Q ST 19 Shipping Commerce Form

What is the Q ST 19 Shipping Commerce

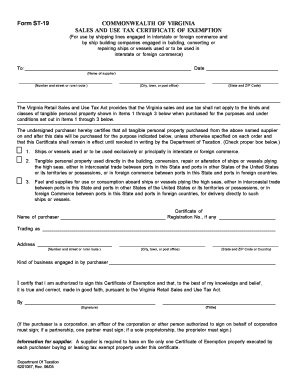

The Q ST 19 Shipping Commerce form is a crucial document used in the shipping industry to report sales and use tax related to the sale of tangible personal property and certain services. This form is essential for businesses engaged in shipping and commerce, as it helps ensure compliance with state tax regulations. It provides detailed information about the transactions, allowing tax authorities to assess the appropriate tax liabilities. Understanding the purpose of this form is vital for businesses to maintain good standing with tax authorities and avoid potential penalties.

How to use the Q ST 19 Shipping Commerce

Using the Q ST 19 Shipping Commerce form involves several steps to ensure accurate reporting. Businesses must first gather all relevant transaction data, including sales amounts and applicable tax rates. Once the necessary information is collected, the form can be filled out, detailing each transaction and the corresponding tax owed. After completing the form, it should be submitted to the appropriate state tax authority, either electronically or via mail, depending on state regulations. Proper use of this form helps businesses remain compliant and avoid any issues with tax authorities.

Steps to complete the Q ST 19 Shipping Commerce

Completing the Q ST 19 Shipping Commerce form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation, including sales records and tax rates.

- Fill out the form, ensuring all transaction details are accurate and complete.

- Double-check the calculations for total sales and tax amounts.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the appropriate state tax authority by the specified deadline.

Legal use of the Q ST 19 Shipping Commerce

The legal use of the Q ST 19 Shipping Commerce form is governed by state tax laws. Businesses must ensure that they are using the most current version of the form and that they comply with all applicable tax regulations. Failure to use the form correctly can result in penalties, including fines and interest on unpaid taxes. It is essential for businesses to stay informed about any changes in tax legislation that may affect their reporting obligations.

Key elements of the Q ST 19 Shipping Commerce

Several key elements define the Q ST 19 Shipping Commerce form. These include:

- Identification of the business and its tax identification number.

- Details of each transaction, including dates, amounts, and types of goods or services sold.

- Calculation of total sales and the corresponding tax owed.

- Signature of the authorized representative certifying the accuracy of the information provided.

Form Submission Methods

The Q ST 19 Shipping Commerce form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state tax authority's website.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete q st 19 shipping commerce

Easily prepare [SKS] on any device

Managing documents online has become increasingly popular among both businesses and individuals. It offers a fantastic eco-friendly option to traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and improve any document-related process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Q ST 19 Shipping Commerce

Create this form in 5 minutes!

How to create an eSignature for the q st 19 shipping commerce

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Q ST 19 Shipping Commerce?

Q ST 19 Shipping Commerce is a streamlined solution designed to enhance your shipping operations. It provides tools for managing shipping processes efficiently and integrating with various platforms. By utilizing Q ST 19 Shipping Commerce, businesses can signNowly reduce time spent on logistics and paperwork.

-

How does airSlate SignNow integrate with Q ST 19 Shipping Commerce?

airSlate SignNow integrates seamlessly with Q ST 19 Shipping Commerce, allowing users to send and eSign shipping documents effortlessly. This integration ensures that all necessary documents are managed in one place, reducing errors and improving workflow. Businesses can save time and enhance compliance with this effective pairing.

-

What are the pricing options for Q ST 19 Shipping Commerce?

Pricing for Q ST 19 Shipping Commerce varies based on the specific features and volume of usage your business requires. Generally, options range from basic plans to more advanced solutions tailored for larger operations. Contact us for a custom quote that meets your unique needs.

-

What features does Q ST 19 Shipping Commerce offer?

Q ST 19 Shipping Commerce includes features such as document tracking, automated shipping labels, eSignature capabilities with airSlate SignNow, and robust reporting tools. These features are designed to make the shipping process more efficient and user-friendly. Businesses can rely on these tools to streamline their shipping workflows.

-

What are the benefits of using Q ST 19 Shipping Commerce?

The primary benefits of Q ST 19 Shipping Commerce include improved operational efficiency, reduced errors, and enhanced visibility into shipping processes. By utilizing airSlate SignNow for document signing, businesses can also speed up their transactions and improve customer satisfaction. This comprehensive approach helps organizations meet their shipping goals with ease.

-

Is customer support available for Q ST 19 Shipping Commerce users?

Yes, dedicated customer support is available for all users of Q ST 19 Shipping Commerce. Our support team is equipped to assist with any questions or challenges you might face. We are committed to ensuring you have a smooth experience using our platform.

-

Can Q ST 19 Shipping Commerce be used by small businesses?

Absolutely! Q ST 19 Shipping Commerce is designed to be scalable, accommodating businesses of all sizes. Small businesses particularly benefit from its cost-effective solutions and easy-to-use interface, making it a great choice for anyone looking to optimize their shipping processes.

Get more for Q ST 19 Shipping Commerce

- Winter application university of alberta students39 union form

- Research fellowship application may primary health care form

- Glendon college york university residence life assistant application myglendon yorku form

- Application xlsx faculty of health sciences form

- St michael parish first holy communion registration form

- Recommendation form for reappointments promotion and tenure uvic

- Photo contest entry form mcgill university mcgill

- Group medical services cost plus claim form effective march 1

Find out other Q ST 19 Shipping Commerce

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document