care insurance.

How to use the Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

Using the Form IT 249 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all relevant documentation related to their long-term care insurance premiums. This includes policy details and proof of payment. After filling out the form, individuals should review the instructions carefully to ensure that all required information is included. Once completed, the form can be submitted with the taxpayer's New York State income tax return, either electronically or by mail, depending on the filing method chosen.

Steps to complete the Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

Completing the Form IT 249 requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documentation, including proof of long-term care insurance premiums paid.

- Fill out the personal information section accurately, including your name, address, and Social Security number.

- Enter the total amount of long-term care insurance premiums paid during the tax year in the designated section.

- Calculate the credit amount based on the guidelines provided in the form instructions.

- Review the form for accuracy before submission.

Eligibility Criteria

To qualify for the credit claimed on Form IT 249, taxpayers must meet specific eligibility criteria. The long-term care insurance policy must be issued by a licensed insurer and must provide coverage for qualified long-term care services. Additionally, the taxpayer must have paid premiums during the tax year for which the credit is being claimed. There may also be limits on the amount of premiums that can be claimed, depending on the taxpayer's filing status and income level.

Required Documents

When preparing to file Form IT 249, certain documents are essential for substantiating the claim. Taxpayers should have:

- Proof of payment for long-term care insurance premiums, such as receipts or bank statements.

- A copy of the long-term care insurance policy, which outlines the coverage details.

- Any additional documentation that may be required by the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with Form IT 249. Typically, the form must be submitted by the same deadline as the New York State income tax return, which is usually April fifteenth for most taxpayers. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also stay informed about any changes to deadlines that may occur in a given tax year.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 249 claim for long term care insurance credit tax year 772088886

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 249 form and how can airSlate SignNow help?

The IT 249 form is a document used for tax purposes, and airSlate SignNow simplifies the process of sending and eSigning this form. With our platform, you can easily prepare, send, and track the IT 249 form, ensuring compliance and efficiency in your tax documentation.

-

Is there a cost associated with using airSlate SignNow for the IT 249 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage the IT 249 form and other documents without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing the IT 249 form?

airSlate SignNow provides a range of features for managing the IT 249 form, including customizable templates, secure eSigning, and real-time tracking. These features streamline the document workflow, making it easier to handle your tax forms efficiently.

-

Can I integrate airSlate SignNow with other software for the IT 249 form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the IT 249 form alongside your existing tools. This integration enhances productivity and ensures that your document management process is cohesive.

-

How does airSlate SignNow ensure the security of the IT 249 form?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your IT 249 form and other sensitive documents, ensuring that your information remains confidential and safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for the IT 249 form?

Using airSlate SignNow for the IT 249 form offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced collaboration. Our platform allows you to manage your tax documents effortlessly, helping you focus on your core business activities.

-

Is it easy to eSign the IT 249 form with airSlate SignNow?

Yes, eSigning the IT 249 form with airSlate SignNow is incredibly easy. Our user-friendly interface allows you to sign documents electronically in just a few clicks, making the process quick and hassle-free.

Get more for Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

- Dc4 711b form

- Philippine embassy osaka form

- Application for agriculture horticulture and for form

- Henderson county occupancy tax report henderson co form

- Complete and mail original to swain county finance office p form

- Corporations required to file estimated tax payments form

- 52 212 3 offeror representations and certificationscommercial products and commercial services form

- Form 3528 5108411

Find out other Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement