Form it 611 Claim for Brownfield Redevelopment Tax Credit Tax Year

What is the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

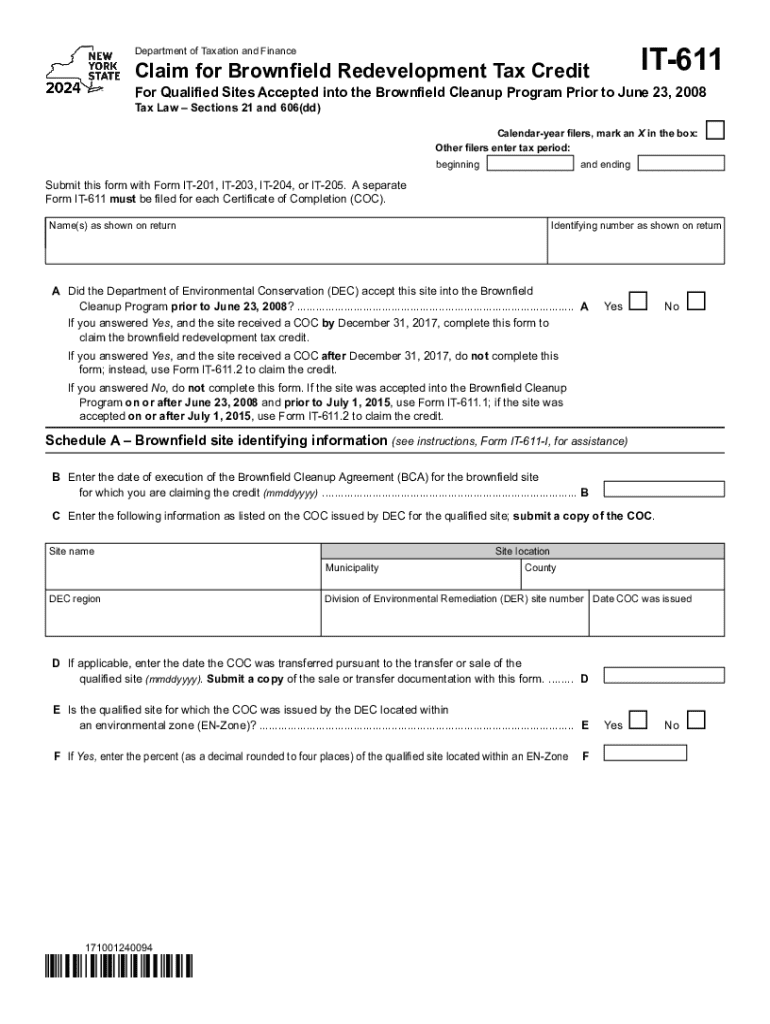

The Form IT 611 is a tax form used by businesses and property owners in the United States to claim the Brownfield Redevelopment Tax Credit. This credit is designed to incentivize the redevelopment of contaminated properties, known as brownfields, by allowing eligible taxpayers to receive a credit against their state income tax. The form requires detailed information about the property, the costs associated with its cleanup, and the redevelopment efforts undertaken.

Steps to complete the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

Completing the Form IT 611 involves several key steps:

- Gather necessary documentation, including proof of cleanup costs and redevelopment expenses.

- Fill out the form accurately, providing details about the property and the nature of the redevelopment.

- Calculate the tax credit based on the eligible expenses incurred during the redevelopment process.

- Review the form for completeness and accuracy before submission.

Eligibility Criteria

To qualify for the Brownfield Redevelopment Tax Credit, applicants must meet specific eligibility criteria. The property must be designated as a brownfield, and the redevelopment activities must comply with state regulations. Additionally, the applicant must have incurred eligible expenses related to the cleanup and redevelopment of the property. It is essential to verify that all activities align with the requirements set forth by the state tax authority.

Required Documents

When filing the Form IT 611, certain documents are necessary to support the claim. These may include:

- Invoices and receipts for cleanup and redevelopment costs.

- Environmental assessments or reports confirming the property's brownfield status.

- Documentation of any permits or approvals obtained for redevelopment activities.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Form IT 611 to ensure timely submission. Typically, the form must be filed by a specific date following the end of the tax year in which the eligible expenses were incurred. Check with the state tax authority for the exact deadlines, as they may vary by state and year.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 611 can usually be submitted through various methods, including online filing, mailing a paper form, or delivering it in person to the appropriate tax office. Each submission method has its own guidelines and requirements, so it is advisable to review the instructions provided with the form to choose the most suitable option for your situation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 611 claim for brownfield redevelopment tax credit tax year 772088882

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year?

The Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year is a tax form used by businesses to claim tax credits for the redevelopment of brownfield sites. This form helps businesses recover costs associated with environmental cleanup and redevelopment, making it a valuable tool for eligible projects.

-

How can airSlate SignNow assist with the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year. Our user-friendly interface simplifies the document management process, ensuring that your claims are submitted accurately and on time.

-

What are the pricing options for using airSlate SignNow for the Form IT 611 Claim?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you have access to the necessary features for managing the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year.

-

What features does airSlate SignNow offer for managing tax credit claims?

With airSlate SignNow, you can easily create, edit, and eSign documents, including the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year. Additional features include document templates, real-time tracking, and secure cloud storage, all designed to streamline your tax credit claim process.

-

Are there any integrations available with airSlate SignNow for tax-related documents?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year. These integrations allow for easy data transfer and improved workflow efficiency, making tax preparation simpler.

-

What are the benefits of using airSlate SignNow for the Form IT 611 Claim?

Using airSlate SignNow for the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform ensures that your claims are processed quickly and securely, allowing you to focus on your business operations.

-

Is airSlate SignNow secure for submitting sensitive tax documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your sensitive information, including the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year. Our platform uses encryption and secure access protocols to ensure that your documents remain confidential and secure.

Get more for Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

- Wisconsin form 5s 533327422

- Form 8691 04

- Memorandum of understanding mou between mdindia health care services tpa amp form

- School truancy letter to parents form

- Salary reduction agreement for tax sheltered annuities broward broward k12 fl form

- Protocolo de exportacin de ganado en pie hacia los e u a form

- Convocatoria de becas para la realizacin de prcticas de form

- Innovacin portal del gobierno de la rioja form

Find out other Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe