Form it 255 Claim for Solar Energy System Equipment Credit Tax Year

What is the Form IT-255 Claim for Solar Energy System Equipment Credit Tax Year

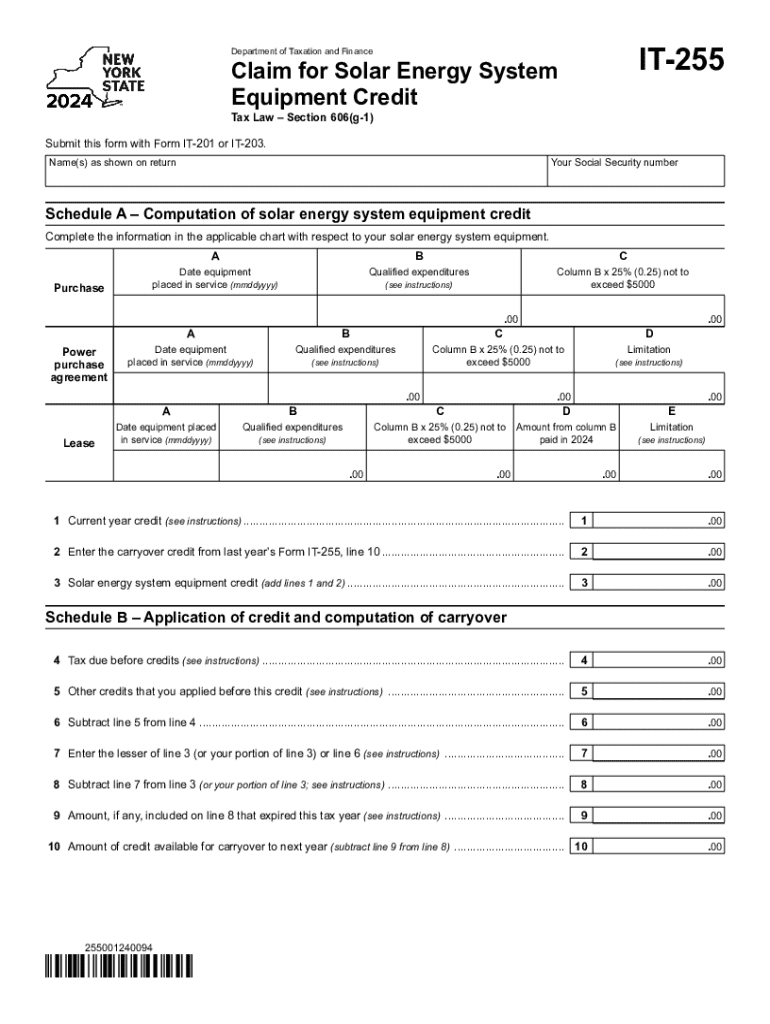

The Form IT-255 is a tax form used by residents of New York State to claim a credit for the purchase and installation of solar energy system equipment. This form allows taxpayers to receive a credit against their New York State income tax liability, promoting the use of renewable energy sources. The credit is applicable for solar energy systems that meet specific eligibility criteria, including the type of equipment installed and the date of installation. By utilizing this form, taxpayers can significantly reduce their tax burden while contributing to environmental sustainability.

How to Use the Form IT-255 Claim for Solar Energy System Equipment Credit Tax Year

To effectively use the Form IT-255, taxpayers should first ensure they meet the eligibility criteria for the solar energy system credit. This includes having installed qualified solar equipment on their property. Once eligibility is confirmed, taxpayers can download the form from the New York State Department of Taxation and Finance website or obtain a physical copy from local tax offices. After filling out the necessary information, including details about the solar equipment and installation costs, the completed form should be submitted along with the New York State income tax return.

Steps to Complete the Form IT-255 Claim for Solar Energy System Equipment Credit Tax Year

Completing the Form IT-255 involves several key steps:

- Gather all necessary documentation, including receipts for the solar equipment and installation costs.

- Download or obtain a copy of the Form IT-255.

- Fill out the form, providing accurate information about the solar energy system, including the type of equipment and installation date.

- Calculate the credit amount based on the eligible expenses incurred.

- Attach the completed form to your New York State income tax return.

- Submit your tax return by the appropriate deadline.

Eligibility Criteria for the Form IT-255 Claim for Solar Energy System Equipment Credit Tax Year

To qualify for the credit claimed on the Form IT-255, taxpayers must meet specific eligibility criteria. These include:

- The solar energy system must be installed on a residential property in New York State.

- The equipment must be certified and meet the standards set by the state.

- The installation must be completed within the tax year for which the credit is being claimed.

- Taxpayers must provide proof of purchase and installation costs.

Required Documents for the Form IT-255 Claim for Solar Energy System Equipment Credit Tax Year

When submitting the Form IT-255, taxpayers must include several key documents to support their claim. These typically include:

- Receipts or invoices for the solar equipment purchased.

- Documentation of installation costs, such as contracts or service agreements.

- Any certifications proving the solar energy system meets state requirements.

Filing Deadlines for the Form IT-255 Claim for Solar Energy System Equipment Credit Tax Year

It is crucial for taxpayers to be aware of the filing deadlines associated with the Form IT-255. Typically, the form must be submitted along with the New York State income tax return by the standard tax filing deadline, which is usually April 15. However, if taxpayers file for an extension, they should ensure that the form is included in their extended filing as well. Keeping track of these deadlines helps avoid penalties and ensures that taxpayers can take full advantage of the available credits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 255 claim for solar energy system equipment credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ny solar?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents electronically. For companies in the ny solar industry, it streamlines the contract process, making it easier to manage agreements related to solar installations and services.

-

How much does airSlate SignNow cost for ny solar businesses?

The pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for ny solar businesses of all sizes. You can select from different tiers that offer various features, ensuring you find a plan that fits your budget and needs.

-

What features does airSlate SignNow offer for ny solar companies?

airSlate SignNow provides a range of features tailored for ny solar companies, including customizable templates, automated workflows, and secure document storage. These features help streamline the signing process and enhance efficiency in managing solar contracts.

-

How can airSlate SignNow benefit my ny solar business?

By using airSlate SignNow, your ny solar business can reduce paperwork, speed up the signing process, and improve customer satisfaction. The platform's user-friendly interface allows for quick document management, which is essential in the fast-paced solar industry.

-

Does airSlate SignNow integrate with other tools used in the ny solar industry?

Yes, airSlate SignNow offers integrations with various tools commonly used in the ny solar industry, such as CRM systems and project management software. This ensures that your workflow remains seamless and efficient, allowing you to focus on your solar projects.

-

Is airSlate SignNow secure for handling sensitive documents in the ny solar sector?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect sensitive documents related to your ny solar business. You can trust that your data is safe while using our eSignature solution.

-

Can I customize documents for my ny solar business using airSlate SignNow?

Yes, airSlate SignNow allows you to create and customize documents specifically for your ny solar business needs. You can easily add your branding, adjust templates, and include necessary fields to ensure that all contracts meet your requirements.

Get more for Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year

- What makes up a healthy breakfast form

- Starfsvottor form

- Bacterial meningitis immunization record wellness center tams unt form

- Mri checklist form

- Affidavit of citizenship domicile and tax status fill in form

- Basic geometry terms worksheet pdf form

- Eeoc form 5a

- Higher education application approved by tc 06 17 pdf form

Find out other Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online